A decade of solar PV deployment in ASEAN: Policy landscape

Nov 1, 2022 · This strategy is critical for developing a solid, self-sustaining PV market. Uncertainty and delay affected the success of solar policies in some ASEAN member states. Adoption of

2025 Photovoltaic Projects Continue To Develop In Singapore

Feb 8, 2025 · Kinsend''s photovoltaic cooperation projects in Singapore continue to increase, with a high installation rate of rooftop projects, using the space of industrial and commercial roofs to

Leading PV Markets & Top 10 Asset Owners in the ASEAN

Jul 23, 2025 · ASEAN''s solar surge is real — and this report reveals who''s leading it. Packed with market intelligence and regional insights, this Solarplaza white paper profiles the five most

6 FAQs about [ASEAN builds photovoltaic panel manufacturers]

What is the role of solar photovoltaics in Southeast Asia?

Solar photovoltaics (PV) play a pivotal role renewable energy revolution of Southeast Asia. Abundant sunlight, economic growth, and the rising demand for clean energy drive this shift. Vietnam and the Philippines dominate the solar and wind capacity projections of South-east Asia, contributing 80 percent of the anticipated utility-scale projects.

Will solar energy be a mainstay in Asean's energy mix?

In Malaysia, the introduction of the Net Energy Metering and tax allowances serve as catalysts for solar PV installation, while government-led tariff adjustments further propel the adoption of solar energy. These concerted efforts show how solar energy is set to be a mainstay in ASEAN’s energy mix for decades to come.

Where is solar power available in ASEAN?

The current key markets for solar power are Vietnam, Malaysia, Thailand, the Philippines, and Indonesia, which also account for more than 87% of ASEAN’s population. The solar M&A scene is most active in Thailand and Vietnam – the countries with the highest installed capacities in the ASEAN region.

How can ASEAN grow its dominance in the global solar supply chain?

Seow added: “ASEAN is also seeking to grow its dominance in the global solar supply chain through three areas: introducing new renewable energy laws; increasing large-scale installations of solar and wind power; and installing floating solar panels.”

How much solar power does Southeast Asia have?

Presently, ASEAN boasts 28 GW of large utility-scale solar and wind power, contributing 9 percent to the region’s total electricity capacity. Solar photovoltaics (PV) play a pivotal role renewable energy revolution of Southeast Asia. Abundant sunlight, economic growth, and the rising demand for clean energy drive this shift.

Why should ASEAN invest in solar energy?

Furthermore, ASEAN's solar energy targets are also enabled by strategic partnerships and foreign investments. Through collaborations with global players, the region aims to leverage both expertise and resources, fostering a conducive environment for solar energy development across borders.

Random Links

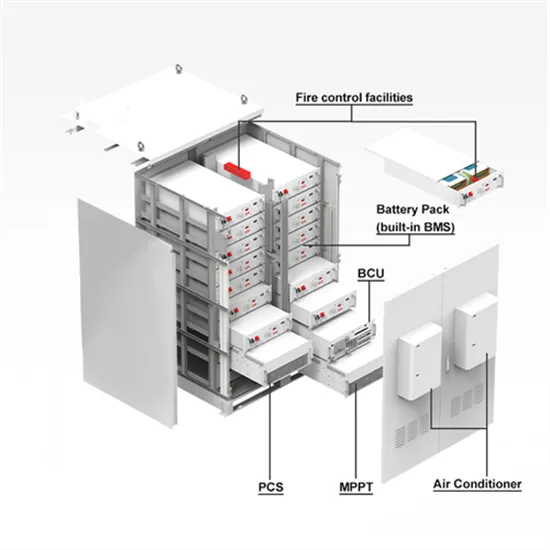

- Energy storage power station structure system

- Photovoltaic glass thermal bending

- Kuala Lumpur Capacitor Energy Storage System

- 48v super capacitor price

- High quality isolator breaker in Yemen

- Angola Solar Photovoltaic Folding Container Liquid Cooling

- Power generation loss of the auxiliary photovoltaic panels in the north

- What is energy storage power in Portugal

- Is the all-vanadium liquid flow battery solid

- Which is the high frequency output terminal of the inverter

- Factory price serket breaker in Denmark

- Home battery storage for sale in Azerbaijan

- Thailand household photovoltaic energy storage equipment manufacturer

- Regulate the management of battery energy storage systems for communication base stations

- Photovoltaic panels in Guinea

- Suriname battery energy storage container wholesale

- Design of household energy storage system

- Energy storage container power station design scheme

- Lobamba 48V Inverter

- 60v inverter host

- Battery cabinet batteries are not returned

- Myanmar Communications 5g base station detection

- Specifications of energy storage equipment

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.