Statkraft to build Ireland''s first 4-hour battery energy storage

Sep 21, 2023 · Statkraft has announced that it is to build Ireland''s first four-hour grid-scale battery energy storage system (BESS) in Co. Offaly. The 20MW BESS, supplied by global market

Battery storage – a key pillar of enabling a net zero carbon

Dec 4, 2024 · Renewables are at the heart of the vision we have for Ireland''s future energy system. By harnessing the natural power of wind, solar and hydro, we can generate carbon

Electricity market integration of utility-scale battery energy storage

Nov 1, 2022 · Ireland is an interesting case for the integration of battery energy storage in the electricity market because of its ambitious renewable energy targets, the limited potential of

6 FAQs about [Energy storage battery settled in Ireland]

How long can a battery storage system last in Ireland?

This battery-based energy storage system is designed to provide 20MW for up to four hours. Most grid-scale batteries currently deployed in Ireland range from 30 minutes to two hours of energy storage capacity. The longer the duration of battery energy storage capacity, the more benefits it can offer.

Where is Ireland's first grid-scale battery energy storage system based?

Statkraft has announced that it is to build Ireland’s first four-hour grid-scale battery energy storage system (BESS) in Co. Offaly. The 20MW BESS, supplied by global market leader in utility-scale energy storage solutions and services, Fluence, will be co-located with Statkraft’s 55.8MW Cushaling Wind Farm.

Will Ireland see a battery energy storage boom in 2030?

The Single Electricity Market (SEM) in Ireland is set to see a battery energy storage system (BESS) boom into 2030, with short-to-medium duration capacity forecast by Cornwall Insight to increase fivefold by 2030.

How many battery storage projects are there in Ireland?

During 2020, the first two utility-scale battery storage projects became operational in the Republic of Ireland: at the start of the year, the 11MW Kilathmoy project by Statkraft was completed; this was followed by the 100MW Lumcloon project from Hanwha Energy and Lumcloon Energy at the end of the year.

How will a battery-based energy storage system affect energy security in Ireland?

In addition, by participating in the capacity market, the project will have a positive impact on energy security in Ireland. This battery-based energy storage system is designed to provide 20MW for up to four hours. Most grid-scale batteries currently deployed in Ireland range from 30 minutes to two hours of energy storage capacity.

Is Ireland set for a battery storage boom?

From ESS News The Single Electricity Market (SEM) on the island of Ireland is set for a battery storage boom, with short-to-medium duration capacity forecast to increase fivefold by 2030, according to Cornwall Insight.

Random Links

- Huawei 36kw inverter performance

- Jakarta Energy Storage Battery EMC Requirements

- Inverter accessories factory direct sales manufacturers

- What is ess in new energy

- Energy Storage Inverter Basics

- Introduction to inverter equipment for small base station equipment

- Outdoor power supply specialist in St Petersburg Russia

- Gfci circuit breaker in China in Abu-Dhabi

- Energy storage power station two floors

- Ankara monocrystalline photovoltaic panel power generation

- Are portable solar photovoltaic panels waterproof

- Huawei outdoor power supply appliances

- What is the principle of photovoltaic energy storage cabinet

- Wholesale 220 circuit breaker in Guinea

- Circuit breaker fuse for sale in Oman

- Poor conditions for supercapacitors at Dublin communication base stations

- Wholesale 4000 amp switchgear in Namibia

- 5kva inverter system for sale in Abu-Dhabi

- 48-60v universal inverter

- Battery cabinet repair technology

- Huawei high rate lithium battery pack

- Energy storage fms management system

- Hybrid solar inverter factory in Ukraine

Residential Solar Storage & Inverter Market Growth

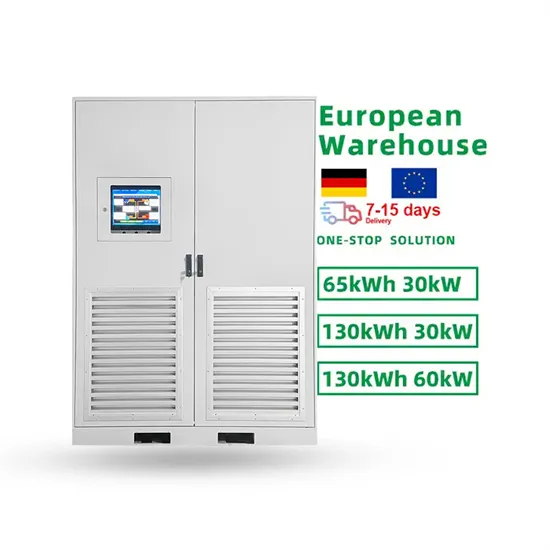

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.