Operational strategy and economic analysis of energy storage

Dec 16, 2022 · With the continuous development of battery technology, the potential of peak-valley arbitrage of customer-side energy storage systems has been gradually explored, and

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · 1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · • The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. • The retrofitted energy storage system is more cost-effective than batteries for

获取多场景收益的电网侧储能容量优化配置

Apr 20, 2021 · In view of the current grid energy storage system, application scena-rio is relatively single, we propose a grid side energy storage capacity allocation method that takes into

C&I energy storage to boom as peak-to-valley spread

Aug 31, 2023 · In China, C&I energy storage was not discussed as much as energy storage on the generation side due to its limited profitability, given cheaper electricity and a small peak-to

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Dyness Knowledge | Solar and energy storage must-learn

Jan 18, 2024 · During peak hours, electricity prices are higher, while during valley hours, electricity prices are lower. Therefore, the business model of energy storage peak-valley arbitrage is to

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The

Energy Storage Arbitrage Under Price Uncertainty:

Jan 16, 2025 · Energy storage participants in electricity markets leverage price volatility to arbitrage price differences based on forecasts of future prices, making a profit while aiding grid

Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time,

Demand response-based commercial mode and operation strategy

Nov 1, 2021 · Second, time of use optimization model is built for obtaining optimal electricity prices of peak–flat–valley periods. Third, a commercial mode based on the peak valley arbitrage

Research on the integrated application of battery energy storage

Mar 1, 2023 · Abstract To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive

Arbitrage analysis for different energy storage technologies

Nov 1, 2021 · The estimated capacity cost of energy storage for different loan periods is also estimated to determine the breakeven cost of the different energy storage technologies for an

6 FAQs about [Georgia Energy Storage Peak-Valley Arbitrage Program]

What is Peak-Valley price arbitrage?

1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and discharging during peak hours (high rates), businesses achieve direct cost savings. Key Considerations:

What is energy arbitrage?

Energy arbitrage means that ESSs charge electricity during valley hours and discharge it during peak hours, thus making profits via the peak-valley electricity tariff gap [ 14 ]. Zafirakis et al. [ 15] explored the arbitrage value of long-term ESSs in various electricity markets.

Is a retrofitted energy storage system profitable for Energy Arbitrage?

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage.

Are energy storage systems more cost-effective than batteries for Energy Arbitrage?

The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage. In the context of global decarbonisation, retrofitting existing coal-fired power plants (CFPPs) is an essential pathway to achieving sustainable transition of power systems.

Is energy arbitrage profitability a sizing and scheduling Co-Optimisation model?

It proposes a sizing and scheduling co-optimisation model to investigate the energy arbitrage profitability of such systems. The model is solved by an efficient heuristic algorithm coupled with mathematical programming.

What is the scale of the energy storage system and operation strategy?

The scale of the energy storage system and operation strategy was related to the technical and economic performance of the coupling system , . In order to reduce the extra cost of the BESS, it is necessary to conduct the optimization research of the BESS and RE coupling system .

Random Links

- Wholesale 1600 amp switchgear in Panama

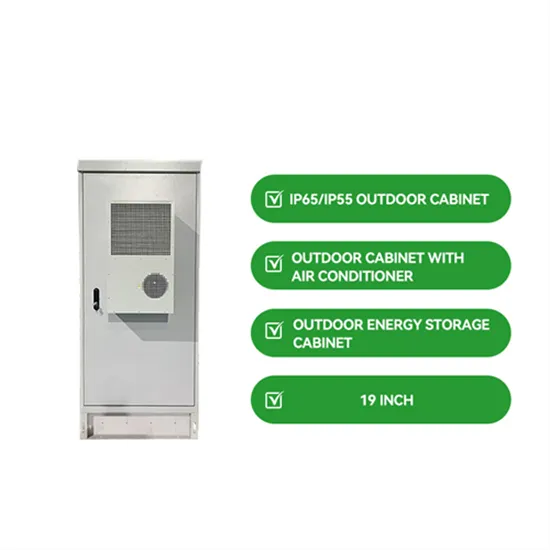

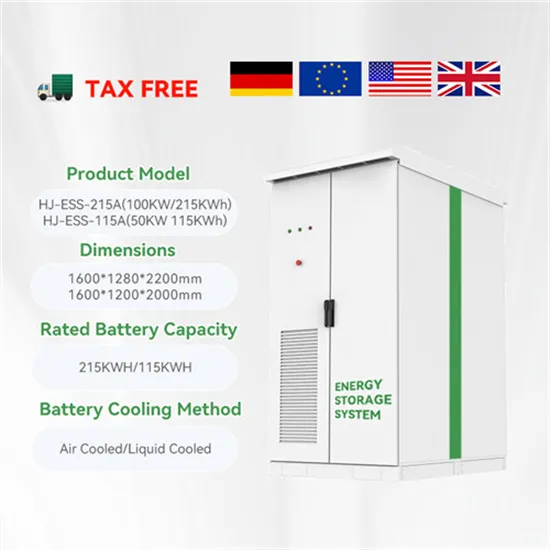

- Battery cabinet production outdoor site

- How many kilowatt-hours of electricity can a 60v20a inverter generate

- How many watts is a 90w solar light equivalent to

- Solar Photovoltaic Inverter System

- Wind-solar-storage system power ratio

- How much is the photovoltaic energy storage cabinet in Slovakia

- Supply 10kw uninterruptible power supply manufacturers

- Ukrainian energy storage container park design

- Ljubljana professional battery cabinet price

- 300wh power station for sale in Croatia

- Lebanese Small Uninterruptible Power Supply Company

- 12v can be converted to 380v inverter

- 10000w power inverter factory in Zambia

- Niue 5g communication green base station heat dissipation

- Can 5G base stations be powered together with photovoltaics

- Dominican Republic PV Container

- Hot sale wholesale dcc circuit breaker producer

- China 3 5 kva hybrid inverter in Atlanta

- The role of energy storage battery pre-charging system

- Nassau Energy Storage Equipment Company

- 625W monocrystalline photovoltaic panel

- OEM energy storage power supply

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.