Youngy Group to Build Li-Ion Battery Plant in Inner Mongolia

Jun 2, 2023 · According to the letter, Youngy Group will set up a local base for the manufacturing of Li-ion battery cells and packs. The total investment in this project is estimated to reach

How much does a lithium battery cost Manufacturer & Supplier

Factors that influence the cost of lithium batteries With a few factors that could affect the cost of lithium batteries. There is one major things that is the brand that the make. Some brands are

Historical and prospective lithium-ion battery cost

Jan 15, 2024 · Lithium-ion batteries (LiBs) are pivotal in the shift towards electric mobility, having seen an 85 % reduction in production costs over the past decade. However, achieving even

How Much Do Lithium-Ion Batteries Cost? An Insight into

Feb 21, 2025 · Lithium-ion batteries are crucial for various applications, including electric vehicles (EVs) and renewable energy storage systems. Understanding their pricing dynamics is

How much does Dongguan energy storage lithium battery cost

Oct 8, 2024 · The cost of energy storage lithium batteries in Dongguan is influenced by various factors. 1. Pricing variations, 2. Market demand, 3. Battery specifications, 4. Manufacturer

Top Lithium-Ion Battery Manufacturers Suppliers in Mongolia

Feb 18, 2025 · Solar Energy Equipment Supply Capacity in Mongolia There are plenty of suppliers and manufacturers of solar power equipment in Mongolia. You can also find plenty of options

6 FAQs about [How much does a Mongolian lithium battery manufacturer cost]

Does Mongolia have a lithium market?

The world’s lithium market is at the center of attention for investors. Although Mongolia is far behind other countries, policymakers are discussing the future of lithium exploration at the policy level.

Could Mongolia become a battery manufacturing hub?

"Mongolia has lithium assets, Mongolia is building manufacturing facilities, the University of Science and Technology is well-versed in hydrogeology – a joint venture between the public and private sectors could put this manufacturing capability in Mongolia," Haji says - envisioning a greater role for the country in the global battery supply chain.

Is Mongolia's first lithium brine explorer?

Enter ION Energy, Mongolia's first lithium brine explorer. The company (listed on Canada's TSX Venture Exchange) has a license to explore lithium reserves in Sukhbaatar aimag and aims to export high-quality lithium into the burgeoning battery metals Asian market, which would put Mongolia at the forefront of the electric transport revolution.

Is Mongolia a good place to invest in lithium & cobalt?

While investment in lithium and cobalt exploration alone has increased several times, Mongolia’s exploration sector has the potential to attract it. What do we have? The amount of lithium reserves registered in the Unified Mineral Resources Fund of Mongolia is 713,000 tonnes. Currently, five lithium projects are being implemented in Mongolia.

How much does lithium carbonate cost in 2022?

Raw Materials: Lithium carbonate prices swung from $6,000/ton (2020) to $80,000/ton (2022). Manufacturing Scale: Gigafactories like Tesla’s reduce costs through economies of scale. Energy Density: NMC 811 batteries cost $98/kWh vs. LFP’s $80/kWh in 2024. Policy Shifts: US Inflation Reduction Act subsidies cut domestic production costs by 12%.

How much does a lithium battery cost in 2022?

However, 2022 saw a 7% price spike due to lithium supply constraints. LFP batteries now dominate stationary storage at $105/kWh, while NMC remains preferred for EVs despite higher costs ($130/kWh). Maintenance-free sealed AGM battery, compatible with various motorcycles and powersports vehicles.

Random Links

- Price of rooftop solar photovoltaic panels

- Best solar power with grid backup Wholesaler

- Rooftop photovoltaic panel cost

- Does photovoltaic panel power generation require a machine room

- How many watts is equivalent to one thousand watts of solar energy

- Cape Verde cylindrical lithium battery manufacturer

- Pretoria Independent Energy Storage Power Station

- What is the temperature of the solar inverter

- Telecom Energy Storage Clean Household Energy Storage Battery Cabinet

- Colombia s energy storage installations accelerate

- Inverter 4 5kw

- Photovoltaic power supply 40kw energy storage

- Panama UPS uninterruptible power supply supplier

- C63 inverter manufacturer

- Huawei Argentina Home Energy Storage

- Bahamas EK Energy Storage Battery Products

- How many solar panels are there in one watt

- 36v super 220 inverter

- Bolivia Energy Storage Charging Pile Electricity Price Standard

- Ghana rechargeable energy storage battery

- How many watts can a 1000v solar panel produce

- Morocco Rural Energy Storage Power Station Project

- Common battery cabinet samples

Residential Solar Storage & Inverter Market Growth

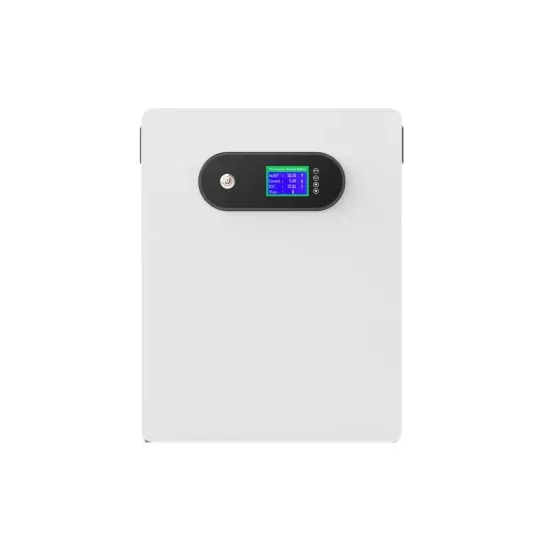

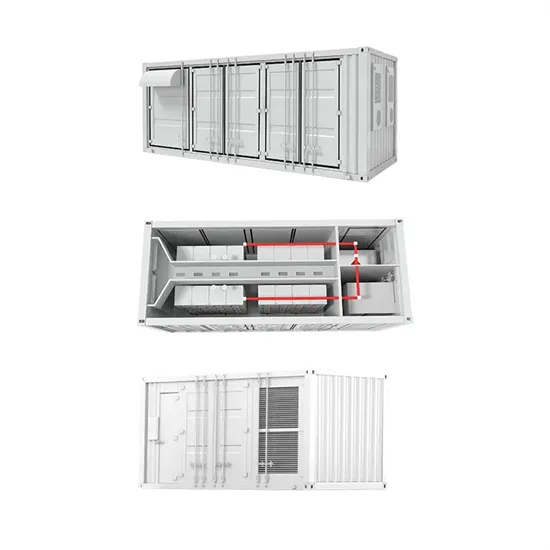

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.