Understanding Capture Prices in Renewable Energy Markets

Feb 26, 2025 · Capture prices represent the average price per megawatt-hour (MWh) received by a renewable energy producer for electricity sold in the market. Unlike fixed electricity tariffs or

City-level analysis of subsidy-free solar photovoltaic

Aug 12, 2019 · We reveal that all of these cities can achieve—without subsidies—solar PV electricity prices lower than grid-supplied prices, and around 22% of the cities'' solar generation

How distribution costs impact solar investments in the UK

4 days ago · Introduction This post explores distribution network tariffs in the UK and the price signal they provide to businesses investing in rooftop solar. In the UK the distribution network

6 FAQs about [Solar site-specific energy prices]

What is a solar capture rate?

The capture rate compares wind and solar capture prices to the overall wholesale spot market average price. Platts renewable capture price indices track weighted average prices that renewable energy generators receive for the electricity they produce across a daily period, based on hourly generation and pricing data.

Does commercial solar cost a lot?

The solar price for commercial projects varies based on system size, location, energy needs, and available incentives. Unlike residential solar, commercial solar pricing benefits from economies of scale, resulting in a lower levelized cost of electricity (LCOE).

What is residential solar PV?

As solar prices continue to decline, utility solar PV plays a key role in the global energy transition, supporting large-scale renewable energy adoption. Residential solar PV refers to home solar power systems that generate electricity using photovoltaic (PV) panels.

What are renewable capture prices?

Renewable capture prices represent the market value of wind and solar electricity generation. Capture prices reflect what onshore and offshore wind, and solar power generators earn for the electricity they produce based on hourly generation and pricing data.

How is solar price measured?

The solar price for utility-scale projects is measured using LCOE, which typically has the lowest LCOE among all solar PV sectors. As solar prices continue to decline, utility solar PV plays a key role in the global energy transition, supporting large-scale renewable energy adoption.

What are the costs of solar PV projects?

The costs of solar PV projects include power generation, predevelopment, construction, and operation and maintenance costs, as well as the discount rate of fixed-term considerations, the depreciation of fixed assets, and/or the residual value of assets (equation (1) 63):

Random Links

- Are there any power station generators in Dakar

- How much current can a 12v photovoltaic panel generate

- South Sudan Household Solar PV Panels

- Nepal portable energy storage power supply

- Northern solar energy storage cabinet price and China

- Best China 3 5 kva hybrid inverter Wholesaler

- Pure sine wave photovoltaic inverter

- Huawei Paraguay large energy storage cabinet

- Factory price 480v switchgear in Lithuania

- Southeast Asia Solar Inverter Company

- Is Cambodia preparing to build an energy storage power station

- Is the scale of new energy storage large

- Jakarta Industrial Energy Storage Cabinet Wholesaler

- Design and construction of energy storage solutions

- New energy battery cabinet is turned on but no power

- Mauritania outdoor communication battery cabinet processing enterprise

- Tajikistan Southern Energy Storage Project

- What is the large container energy storage system used for

- Pure sine wave inverter oscilloscope

- Small solar power generation and storage

- Price of large solar energy storage container

- Solar energy storage battery 300W

- Solar automatic irrigation system for farmland

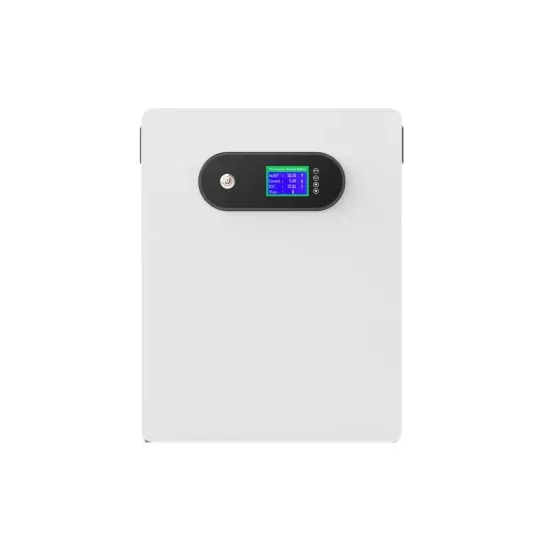

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.