Energy Storage Installation: Europe is the First-Mover, China

Aug 15, 2023 · In the first quarter of 2023, fresh energy storage installations amounted to 778MW/2145MWh, marking a year-on-year decline of 26% and 28% respectively. Specifically,

2023 energy storage installation outlook: China, US, and Europe

Sep 26, 2023 · In 2023, Europe may add 17 GWh of installed energy storage capacity, with 9 GWh in the residential sector. Overall, China, the U.S., and Europe saw installed capacities

China-Europe Energy Storage Collaboration: Powering the New Energy

Feb 12, 2025 · Here''s where it gets juicy – while the EU frets about lithium supply chains, Chinese engineers are retrofitting coal mines in Shanxi province with vanadium redox flow batteries.

China''s Solution to Europe''s Energy Crisis: Desay Battery

May 15, 2025 · According to data from the European Association for Storage of Energy (EASE), the EU needs to add at least 200 GW of storage capacity by 2030 to effectively mitigate the

5 FAQs about [China-Europe volt energy storage installation]

Will China add more energy storage capacity in 2023?

InfoLink expects China to add 39 GWh of energy storage capacity in 2023. The U.S. added 8.2 GWh of installed energy storage capacity in the first half of 2023, far behind anticipations. Constructions under the IRA face delays worse than expected.

Which countries will add more energy storage capacity in 2023?

France and Germany launched tenders successively. In 2023, Europe may add 17 GWh of installed energy storage capacity, with 9 GWh in the residential sector. Overall, China, the U.S., and Europe saw installed capacities growing at varying paces in the first half of 2023.

How much energy storage does the world have in 2023?

As of the first half of 2023, the world added 27.3 GWh of installed energy storage capacity on the utility-scale power generation side plus the C&I sector and 7.3 GWh in the residential sector, totaling 34.6 GWh, equaling 80% of the 44 GWh addition last year. Despite a global installation boom, regional markets develop at varying paces.

How much energy will China add in 2023?

In 2023, China will add 39 GWh of installed energy storage capacity. The U.S. may add 25.5 GWh, with utility-scale projects connecting to the grid in the second half, given enormous domestic demand and strong policy supports, despite installation progress taking up to a year or more time.

Why is China becoming a lithium manufacturing hub?

The rapid increase can be attributed to the mandatory energy storage integration policy, as well as the country’s advantage as a lithium manufacturing hub with access to cheaper cells and faster delivery.

Random Links

- Burkina Faso outdoor communication battery cabinet price inquiry

- Myanmar power inverter price

- House solar inverter in China in Monaco

- Ground fault breaker in China in Azerbaijan

- Tirana uses lithium battery energy storage system

- Uninterruptible power supply redundancy module

- Niger large ups uninterruptible power supply price

- Energy Storage Safety Operation and Maintenance System

- China high voltage switchgear in Cameroon

- Somali Garden Energy Storage Power Generation

- Home battery storage for sale in Cairo

- Best short circuit breaker factory exporter

- 21700 battery cell assembly 12v battery pack

- Asmara Energy Storage Battery

- Distributed power generation at wireless communication base station sites

- Burkina Faso Communications 5G Base Station Construction Progress

- Hanoi Energy Storage Container Power Station Manufacturer

- Photovoltaic curtain wall clamp

- Icelandic photovoltaic energy storage battery

- High frequency inverter to pure sine wave

- Dominican photovoltaic folding container wholesale number

- Can battery inverters be used as outdoor power supplies

- Which places are suitable for photovoltaic energy storage

Residential Solar Storage & Inverter Market Growth

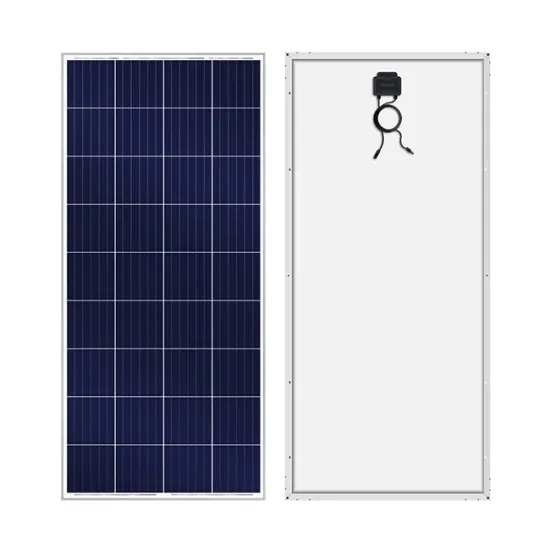

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

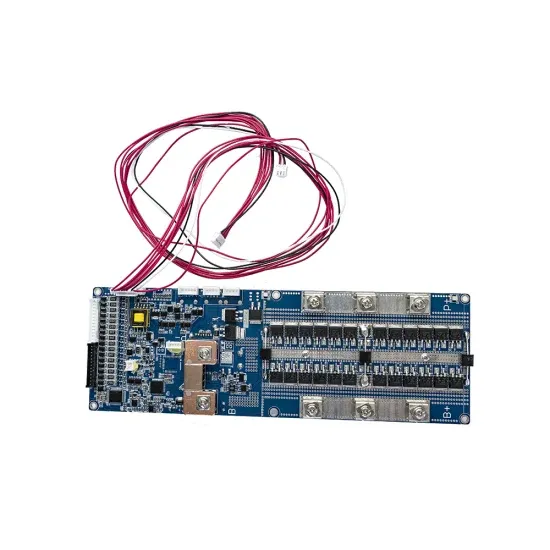

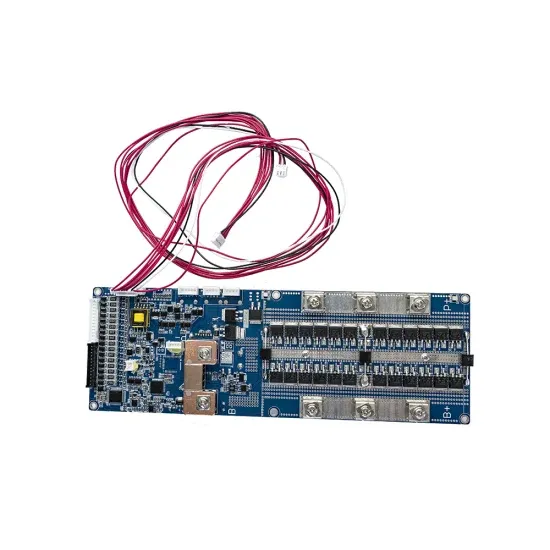

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.