Progress of PV cell technology: Feasibility of building materials, cost

Jul 1, 2023 · The commercially available Si-based PV modules are mostly either single- (sc-Si) or multi-crystalline silicon (mc-Si). To date, silicon is the most widely used semiconductor

Innovations in improving photovoltaic efficiency: A review of

Mar 1, 2025 · This review paper presents a comprehensive analysis of state-of-the-art innovations in PV efficiency enhancement techniques, including cooling methods, mobile PV systems,

PV cells and modules – State of the art, limits and trends

Dec 1, 2020 · The influence of price, efficiency and service life of PV modules on LCOE (together with the availability of materials) sets limits for applicable technologies. Over the past 15 years

6 FAQs about [Ngerulmud high-efficiency photovoltaic module prices]

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

How much does a module cost in 2024?

High-Efficiency Modules: Average price of €0.14/Wp, down 6.7% from September 2024 and 39.1% from January 2024. Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024.

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

Are high-efficiency solar modules becoming scarce?

High-efficiency solar modules are becoming scarce, prompting some retailers to stockpile in anticipation of rising prices, says Martin Schachinger, founder of pvXchange.com. He expects module prices to climb moderately but steadily until at least early next quarter. From pv magazine Germany

How efficient are photovoltaic modules in 2025?

But let’s take a closer look at the figures recorded in January 2025: Photovoltaic modules with monocrystalline or bifacial HJT cells, N-type/TOPCon or xBC (Back Contact) and their combinations, with efficiencies above 22.5%.

When will PV module prices rise?

As a result, module prices will likely rise moderately but steadily until at least early next quarter. This outlook reflects delays in deliveries from major brands, with restocking for mid-sized PV systems not expected until April or May.

Random Links

- What are the uninterrupted power supplies for island communication base stations

- Energy storage battery prices in Mumbai India

- Outdoor power supply 300W

- Male site energy battery cabinet manufacturer

- Hot sale 5kw sunsynk inverter in China exporter

- Difference between battery pack and lithium battery

- What is Tokyo Energy Storage System

- 12v inverter silver point

- Juba battery inverter manufacturer

- Power distribution cabinet in industrial and commercial energy storage

- 3kw photovoltaic energy storage

- What brand of 24v to 220 inverter is good

- Special Energy Storage Batteries

- Asmara photovoltaic energy storage ratio

- Photovoltaic panel prices are fully charged to the grid

- Outdoor Power Supply Wholesale in the United States

- Main breaker switch in China in Australia

- Danish new energy storage policy

- Dominica grid-connected inverter supply

- Industrial energy storage cabinet installation specifications

- Morocco cylindrical lithium battery customization

- High quality solar powered devices factory Seller

- 150w photovoltaic panel output current

Residential Solar Storage & Inverter Market Growth

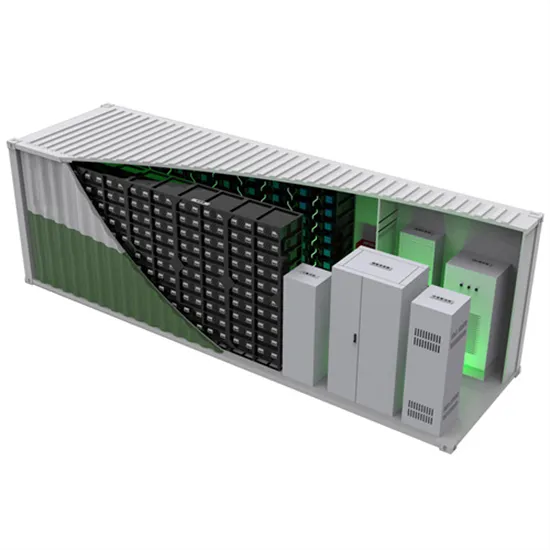

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.