Decentralized Master-Slave Communication and Control

Oct 5, 2018 · A. Lithium-ion batteries Power in EVs is supplied by battery storage systems and the most commonly used technology is Lithium-ion batteries (LIB). LIB consist of two circuits:

Lithium battery solution for power supply guarantee system

May 1, 2025 · This solution is designed to meet the application requirements of lithium batteries in communication base station equipment projects, ensuring that lithium batteries provide safe,

Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · The choice of allocation methods has significant influence on the results. Repurposing spent batteries in communication base stations (CBSs) is a promising option to

How Telecom Battery Systems Work: Architecture, Components

Jul 30, 2025 · In modern telecommunications infrastructure, battery systems play a critical role in ensuring continuous service and system reliability. Whether supporting mobile base stations,

6 FAQs about [Communication base station lithium-ion battery and circuit components]

What makes a telecom battery pack compatible with a base station?

Compatibility and Installation Voltage Compatibility: 48V is the standard voltage for telecom base stations, so the battery pack’s output voltage must align with base station equipment requirements. Modular Design: A modular structure simplifies installation, maintenance, and scalability.

Which battery is best for telecom base station backup power?

Among various battery technologies, Lithium Iron Phosphate (LiFePO4) batteries stand out as the ideal choice for telecom base station backup power due to their high safety, long lifespan, and excellent thermal stability.

Can repurposed EV batteries be used in communication base stations?

Among the potential applications of repurposed EV LIBs, the use of these batteries in communication base stations (CBSs) isone of the most promising candidates owing to the large-scale onsite energy storage demand ( Heymans et al., 2014; Sathre et al., 2015 ).

Are lithium-ion batteries used in EV power supply systems?

Owing to the long cycle life and high energy and power density, lithium-ion batteries (LIBs) are themost widely used technology in the power supply system of EVs ( Opitz et al. (2017); Alfaro-Algaba and Ramirez et al., 2020 ).

What is battery management system (BMS)?

The battery management system (BMS)provides monitoring and manages the charge/discharge processes of the batteries. Fig. 2. (a) Schematic diagram of the CBS power supply system, (b) composition of DC power supply system of CBS.

What is the recycling stage of a lithium ion battery?

In the recycling stage, the collectedLIB packs are dismantled to obtain the main components, such as battery cells, BMSs, and packaging, and various material fractions are recovered from these components separately (Table A1 in the supplementary materials).

Random Links

- Singapore photovoltaic panel installation manufacturer

- How many hydrogen energy stations are there in Peru

- RV Solar Dual System

- Energy Storage Power Station System

- Jerusalem Industrial and Commercial Energy Storage Cabinet Model

- Belgrade Photovoltaic Energy Storage Integrated Machine Company

- Control switchgear in China in Panama

- Is Kenya s outdoor power supply self-operated genuine

- Which large energy storage cabinet is good in Pakistan

- Portable power station cheap in Jamaica

- Discharge income of energy storage power station

- Latest outdoor power supply brand

- Inverter and high voltage power supply

- Lome Solar Self-sufficiency System

- Sloped roof solar tiles

- Is the battery cabinet a power distribution device

- Belize Energy Storage Power Station Revenue Model

- Energy storage cabinet solar panel power generation

- Box-type substation energy storage power supply

- 12v inverter in Dubai UAE

- Wind turbines replace photovoltaic power stations

- 220V inverter production

- 48v energy storage battery communication base station power supply

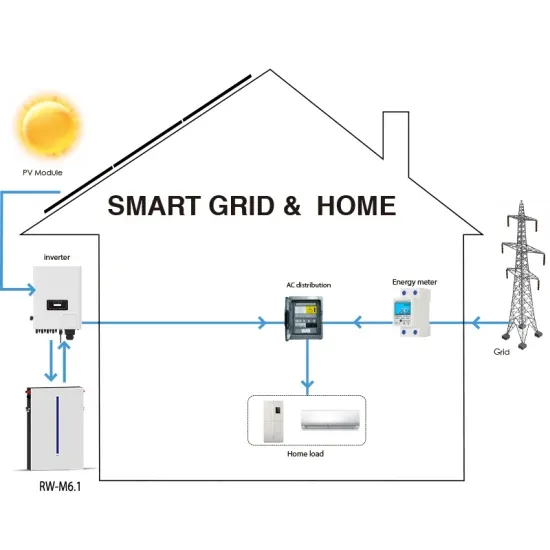

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.