Optimised sustainable energy supply alternatives for Libyan

May 26, 2025 · In this respect, four scenarios are evaluated: first, a standalone PV system with ESS specifically lithium battery bank, operating independently from the grid; second, a

Libya Energy Storage Equipment Co., Ltd.: Powering Tomorrow''s Energy

Let''s cut to the chase: if you''re reading about Libya Energy Storage Equipment Co., Ltd., you''re likely either an engineer tired of blackouts, a solar farm manager chasing sun-powered profits,

Libya''s Photovoltaic Energy Storage Policy: Powering the

Apr 29, 2025 · That''s Libya today – a solar goldmine stuck in fossil fuel limbo. But change is brewing. With global oil prices doing the cha-cha slide and climate targets knocking louder

6 FAQs about [Libya photovoltaic energy storage system customization]

Are solar PV systems a good investment in Libya?

In Libya, the solar photovoltaic (PV) systems are encouraging for the future, due to incident solar radiation is greater than the minimum required rate across the country (Hewedy et al., 2017). Based on that from a techno-economics point-view, there is a need to develop substantial energy resource solutions.

Can Libya develop solar photovoltaics?

Libya has a great opportunity to build large-scale solar photovoltaic power. For the scholars, it's considered as an entrant, which can help to develops and adopt this technology. This paper will be valuable as it is a one-step approach for the development of solar photovoltaics application in Libya.

Does a 50 MW solar PV-Grid work in Libya?

A study performed by (Aldali and Ahwide, 2013) proposed analysis of installing a 50 MW solar photovoltaic power plant PV-grid connected with a tracking system in Libya. Solar PV modules of 200 W are used in that study due to its high conversion efficiency.

How much does a PV system cost in Libya?

The PV system for electricity in the Libyan market is estimated to cost about “5–13,000” Libyan/denars (this price from private business companies); depending on the size/capacity that invested by the private sector.

Can solar energy be used to generate electricity in Libya?

(Kassem et al., 2020) performed a study analysis of the potential and viability of generating electricity from a 10 MW solar plant grid-connected in Libya. The consequences of that study indicate that Libya has a massive potential of solar energy can be utilised to generate electricity.

What is solar energy research & studies (csers) in Libya?

Also, the Centre for Solar Energy Research and Studies (CSERS) in Libya, is one of the research institutions work to develop such technology. In Libya, the solar photovoltaic (PV) systems are encouraging for the future, due to incident solar radiation is greater than the minimum required rate across the country (Hewedy et al., 2017).

Random Links

- China solar powered generator in Melbourne

- Azerbaijan energy storage container manufacturer

- Liquid-cooled energy storage power station structure

- Huawei makes photovoltaic panels in Banjul

- New energy battery cabinets for sale in Reykjavik

- Lobamba Communication Base Station Inverter Project Department

- Inverter 74v DC to 110v AC

- How much is the outdoor power supply of BESS in Abu Dhabi

- Netherlands communication base station energy storage battery

- Use lithium battery as inverter battery pack

- Monaco carport photovoltaic solar panels

- Liquid Cooling Energy Storage Fire Fighting Solution

- Outdoor power supply above ten degrees

- Lesotho container installed photovoltaic

- Guatemala City has battery cabinet manufacturers

- New Energy Storage Cabinet Price Solution

- How much does a photovoltaic tile cost per hour

- Inverter directly connected to the solar panel

- Standards for Montenegro Energy Storage Power Station

- Factory price acme switchgear in Zambia

- What is the wholesale price of inverter in Zimbabwe

- Maldives Photovoltaic Energy Storage

- Is there any energy storage container factory in the Netherlands

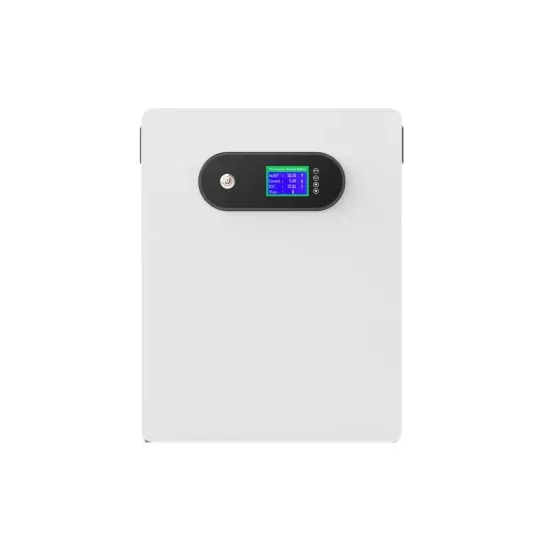

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.