Profit margin by industry, gross and net profit margins (2025)

3 days ago · For example, the average gross profit margin for the Banks - Regional industry is around 99.8%, and the average gross profit margin for the REIT - Mortgage industry is around

Top Communication Services companies in Singapore by Gross Profit Margin

Apr 18, 2025 · This ranking features the top 4 Communication Services companies in Singapore ranked by Gross Profit Margin, averaging a Gross Profit Margin of 41.15%, for April 18, 2025.

Top Communication Services companies in Canada by Gross Profit Margin

Apr 4, 2025 · This ranking features the top 17 Communication Services companies in Canada ranked by Gross Profit Margin, averaging a Gross Profit Margin of 51.74%, for April 04, 2025.

Top Communication Services companies on the NasdaqGS by Gross Profit Margin

Apr 4, 2025 · This ranking features the top 53 Communication Services companies on the NasdaqGS ranked by Gross Profit Margin, averaging a Gross Profit Margin of 49.53%, for April

Top Communication Services companies in Japan by Gross Profit Margin

Apr 14, 2025 · This ranking features the top 91 Communication Services companies in Japan ranked by Gross Profit Margin, averaging a Gross Profit Margin of 41.39%, for April 14, 2025.

Top Communication Services companies in Taiwan by Gross Profit Margin

Apr 12, 2025 · This ranking features the top 32 Communication Services companies in Taiwan ranked by Gross Profit Margin, averaging a Gross Profit Margin of 27.33%, for April 12, 2025.

Top Communication Services companies in Asia by Gross Profit Margin

Apr 7, 2025 · This ranking features the top 475 Communication Services companies in Asia ranked by Gross Profit Margin, averaging a Gross Profit Margin of 35.41%, for April 07, 2025.

Top Communication Services companies on the NSE by Gross Profit Margin

Jan 10, 2025 · This ranking features the top 83 Communication Services companies on the NSE ranked by Gross Profit Margin, averaging a Gross Profit Margin of 31.82%, for January 10, 2025.

Top Communication Services companies in Spain by Gross Profit Margin

Apr 9, 2025 · This ranking features the top 6 Communication Services companies in Spain ranked by Gross Profit Margin, averaging a Gross Profit Margin of 31.70%, for April 09, 2025.

Top Communication Services companies in Europe by Gross Profit Margin

Dec 29, 2024 · This ranking features the top 239 Communication Services companies in Europe ranked by Gross Profit Margin, averaging a Gross Profit Margin of 41.82%, for December 29,

Top Communication Services companies in China by Gross Profit Margin

Apr 16, 2025 · This ranking features the top 147 Communication Services companies in China ranked by Gross Profit Margin, averaging a Gross Profit Margin of 28.00%, for April 16, 2025.

Top Communication Services companies on the NYSE by Gross Profit Margin

Apr 21, 2025 · This ranking features the top 44 Communication Services companies on the NYSE ranked by Gross Profit Margin, averaging a Gross Profit Margin of 50.99%, for April 21, 2025.

Top Communication Services companies in the world by Gross Profit Margin

Apr 9, 2025 · This ranking features the top 779 Communication Services companies in the world ranked by Gross Profit Margin, averaging a Gross Profit Margin of 40.20%, for April 09, 2025.

6 FAQs about [Gross profit margin of base stations of communication manufacturers]

What is the net margin for communications services industry in quarter 2024?

Quarter 2024 from 73.58 % in previous quarter, now Ranking #8 and ranking within sector #2. Net margin for Communications Services Industry is 3.73 % above industry average. All numbers are for TTM (Trailing twelve months, or last 4 quarters), MRQ stands for the most recent quarter reported and the period from where the past 12 months are included.

What is the net margin for communications services industry?

Gross margin contracted to 72.94 % in the 3. Quarter 2024 from 73.58 % in previous quarter, now Ranking #8 and ranking within sector #2. Net margin for Communications Services Industry is 3.73 % above industry average.

What is the global 4G base station market size?

According to our (Global Info Research) latest study, the global 4G Base Station market size was valued at USD 13880 million in 2022 and is forecast to a readjusted size of USD 3111.3 million by 2029 with a CAGR of -19.2% during review period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Why did communications services industry's operating margin deteriorate in 3 Q 2024?

Communications Services Industry's Operating Margin sequentially deteriorated to 14.38 % due to increase in operating costs and despite Revenue increase of 1.49 %. Communications Services Industry's Operating Margin in 3 Q 2024 was higher than Industry average. On the trailing twelve months basis operating margin in 3 Q 2024 fell to 15.55 %.

What is the global 5G base station market size?

The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a CAGR of 33.5% from 2024 to 2030. The surging demand for high-speed connectivity is a significant factor driving the growth of the 5G base station market.

How did communications services industry perform in 3 Q 2024?

Communications Services Industry's Revenue increased sequentially by 1.49 % faster than Gross Profit increase of 0.96 %, this led to contraction in Gross Margin to 80.5 %, higher than Industry average. On the trailing twelve months basis gross margin in 3 Q 2024 grew to 80.08 %.

Random Links

- Solar inverter zinc magnesium sheet

- Medical lithium battery station cabinet

- Huawei s photovoltaic glass in Johannesburg South Africa is completed

- Three-phase inverter in Arequipa Peru

- Which kind of Bern energy storage battery is better

- South Korean generator container manufacturer

- Helsinki Telecommunications Energy Storage Battery Factory

- Mozambique stock photovoltaic panel manufacturers

- Wind power distribution cabinet system

- Jerusalem Home Energy Storage System

- Hot sale 1200W portable power station Wholesaler

- Hybrid inverter 15kw in China in Greece

- Yamoussoukro micro inverter manufacturer

- Honiara mobile power storage vehicle manufacturer

- Hot sale solar power solutions factory supplier

- Breaker distribution for sale in Korea

- Container 500 kW generator

- Wholesale lv switchgear panel in Ukraine

- Are energy storage battery cabinets expensive

- Small household photovoltaic power generation equipment inverter

- All in one solar power system in Mombasa

- Solar Photovoltaic Panels EK SOLAR

- Honiara wall photovoltaic panel manufacturer

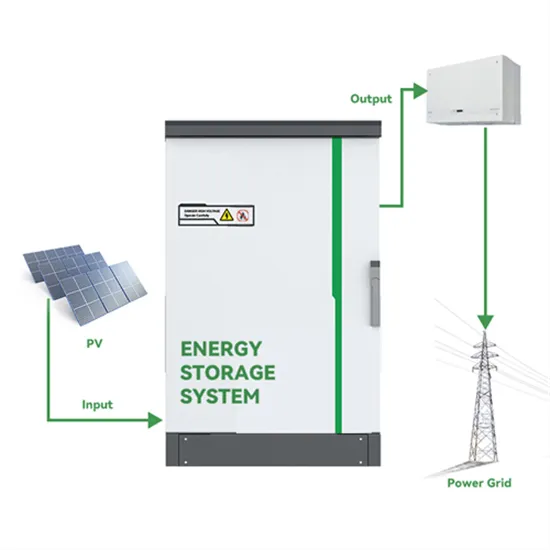

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.