Global solar inverter manufacturer rankings – pv magazine USA

Aug 11, 2025 · Quality assurance firm Sinovoltaics updated its inverter manufacturer financial stability ranking with APSystems (Yuneng Technology), Sinexcel, and Eaton in the top three

Solis Makes Top Global Ranking in Residential PV String Inverters

Aug 14, 2024 · Solis (Ginlong Technologies), a global leader in solar inverter technology, proudly announces it has received the #1 ranking position in global residential inverter shipments, as

2024 PVBL Ranking of the Most Valuable Photovoltaic Brands

6 days ago · On the first day of the conference, PVBL''s annual ranking of the Top 100 Solar Photovoltaic Brands was announced. According to the list, the total revenue of the 2024 global

6 FAQs about [Global PV Inverter Brand]

How pvbl ranked the top 20 global photovoltaic inverter brands in 2023?

On the first day of the conference, PVBL’s annual ranking of the Top 20 Global Photovoltaic Inverter Brands was announced. Preferential policies promoted the inverter market growth in 2023. Most of the major inverter companies won a large amount of orders and expanded their capacity with high shipment volume.

Who are the top 10 solar inverter manufacturers in 2025?

Top 10 Solar Inverter Manufacturers in 2025 1. Huawei 2. Sungrow 3. SMA Solar Technology 4. SolarEdge Technologies 5. Fronius 6. Enphase Energy 7. Growatt 8. GoodWe 9. Sineng Electric 10. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) Part 4. Global Supply Chain Centers for Solar Inverters Part 6.

Who makes the best solar inverter?

Building on almost a century of power electronics expertise, Italy’s Fimer has quickly become a leading global provider of solar inverters. Their comprehensive portfolio includes string, central, and large-scale inverters integrating storage and smart grid capabilities.

Who is the world leader in PV inverter industry?

Sungrow Power (China): In 2022, Sungrow Power became the world leader in the PV inverter industry and surpasses any competitor by nearly eight GW of shipment volume. Main product categories: String inverters & inverters & storage inverters.

Who makes the most PV inverters in 2022?

In 2022, Huawei will become the most important PV converter market globally, generating around 29 percent of global sales of PV inverters. Huawei followed Sungrow Power Supply and Ginlong Solis in second and third positions, respectively, according to shipment numbers. Who is the largest manufacturer of PV inverters?

What will the solar inverter industry look like in 2025?

Part 9. Conclusion The solar inverter industry in 2025 is set to be a vibrant and competitive landscape, led by a mix of established giants and innovative players. From Huawei’s smart technology to Enphase’s microinverter expertise, the top 10 solar inverter manufacturers offer a range of solutions to meet diverse energy needs.

Random Links

- Madagascar DC screen inverter installation

- Can the inverter generate three-phase electricity

- What are the outdoor communication battery cabinet factories in Bucharest

- Yemen photovoltaic glass panel glass

- EU Mobile Photovoltaic Folding Container Wholesale

- Fiji outdoor power prices

- Portable power supply ip65

- Zagreb energy storage container system manufacturer

- Outdoor power supply at the seaside

- South Korean lithium battery pack factory

- Minsk Industrial and Commercial Energy Storage Cabinet

- Portonovo UPS Uninterruptible Power Supply

- Recommended manufacturers of containerized energy storage vehicles

- Wholesale solar power system in Afghanistan

- Backup inverter systems factory

- Solar energy storage is divided into

- How much does it cost to customize a lithium battery pack in Ljubljana

- 48v4ah lithium battery pack

- Factory price 1000kw inverter in Ukraine

- Lithium battery station cabinet base station energy equipment

- Ranking of annual solar power generation of communication base stations

- How high the inverter voltage is the better the effect

- What is the energy storage battery industry in Asia

Residential Solar Storage & Inverter Market Growth

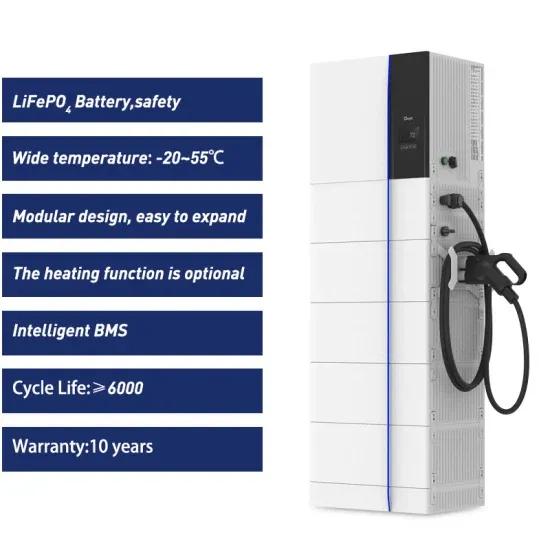

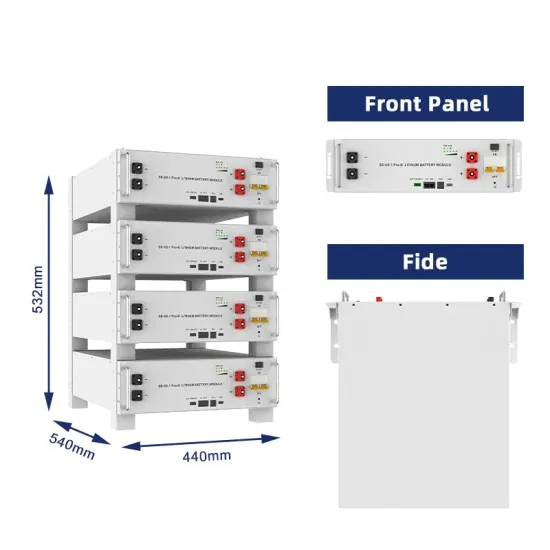

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.