Korea Battery Management System Market Forecast 2023-2033

Nov 9, 2023 · Intelligent BMS software facilitates the reduction of Electric Vehicle (EV) battery size without compromising their range, addressing the issue of limited battery production and

LG Energy Solution, Qualcomm complete new battery management system

Dec 23, 2024 · Korean leading battery maker LG Energy Solution said Monday that it will roll out a new battery management system for electric vehicles developed in cooperation with US chip

6 FAQs about [Seoul BMS Battery Management System]

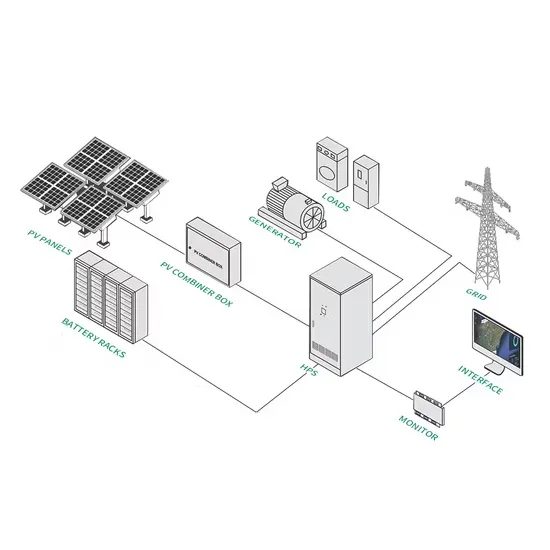

Will South Korean battery management systems upscale the demand for energy storage systems?

Presently, the market has reached pre-pandemic levels. Over the long term, South Korean battery management systems (BMS) are likely to have an upscaled demand due to their functional safety for the better performance of battery packs and the growing demand for energy storage systems in the country.

How big is the South Korea battery management systems market?

The Market Size is Growing at a CAGR of 14% from 2022 to 2032. The South Korea Battery Management Systems Market Size is Expected to Hold a Substantial Share by 2032. The South Korea Battery Management Systems Market Size is Expected to Hold a Substantial Share by 2032, at a CAGR of 14% during the forecast period 2022 to 2032. Market Overview

What is the segmentation of South Korea battery management systems market?

Based on the application, the South Korea battery management systems market is segmented into automotive, consumer/industrial handheld devices, and energy. Among these, the automotive segment has a significant revenue share over the forecast period.

What is a battery management system (BMS)?

Modern BMS have systems that monitor the health of the cells and can provide the user with performance and maintenance information. While BMS is required for all current battery applications in energy systems, hybrid electric vehicles, including plug-in hybrid electric vehicles and fuel cell electric vehicles, are especially important.

Why is the BMS market growing in South Korea?

Several factors are positively influencing the growth of the BMS market in South Korea, including the increasing adoption of electric vehicles and battery-powered public transportation, as well as a growing preference for renewable energy, which is increasing demand for sustainable battery solutions across a variety of industries.

How much will battery management systems cost in Korea by 2033?

By 2033, the sales of battery management systems are anticipated to reach a substantial US$ 1,661.10 million. The exceptional demand for battery management systems in Korea can be attributed to their ability to drive a revolutionary shift in the automotive industry.

Random Links

- Hanoi outdoor energy storage power supply

- Is the new energy battery cabinet sturdy

- Cheap koten circuit breaker factory Price

- How many mobile base station sites are there in Belmopan

- Manila PV Energy Storage 15kw Inverter Sales

- Port Louis Photovoltaic Panel Solar Brand

- Riyadh 5G Island Energy Storage Project

- High-efficiency photovoltaic panel structure and price

- Inverter power size and internal components

- British solar panels photovoltaic panels

- Bahamas wind power dedicated off-grid inverter

- Portugal can be equipped with industrial and commercial energy storage cabinets

- Does working at an energy storage power station affect fertility

- Iran Power Technology Energy Storage

- Apia Energy Storage Cabinet Battery is an enterprise

- Profit model of micro energy storage power station

- How much power does the inverter need to have

- Hxd1c battery cabinet

- South Tarawa Energy Storage New Energy

- Household UPS Uninterruptible Power Supply

- Advantages and disadvantages of batteries and energy storage batteries

- Battery for base station of telecommunication engineering

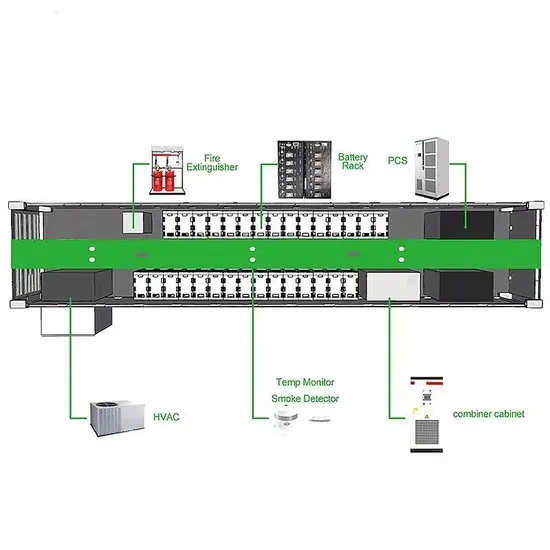

- Distributed energy storage cabinet fire protection

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.