Desay Battery and DOS Sign Strategic Cooperation

May 14, 2025 · The two parties will strategically deploy a 4GWh energy storage power station in the Middle East region. Starting from the Gulf area, they will jointly explore innovative paths for

Siemens Energy secures USD 1.6 billion project to advance

Mar 12, 2025 · Siemens Energy has been awarded a USD 1.6 billion project, with Harbin Electric International as the EPC contractor, to provide key technologies for the Rumah 2 and Nairyah

Energy Series Advancing Energy Storage in the MENA

Dec 11, 2024 · Speakers will examine various storage technologies, from long-duration batteries to advanced grid-scale solutions, and discuss the role they play in stabilizing energy grids and

6 FAQs about [Middle East Energy Storage Power Station Land Area]

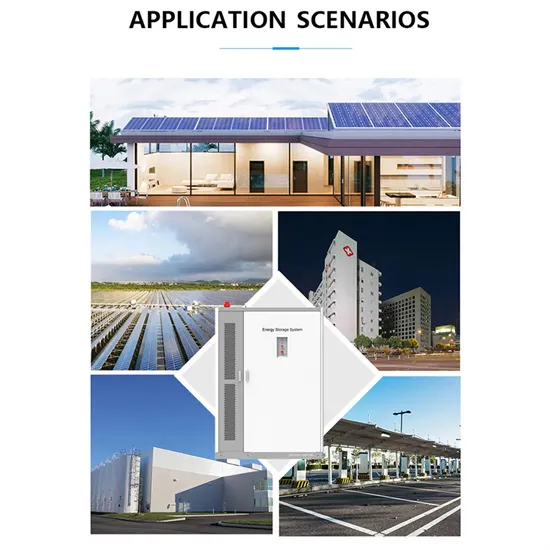

Is large-scale energy storage a viable option in the Middle East?

Until recently, large-scale energy storage was barely a consideration in the Middle East, where fossil fuels have long dominated power generation. With renewable energy projects expanding across the region, energy storage has started gaining traction.

Is energy storage gaining traction in the Middle East?

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and storage technologies are well-established, the Middle East remains in the early stages of development.

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Will energy storage expand in MENA?

The current utility business model limits the prospects of energy storage expansion opportunities, unless driven by direct governmental support. Auctions in MENA have been a major driver for renewable energy deployment, most notably for solar and wind, but only a few have included energy storage.

How long can a solar power plant store energy in MENA?

The proposed facility is designed to store energy for up to 12 hours. The MENA region is also home to a number of Concentrated Solar Power (CSP) plants that offer cost-effective, utility-scale thermal storage. Dubai’s Noor Energy 1, a 950 MW hybrid CSP and PV plant, is the world’s largest single-site hybrid solar project.

Random Links

- Pyongyang cylindrical lithium battery winter charging

- Spanish lithium battery pack

- Hybrid inverter mppt for sale in Lisbon

- Sodium battery energy storage series products

- Laos Uninterruptible Power Supply Vehicle

- Valletta BMS Battery Management Control System Features

- Energy Metering of Energy Storage System in Malaysia

- High quality solar power unit in Mombasa

- Conditions for establishing energy storage base stations in Tuvalu

- What are the disadvantages of battery cabinets at communication sites

- How long can a battery inverter last

- Vietnam supercapacitor module manufacturer

- India Mumbai Energy Storage Power Station bans lithium batteries

- Photovoltaic inverter equipment design and selection

- Nouakchott smart energy storage cabinet project bidding

- High quality thermal breaker in Latvia

- China ground fault breaker for sale Factory

- How long does a tool lithium battery discharge

- Tashkent Outdoor Energy Storage Equipment Company

- How many watts of normal outdoor power supply are sufficient

- Albania Solar Panels Photovoltaic Panels

- Wholesale off-grid inverters in Milan Italy

- Pure sine wave inverterPure sine wave inverter

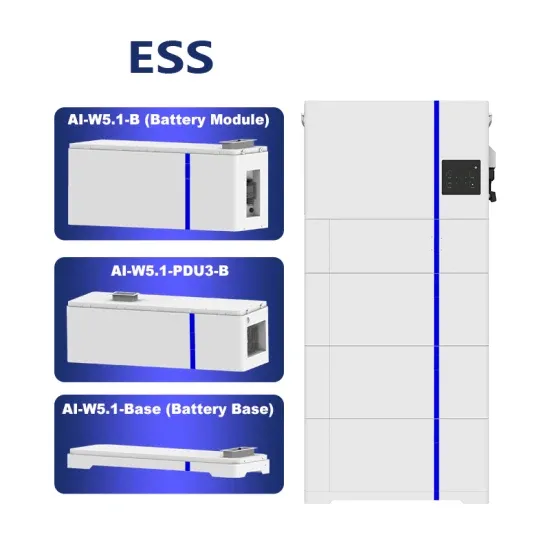

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.