Nearly 10 battery companies built factories in Southeast Asia

Sep 12, 2023 · Nearly 10 battery companies built factories in Southeast Asia. At present, Chinese domestic power battery companies accelerate the formation of groups to go abroad, with core

Power battery companies "catch the sea" in Southeast Asia

Aug 2, 2024 · The Southeast Asian market is a key word that China''s power battery "going to sea" cannot be avoided in recent times. According to incomplete statistics, power battery

6 FAQs about [Southeast Asian lithium battery manufacturers]

How big is the Southeast Asia lithium-ion battery market?

The market size and forecasts for the Southeast Asia lithium-ion battery market in revenue (USD Billion) for all the above segments. The Southeast Asia Lithium-ion Battery Market is expected to register a CAGR of 15% during the forecast period.

Is Vietnam a leader in Southeast Asia's lithium-ion battery market?

Vietnam has established itself as the dominant force in Southeast Asia's lithium-ion battery market, commanding approximately 64% of the regional market share in 2024. The country's strategic advantage stems from its abundant high-quality nickel reserves, which have become increasingly attractive to international mining companies.

How many Chinese battery companies have built factories in Southeast Asia?

Nearly 10 battery companies built factories in Southeast Asia At present, Chinese domestic power battery companies accelerate the formation of groups to go abroad, with core competitiveness of high-end products to overseas markets, accelerate the pace of "going out" to fill the international capacity gap.

Which lithium battery enterprises are preparing to invest in Southeast Asia?

In addition to CATL, at present, domestic lithium battery enterprises including Guoxuan High-tech, EVE Lithium Energy, Sunwoda, Rupu Lanjun, Tianneng , AZURE, GEM, Huayou Cobalt, Zhongwei (CNGR) and other battery and raw material enterprises have or are preparing to invest and cooperate in Southeast Asia.

Where are China's power battery factories located?

According to incomplete statistics, up to now, China's power battery companies have built, under construction and planned to build overseas factories with a cumulative capacity of more than 300GWh, of which Southeast Asia, South Asia and other places have also become key markets of concern

Why is Singapore a leader in lithium-ion battery technology?

Singapore has positioned itself as a technology and innovation hub for the lithium-ion battery market in Southeast Asia, leveraging its advanced infrastructure and pro-business environment. The country's strategic location and sophisticated technological ecosystem have attracted major investments in battery technology research and development.

Random Links

- Zimbabwe photovoltaic solar energy storage cabinet model

- Is the photovoltaic energy storage system good

- Rooftop inverter factory direct sales

- Overseas household energy storage batteries

- Vanuatu Silin Communication Base Station Inverter

- China main circuit breaker factory exporter

- The role of photovoltaic energy storage containers

- 20-foot site container energy storage size

- Zinc-iron flow battery put into use

- Chisinau energy storage system supplier

- Switzerland Zurich farm installs solar air conditioning

- Photovoltaic panel tracking system manufacturer

- Mongolia energy storage lithium iron phosphate battery manufacturer

- How big is a photovoltaic glass panel

- Malaysia Mobile Outdoor Power Supply

- Power generation of photovoltaic panels in Ulaanbaatar

- Namibia off-grid energy storage inverter

- Lilongwe Energy Storage Industry Support Project

- Abuja Outdoor Solar Light Manufacturer

- Huawei Energy Storage Battery Control Unit

- How many phases of power should a communication base station use

- Solar fan photovoltaic panel

- Wholesale pv breaker isolator in Morocco

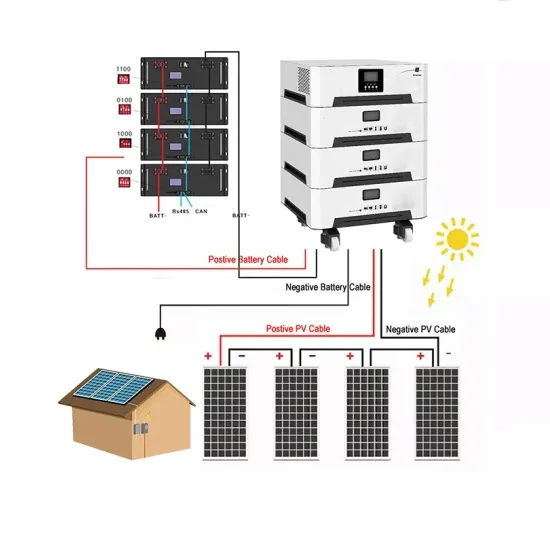

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.