How Does Photovoltaic Export Agency Operate? These 10

Jul 4, 2025 · This article provides a detailed analysis of the core processes involved in the export agency of photovoltaic products, covering key aspects such as qualification requirements,

Photovoltaic product exports hit record high in first 10 months

Dec 16, 2023 · The value of photovoltaic products exported by China hit a record in the first 10 months of 2023, with industry experts saying the momentum will persist through the year,

Five Points of Impact! China''s PV cuts 4% export tax rebate

Nov 18, 2024 · This represents a 4% decrease in the rebate rate for photovoltaic exports, significantly impacting China''s PV market, which heavily relies on exports. Export tax rebates

6 FAQs about [Export version of photovoltaic modules]

Where do solar PV exports come from?

The latest monthly solar PV export data from the world’s largest exporter, China, by country or region of destination. Ember China solar export dataset provides the following information: The IEA has stated that China’s solar photovoltaic exports account for 80% of the global market.

How many PV modules did China Export in 2023?

Separately, market research firm InfoLink has also released an analysis report based on customs data, which pointed out that from January to December 2024, China exported a total of 235.93GW of PV modules, an increase of 13% compared to 207.99GW in the same period in 2023. Comparison of Chinese PV module exports in 2023 and 2024. Source InfoLink

Which countries import PV modules from China?

In December, China exported approximately 16.63GW of PV modules, a 9% increase compared with the 15.2GW in November. The ranking of countries importing PV modules from China was Brazil, the Netherlands, India, Saudi Arabia and Spain. The total monthly imports of these major countries accounted for about 42% of the global market.

Which country exports the most PV modules in 2022?

The European Union was the biggest destination for China's PV exports in 2022, buying nearly $23 billion worth of products, up 113 percent year-on-year. This is equivalent to about 84 GW of modules, more than half of China's total module exports in 2022.

What is China's photovoltaic export value?

The export value, which includes photovoltaic products such as silicon wafers, cells and modules, reached about $43 billion during the first 10 months, the China Photovoltaic Industry Association said on Friday.

Will China continue to export photovoltaic products in 2023?

The value of photovoltaic products exported by China hit a record in the first 10 months of 2023, with industry experts saying the momentum will persist through the year, buoyed by higher demand amid a green energy transition worldwide.

Random Links

- Low-efficiency photovoltaic panel manufacturers

- Home energy storage has always used valley electricity

- Portable Power Supply 220

- 2 volt energy storage battery

- Uzbekistan wall-mounted energy storage lithium battery factory

- Is rechargeable lithium battery pack safe

- Can monocrystalline photovoltaic panels generate electricity in weak light

- 1 2 kw solar inverter factory in Nigeria

- Outdoor power three-phase electricity

- Portable power station europe in Korea

- You can see the solar panels in the power storage container

- Battery container production line

- North Asia Energy Storage Battery Container Wholesale

- Modular UPS uninterruptible power supply equipment in Cordoba Argentina

- Addis Ababa lithium battery site cabinet base station energy

- Photovoltaic glass improves light transmittance

- East Timor Energy Storage Power Station General Contractor

- Budapest container energy storage pigment manufacturer

- Nouakchott energy storage container house customization

- Solar energy storage cabinet lithium iron phosphate battery

- The most worthwhile outdoor power supply

- Ukrainian small photovoltaic folding container wholesale

- Pv breaker isolator for sale in Zambia

Residential Solar Storage & Inverter Market Growth

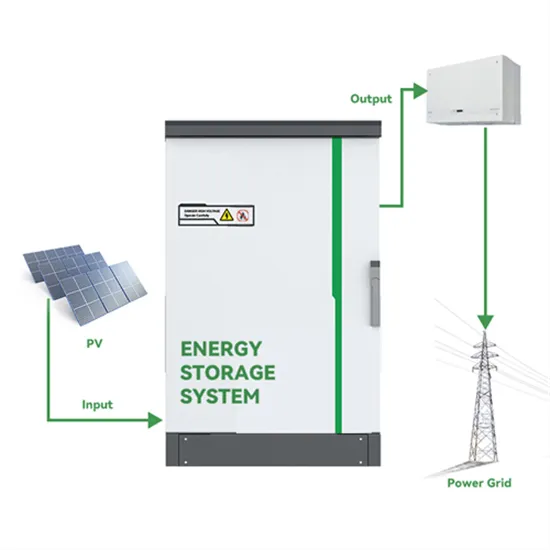

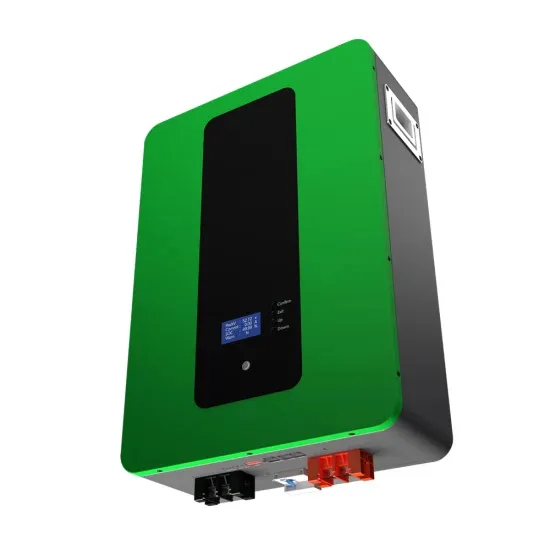

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.