Electricity markets and regulatory developments for storage in Brazil

Jan 1, 2022 · Brazil is taking its first steps toward its ambitions of bringing storage into the energy transition of its electricity sector. The modernization of the electricity sector discussed under

29 Top Renewable Energy Companies in Brazil · August 2025

Aug 1, 2025 · Detailed info and reviews on 29 top Renewable Energy companies and startups in Brazil in 2025. Get the latest updates on their products, jobs, funding, investors, founders and

The Strategic Importance of Hydropower and Energy Storage in Brazil

Jul 3, 2025 · As wind and solar energy sources—currently constituting 34% of the energy matrix—continue to grow rapidly, the system is beginning to face operational challenges.

Energy Storage Companies in Brazil: Key Players, Trends, and

Jun 25, 2022 · With solar capacity hitting 4GW+ in Q1 2025 alone [5], the country''s energy storage sector is booming faster than a Carnival parade. This article dives into the top energy

Brazil''s Energy Storage Auction to Attract $450M in

Feb 4, 2025 · The auction aims to boost Brazil''s grid reliability by integrating energy storage for wind and solar power. Brazil is set to conduct its first auction for adding batteries and storage

Brazil''s energy storage auction to attract $450m in investments

Jan 23, 2025 · Brazil is set to conduct its first auction for adding batteries and storage systems to the national power grid, as reported by Reuters. The auction, to take place in June 2025, will

6 FAQs about [Which companies have energy storage power stations in Brazil ]

What are the top 10 energy storage companies in Brazil?

Due to various incentives and policies, Brazil's optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage companies including Baterias Moura, BYD, Freedom Won, Blue Nova Energy, Intelbras, Huntkey, FIMER, SMA Solar, Sungrow, and SolarEdge.

Where is Brazil's first commercial wind power & energy storage project located?

In March 2021, Acumuladores Moura and Baterias Duran jointly developed Brazil’s first commercial wind power + energy storage project and put it into operation. It is located in the state of Bahia in northeastern Brazil, with a total capacity of 1.5MW/3MWh, aiming to provide local Agricultural irrigation provides stable and clean energy.

Could pumped hydro be the missing piece in Brazil's energy system?

Conclusion Although energy storage solutions have yet to be widely deployed in Brazil, generation flexibility remains a scarce commodity. Therefore, storage projects, including pumped hydro, could be the missing piece needed to enhance the country’s energy system.

Can Brazil be a big battery storage country?

With well-designed policies and regulations, Brazil has significant potential to follow in the footsteps of jurisdictions like California and Chile for large-scale battery storage, Germany for distributed and large-scale storage, and Australia for both pumped hydro and large-scale battery systems.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Who is the largest battery supplier in Brazil?

BYD (002594.SZ) is Brazil’s largest battery supplier and has two factories in Brazil, producing lithium-ion batteries and solar modules respectively. BYD will start producing new N-type TOPCON photovoltaic modules in Brazil in December 2022, with a power capacity of 575W.

Random Links

- Kinshasa EK Energy Storage Systems Limited

- Bucharest energy storage equipment supplier

- East Africa lithium iron phosphate energy storage battery

- Castries Energy Storage Photovoltaic Industrial Park

- Production of photovoltaic glass

- Huawei Nordic Portable Power Bank

- Split-phase inverter price

- New Energy Storage in London

- Solar lights portable home outdoor lights

- Thimbu Photovoltaic Energy Storage Lithium Battery

- China-Africa containerized energy storage vehicle manufacturer

- Pristina Ground Solar System Application

- Niue photovoltaic panel custom manufacturer

- Brunei computer room uninterruptible power supply manufacturer

- Introduction to photovoltaics and energy storage

- Inverter battery cabinet production line

- M3p battery energy storage

- Guyana communication base station inverter grid-connected hybrid power supply

- Island 24v inverter

- House solar inverter for sale in Brunei

- Official discussion on the scale of new energy storage installations

- Distributed Energy Storage in Nepal

- Lithium battery pack low voltage protection voltage

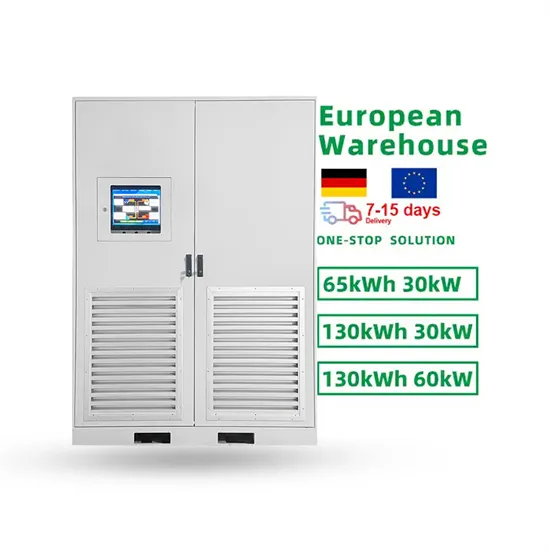

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

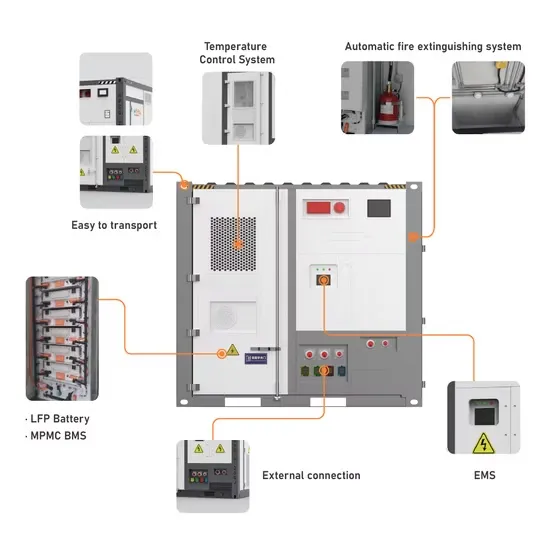

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.