Greece awards 189 MW of battery storage in third auction

Mar 24, 2025 · Greece''s latest auction has awarded subsidies to 188.9 MW of standalone, front-of-the-meter, utility-scale battery energy storage. The auction was the third and final edition of

Empowering Greece''s Green Future: The Dyness DH200F

Jul 3, 2024 · This diverse product lineup ensures that Dyness can cater to a wide range of energy storage requirements, from residential to large-scale C&I applications, further establishing the

RES & Energy Storage in Greece: The Green Tank presents

Jun 27, 2025 · Presenting to the Special Standing Committee on Environmental Protection of the Hellenic Parliament on June 25, 2025, Nikos Mantzaris, policy analyst and co-founder of The

Dozens of Pumped Storage Hydropower Projects Underway in Greece

Sep 2, 2024 · The pileup of proposals for wind and solar power plants in Greece bolstered the interest in investments in pumped hydropower storage facilities to balance the output from the

Greece launches generous residential energy storage

May 16, 2023 · On the other hand, Greece''s Ministry of the Environment and Energy allocated EUR 200 million under the "Photovoltaics on the Roof" program, encouraging the installation

Distorted licensing of energy storage in Greece leaves small

Feb 12, 2025 · Larger capacity needed in distribution grid POSPIEF warns that actual small-scale investors are left out, arguing that conditions are created for a black market for licenses. It

Greece accelerates energy storage with new battery and

Sep 8, 2024 · PPC holds permits for six energy storage facilities with a total generation capacity of 1.6 GW and is exploring new pumped storage projects at its existing hydroelectric plants. The

6 FAQs about [Scale of household energy storage facilities in Greece]

How long should energy storage be in a Greek power system?

Considering the energy arbitrage and flexibility needs of the Greek power system, a mix of short (~2 MWh/MW) and longer (>6 MWh/MW) duration storages has been identified as optimal. In the short run, storage is primarily needed for balancing services and to a smaller degree for limited energy arbitrage.

How many storage plants are there in Greece?

Currently there are four (4) storage plants operating in Greece, two open-loop pumped-hydro storage (PHS) stations in the mainland (700 ΜW in total) and two small hybrid RES-storage stations in non-interconnected islands (just 3 MW).

How does storage work on Greece's islands?

The introduction and development of storage on Greece’s islands that are that are not connected to the mainland power system is quite different, as it is currently only possible via hybrid stations (i.e. virtual production stations consisting of renewable energy resources and storage units operating as single distribution entities).

Should Greece invest in energy storage facilities?

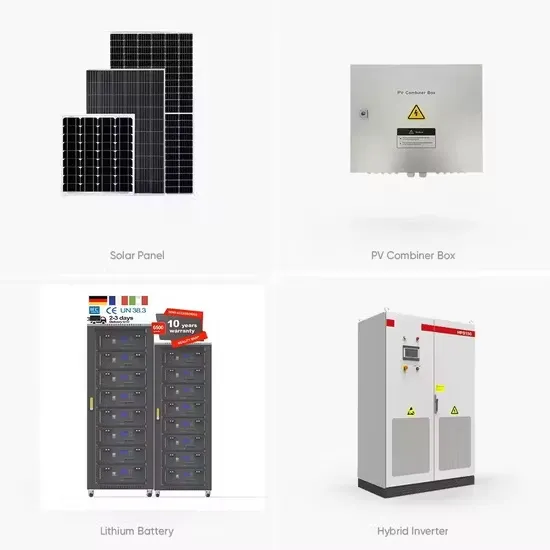

Currently there is a growing interest for investments in storage facilities in Greece. Licensed projects mostly consist of Li-ion battery energy storage systems (BESS), either stand-alone or integrated in PVs, as well as PHS facilities .

How is storage developing in Greece?

The development of storage in Greece has only just begun: this year has been the big "kick-start" and there is now a common understanding of the needs and requirements and the steps to be taken to ensure an adequate identification and prioritization of all necessary actions.

Will res stations be regulated in Greece in 2021?

1 During 2020-2021, Greece has experienced a new explosion of licensing interest for RES stations. The application to the Regulator in mid-2021 exceeded 9000 MW, with most of them having already acquired Electricity Producer Attestation (EPA), far beyond the needs of our national system.

Random Links

- Customized solar energy prices for communication base stations

- Georgetown Battery Energy Storage Box Direct Sales Company

- 13w outdoor power supply

- Procurement of rooftop photovoltaic panels

- How many watts should be installed for solar power generation

- Does the 48v inverter have a large loss

- Slovenia Industrial Uninterruptible Power Supply

- 25kw hybrid inverter for sale in Australia

- Outdoor power supply for courtyard

- Photovoltaic inverter dci

- What are the aspects of power storage projects

- Photovoltaic energy storage in Douala Cameroon

- Base station battery selling price in Asia

- What is the price of photovoltaic inverter

- Digital inverter AC

- Flexible photovoltaic panels series and parallel connection

- Bess battery storage in China in Turkmenistan

- Industrial emergency communication command base station

- Singapore original inverter structure manufacturer

- Prices of photovoltaic power generation components in Zimbabwe

- Kingsdon energy storage power brand ranking latest

- Niger communication base station flow battery shut down

- High frequency inverter with peak power of 6000w

Residential Solar Storage & Inverter Market Growth

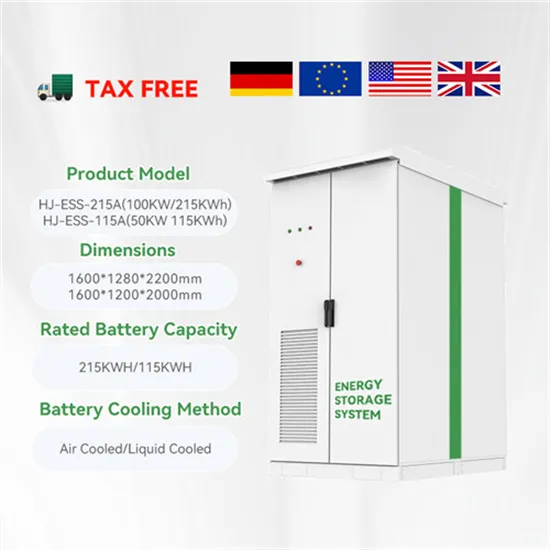

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.