Irrigation Facility: Solar-Powered Generator installed for river

Jan 1, 2025 · On December 31st, the 122 kilowatts solar-powered generator was installed at the facility. Chief Minister of Magway Region U Tint Lwin visited the station and oversaw the

Myanmar, China sign agreement to purchase electricity from three solar

Nov 9, 2023 · ACCORDING to a statement from the Chinese Embassy in Myanmar, the signing of an agreement between Myanmar and China for the purchase of electricity for three solar

Myanmar rice mills go solar, boosting sustainability, global

Jul 31, 2025 · These markets are vital for Myanmar''s rice industry, making solar-powered production a key factor in enabling premium pricing, he added. As part of this initiative, MRF

Solis hybrid system powers 50 kW solar-plus-storage site in Myanmar

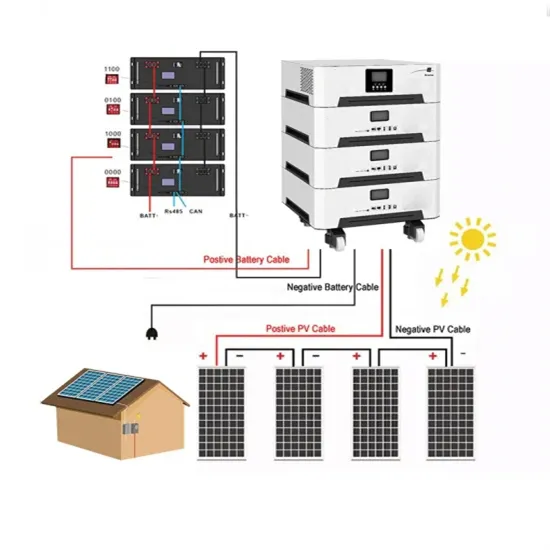

Jun 3, 2025 · Image Source: Solis China''s Solis, a PV inverter manufacturer, completed a 50 kW solar-plus-storage system at a commercial facility in Myanmar''s Yangon Region. The system

6 FAQs about [China solar powered generator in Myanmar]

Who owns Myanmar's solar market?

Myanmar's solar market is predominantly led by Chinese companies, including Sandisolar. In 2022, Sandisolar completed 36 solar projects and that number rose to 115 in 2023, with over 200 projects planned for 2024, Thi Thi Soe said. This growth highlights the increasing use of solar energy in the Southeast Asian country, she added.

Will Myanmar build solar power plants?

On the occasion, Secretary of the State Administration Council Lt-Gen Aung Lin Dwe said as Myanmar is rich in renewable energy sources such as hydropower, solar and wind power, it will make full use of the advantages provided by the nature and build solar power plants.

What are the main power-generating companies in Myanmar?

The Hydropower Generation Enterprise (HPGE) and the Myanmar Electric Power Enterprise (MEPE) are the main power-generating companies in Myanmar. The Yangon City Electricity Supply Board (YESB) distributes power to consumers in Yangon, and the Electricity Supply Enterprise (ESE) distributes power to the rest of the country.

Why is solar energy on the rise in Myanmar?

(Xinhua/Myo Kyaw Soe) YANGON, Oct. 5 (Xinhua) -- The adoption of solar energy in Myanmar is on the rise due to increasing oil prices and electricity costs, Thi Thi Soe, deputy general manager of Sandisolar, a Myanmar-based Chinese new energy company, told Xinhua on Friday.

Why are Chinese solar panels popular in Myanmar?

Chaik Sai, 46, expressed his preference to Chinese-made solar panels, noting their popularity in Myanmar. These panels can provide steady power and light, which helps prevent the frequent on-and-off situations that can damage electrical appliances.

Can solar panels be installed on a house in Myanmar?

This photo taken on Oct. 4, 2024 shows solar panels installed on the roof of a house in Yangon, Myanmar. (Xinhua/Myo Kyaw Soe)

Random Links

- 5kw sunsynk inverter for sale in France

- Tiled solar equipment

- Outdoor power supply 220v330w

- Panama Colon Energy Storage System Agent

- Can multiple 12V lithium battery packs be connected in parallel

- Large-scale battery energy storage power station

- Ireland unveils custom-made high-performance energy storage batteries

- Base station cabinet battery photos

- Outdoor power supply manufacturer with large capacity

- 100kw off-grid inverter price in East Africa

- Energy storage cabinet batteries and ordinary batteries

- Iraqi battery cabinet factory

- General capacity of photovoltaic inverter

- North Macedonia lithium energy storage power production company

- New energy storage grid connection

- Maputo Photovoltaic Energy Storage Cabinet Lithium Battery

- Super cost-effective pure sine wave inverter

- Brand lithium battery station cabinet

- Energy Storage Smart Grid Lithium Batteries

- How much does Bern s industrial energy storage lithium battery cost

- Jakarta Lithium Battery Pack

- Price of energy storage cabinet for communication base station inverter

- New Energy Storage Project Energy Storage Unit

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.