Battery storage project pipeline in Romania in rapid expansion

Aug 16, 2025 · In an accelerating investment wave, companies in Romania are combining BESS with solar power, hydropower and wind power, or building standalone energy storage facilities.

Romania allocates €120 million in state aid to boost battery

Dec 20, 2024 · The Romanian Ministry of Energy has announced a total of €120 million in state aid for six companies to support the production, assembly and recycling of battery energy

Romania: R.Power secures €15 million grant for 127MW/254MWh BESS

Jan 12, 2025 · The funding, totaling RON 74.6 million, was granted by Romania''s Ministry of Energy and was announced by R.Power on LinkedIn on January 3, 2025. This project will

Romania: Trina Storage to Deliver 65MWh Battery System for Romanian

Aug 4, 2025 · Trina Storage is set to supply a 65MWh battery energy storage system (BESS) for a new project in Romania, marking its first deployment in the country. The initiative, located in

6 FAQs about [Romania BESS outdoor power supply]

How many MW is a Bess project in Romania?

This project will feature a 127 MW power rating and an energy storage capacity of 254 MWh, making it one of the largest BESS projects in Romania to date. However, R.Power has not disclosed when the project will become operational.

Is the Bess market heating up in Romania?

The BESS market in Romania is heating up, say local analysts and insiders. Irene Mihai, policy officer at the Romanian Photovoltaic Industry Association (RPIA) recently told pv magazine that a realistic target for the utility-scale BESS segment in Romania “would be around 2 GWh (around 1 GW of installed capacity)” for 2030.

Which Romanian companies are adding Bess to their renewable assets?

Other Romania-based companies, such as Parapet and Waldevar Energy, have told pv magazine that adding BESS to their renewable assets is a top priority. The May edition of pv magazine features an in-depth look at Romania’s solar and energy storage markets.

Is Romania a Bess market?

“As other European BESS markets become increasingly saturated, Romania stands out,” said Evangelos Gazis, Aurora’s head of Southeastern Europe, adding that the investment case for storage is strengthened by wind and solar’s rapid expansion driving high volatility in wholesale and balancing markets. Interesting activity

Who owns the largest Bess project in Bulgaria?

Additionally, Renalfa, which owns the largest operational BESS project in Bulgaria, a 25 MW/55 MWh system, continues to make strides in the region’s energy transition. R.Power has been awarded €15 million (approximately US$15.6 million) in non-reimbursable state funding to build its first large-scale BESS.

What is R power doing in Romania?

In addition to its activities in Romania, R.Power is involved in several renewable energy and storage initiatives across Europe. In related news, IPP Renalfa has acquired a 258 MW solar project in Teleorman, Romania, which is expected to begin operations in 2027.

Random Links

- Control switchgear for sale in Cape-Town

- Is the Baku solar fan useful

- 2kw wind power generation system

- Automatic conversion of photovoltaic panel power generation

- Lithium battery station cabinet test photovoltaic flow

- Does the photovoltaic power supply have an energy storage inverter

- Replacing batteries in Maputo energy storage cabinets

- Necessity Analysis of Communication Base Station Inverter Construction

- UPS uninterruptible power supply for Berne computer room

- Lome Energy Storage Power Station Company

- Energy storage control and microgrid

- 120w fast charging outdoor power supply

- Small Base Station Power Supply

- Mali Phase Change Energy Storage System Production

- 380v three-phase universal inverter

- HJ Telecom Battery Cabinet

- 6v to 48v inverter

- What are the power station energy storage projects

- Rated capacity of household energy storage in the Democratic Republic of Congo

- There is a battery energy storage project in Surabaya Indonesia

- Pretoria energy storage container distribution box manufacturer

- 2625kw energy storage equipment

- Home circuit breaker for sale in Toronto

Residential Solar Storage & Inverter Market Growth

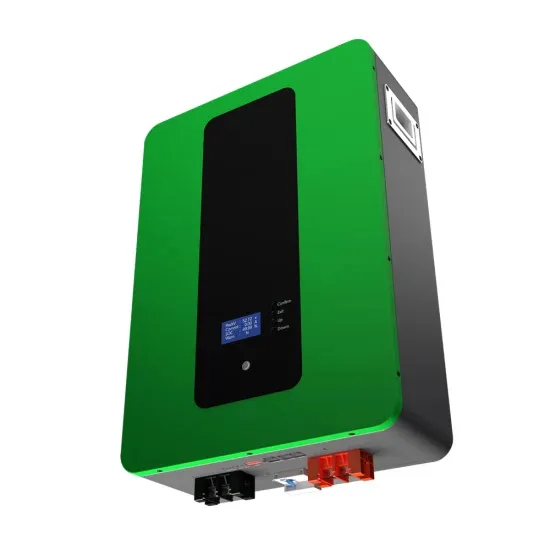

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.