Technical Requirements and Market Prospects of 5G Base

Jan 17, 2025 · 5G base station chips play a critical role in the construction of 5G networks. As technology continues to advance, base station chips will demonstrate higher performance and

Unveiling the 5G Base Station: The Backbone of Next-Gen

Jun 3, 2025 · Explore the inner workings of 5G base stations, the critical infrastructure enabling high-speed, low-latency wireless connectivity. Discover their components, architecture,

San Jose, CA to roll out largest small cell deployment of any

Jun 18, 2018 · AT&T, which had reached a tentative partnership with San Jose in April, will form a full public-private partnership (P3), including using small cells to lay the groundwork for mobile

6 FAQs about [What are the 5G base stations signed by San Jose Communications ]

How does a 5G base station work?

5G base stations operate by using multiple input and multiple output (MIMO) antennas to send and receive more data simultaneously compared to previous generations of mobile networks. They are designed to handle the increased data traffic and provide higher speeds by operating in higher frequency bands, such as the millimeter-wave spectrum.

Does San Jose have 5G?

5G is Officially in San Francisco and San Jose. But Who Really Has Access? | KQED 5G is Officially in San Francisco and San Jose. But Who Really Has Access? Workers rebuild a cellular tower with 5G equipment. San Jose's deal with mobile companies to launch 5G networks ensures that the new technology will be available to all of its residents.

Who has access to 5G in San Francisco & San Jose?

5G is Officially in San Francisco and San Jose. But Who Really Has Access? Workers rebuild a cellular tower with 5G equipment. San Jose's deal with mobile companies to launch 5G networks ensures that the new technology will be available to all of its residents. (George Frey/Getty Images)

What are the prospects of the 5G base station market?

Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period. Furthermore, the growth of the 5G IoT ecosystem and vital communication services is expected to provide lucrative prospects for the 5G base station market to expand.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

Who are 5G base stations suppliers?

Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market. China has installed around 12 times as many 5G base stations as the United States.

Random Links

- Kiribati Large Uninterruptible Power Supply

- 24v outdoor power supply high power

- Tbt three-phase network inverter

- Base station energy storage requirements document

- China Energy Storage Container Solar Equipment Site

- Nassau lithium energy storage power supply price

- 5200w inverter price

- New Energy Battery Cabinet Top Cover

- Nouakchott Micro Uninterruptible Power Supply

- 30kw hybrid inverter for sale in Senegal

- Solar Water Pumping System 90V

- Banjul is suitable for home energy storage

- Home inverter system in China in Bolivia

- Energy storage cabinet battery protection price solution

- Battery cabinets in Warsaw

- Old circuit breaker for sale in Egypt

- Tunisia grid-connected photovoltaic panel manufacturer

- Huawei Niger Energy Storage Container

- Battery cabinet protection system

- Why does the life of lithium battery pack become shorter

- Production of 220v1500w inverter

- Male photovoltaic panel aluminum trough price

- Sudan professional low voltage inverter manufacturer

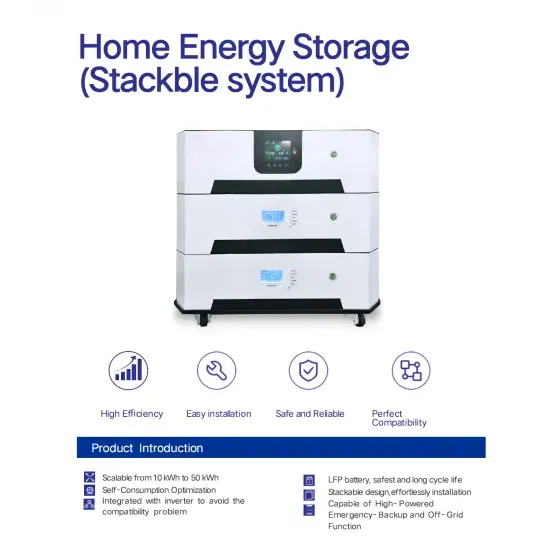

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.