Latin America''s Energy Storage Boom: Market & Outlook 2025

Jul 15, 2025 · Latin America is entering a transformative decade in its energy landscape, driven by the urgent need to expand power output, decarbonize, lower energy costs, improve grid

South America: One of energy storage''s final frontiers

Jun 4, 2025 · A report published by Americas Market Intelligence last year concluded that, of the countries in South America, while a number were offering "some incentives" for battery energy

Which are the top manufacturing Companies of Battery Energy Storage

Dec 10, 2024 · Introduction to the Battery Energy Storage Systems Market/Industry: The battery energy storage systems (BESS) market is poised for transformative growth, driven by the

South America''s Energy Storage Boom: Why the Pack Storage

Jan 6, 2023 · Why South America Can''t Stop Talking About Battery Storage while the rest of the world argues about lithium-ion vs. solid-state batteries, South America''s energy markets are

4 FAQs about [Battery energy storage solutions in South America]

Is South America a key player in the lithium-ion battery industry?

As the global demand for electric vehicles (EVs) and renewable energy storage grows, South America is emerging as a key player in the lithium-ion battery industry. The region is home to some of the world’s largest lithium reserves, particularly in Argentina, Bolivia, and Chile—often referred to as the “Lithium Triangle.”

What are the top 10 lithium-ion battery manufacturers in South America?

This article explores Top 10 Lithium-Ion Battery Manufacturers In South America; CATL, Companhia Brasileira de Lítio (CBL), YPF-Tec,BYD, LG Energy, Panasonic, SQM, EnerSys, Duracell, and Saft. Last Updated on February 21, 2025

Where are lithium batteries made?

The region is home to some of the world’s largest lithium reserves, particularly in Argentina, Bolivia, and Chile—often referred to as the “Lithium Triangle.” In recent years, several manufacturers in South America have been developing lithium-ion battery production capabilities to meet the increasing demand for sustainable energy solutions.

Who makes Duracell batteries?

Duracell is a well-known American brand of batteries and smart power systems, owned by Berkshire Hathaway. It was developed in the 1960s by Samuel Ruben and Philip Mallory, and later acquired by Procter & Gamble in 2005, before being sold to Berkshire Hathaway in 2016. Key products:

Random Links

- Bamako Grid Energy Storage Project

- 482000w inverter

- West Asia rooftop photovoltaic panel source manufacturer

- Vietnam Ho Chi Minh Energy Storage Cabinet Container

- High frequency link structure sine wave inverter

- Romania pure sine wave 20kw inverter company

- Photovoltaic inverter 10kw three phase

- Does solar air conditioner need ordinary electricity

- Mauritius energy storage photovoltaic products

- Global photovoltaic inverter manufacturing companies

- What are the sizes of photovoltaic panels

- Uninterruptible Power Supply Equipment in Cape Verde

- 2025 Latest Specifications for Energy Storage Power Stations

- Bucharest Power Signal Base Station Power Supply

- Photovoltaic energy storage options in Comoros

- Atess hybrid inverter factory in Guatemala

- Communication base station power supply system solution

- Chilean photovoltaic panel manufacturers

- Croatia shopping mall photovoltaic curtain wall price

- How to use the rack-mounted energy storage lithium battery site cabinet

- Electric suction inverter 12v24v universal

- Mexican Energy Storage Batteries

- Portable power supply gross profit

Residential Solar Storage & Inverter Market Growth

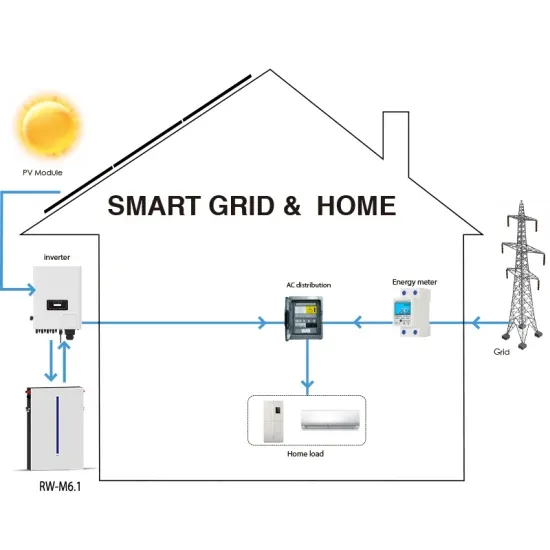

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.