【Solarbe PV Price Index】 Silicon Material Prices Surge by

Jul 18, 2025 · N-type 210 wafers averaged RMB 1.35/piece, N-type 182*210mm wafers averaged RMB 1.15/piece. Price Trends: Wafer prices saw a substantial increase, driven by upstream

Non-destructive recovery of silicon wafers from waste photovoltaic

Jul 19, 2025 · The continuous increase of waste photovoltaic (PV) modules poses a great challenge to global environmental protection and human health. As the main body of waste PV

Future cost projections for photovoltaic module manufacturing using

Apr 1, 2022 · Photovoltaic module prices have typically decreased faster than projections. There are two methods usually used for these projections; cumulative market shipment experience

China''s Solar Wafer Prices Log Sharpest Weekly Drop This

May 12, 2025 · The average transaction price for N-type G12 monocrystalline silicon wafers fell to CNY1.35 (US 19 cents) per piece, marking a 7.5 percent drop from the previous week—a

Photovoltaic industry chain price differentiation, components

Mar 25, 2024 · authoritative advisory body InfoLink recently announced the latest week of photovoltaic industry chain prices, upstream and downstream prices continue to show a trend

6 FAQs about [Price of photovoltaic silicon wafer components]

How much does polysilicon cost?

Wafer (Per Pcs.) This week, the mainstream concluded price for mono recharge polysilicon is RMB 35.5/KG, while mono dense polysilicon is priced at RMB 33.0/KG and N-type granular silicon is currently priced at RMB 32.5/KG. Polysilicon producers continue to hold firm on pricing.

How much does non Xinjiang polysilicon cost?

Currently, non-Xinjiang polysilicon with traceability data generally carries a quoted premium of RMB 3–5/kg. Polysilicon prices in dollar terms are prices for polysilicon with non-China origins in dollar terms, not translated from RMB prices.

How much does a non Xinjiang wafer cost?

Currently, non-Xinjiang wafers with traceability data generally carry a quoted premium of RMB 0.15–0.2/pc. Starting February 2025, spot price updates for 183mm n-type wafers in dollar terms will be introduced. The high prices for M10 PERC and TOPCon cells is based mostly on those of Southeast Asian origins.

What happened to n-type silicon & granular wafers?

n-type silicon was up 3.7% from CW1, just 3 weeks after registering an increase in CW51/2024. Having remained unchanged since CW36/2024, granular silicon prices were also up 5.4% WoW. The 3 n-type wafers were up mid- to high-single-digits, with the 182 mm variant seeing a 9.3% increase WoW.

What happened to granular silicon prices in cw36/2024?

Having remained unchanged since CW36/2024, granular silicon prices were also up 5.4% WoW. The 3 n-type wafers were up mid- to high-single-digits, with the 182 mm variant seeing a 9.3% increase WoW. Prices for the n-type 182 mm cell were up 1.8% WoW in CW2, bringing all n-type cell prices at par at RMB 0.29/W.

Which solar panel and polysilicon pricing report adheres to Iosco reporting requirements?

The only solar panel and polysilicon pricing report that adheres to IOSCO reporting requirements. The OPIS Solar Weekly Report is the first and only solar panel and polysilicon pricing report to follow the International Organization of Securities Commissions’ (IOSCO) requirements for fair and transparent pricing.

Random Links

- Energy storage bidirectional power switching

- Which company in Türkiye is engaged in containerized liquid cooling energy storage

- Papua New Guinea Sunshine Energy Storage Power

- How many square meters are needed for 500 kilowatts of solar energy

- Yaounde lithium iron phosphate energy storage lithium battery

- Advantages and disadvantages of energy storage cold chain containers

- How much does a 90 watt solar street light cost

- Lithium battery 12v 150A battery pack

- Lisbon PV combiner box

- Better lithium battery pack

- Sri Lanka quality energy storage battery

- Home energy storage flywheel

- China high voltage switchgear in Us

- Famous brand of energy storage photovoltaic in Port Vila

- Costa Rica medical UPS uninterruptible power supply manufacturer

- South America Solar Energy Storage Manufacturers

- Reykjavik photovoltaic energy storage project put into operation

- DC 300V inverter

- Berne Energy Storage Power Station

- Brand new solar photovoltaic panels for sale

- Nordic Photovoltaic High-Quality Inverter

- Hot sale factory price safety breaker Price

- Abuja outdoor communication battery cabinet agent franchise

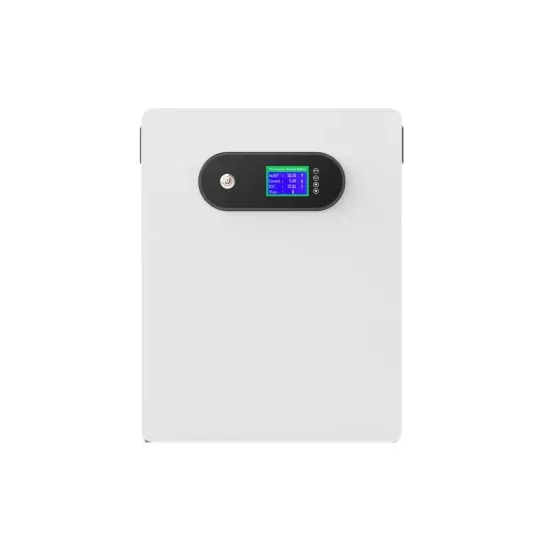

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.