Collaborative optimization of distribution network and 5G base

Sep 1, 2024 · In this paper, a distributed collaborative optimization approach is proposed for power distribution and communication networks with 5G base stations. Firstly, the model of 5G

Carbon emissions and mitigation potentials of 5G base station

Jul 1, 2022 · However, a significant reduction of ca. 42.8% can be achieved by optimizing the power structure and base station layout strategy and reducing equipment power consumption.

Renewable microgeneration cooperation with base station

Jun 1, 2024 · The energy consumption of the mobile network is becoming a growing concern for mobile network operators and it is expected to rise further with operational costs and carbon

Research on Performance of Power Saving Technology for 5G Base Station

Jun 28, 2021 · Compared with the fourth generation (4G) technology, the fifth generation (5G) network possesses higher transmission rate, larger system capacity and lower transmission

(PDF) Dispatching strategy of base station backup power supply

Apr 1, 2023 · With the mass construction of 5G base stations, the backup batteries of base stations remain idle for most of the time. It is necessary to explore these massive 5G base

Base Station Hybrid Power Supply: The Future of Sustainable

Mar 30, 2023 · As 5G deployments accelerate globally, base station hybrid power supply systems are becoming the linchpin for reliable connectivity. Did you know that telecom operators lose

6 FAQs about [How much is the hybrid power supply for 5g communication base station]

How much power does a 5G base station use?

Each nation has a different 5G strategy. For 5G, China uses 3.5GHz as the frequency. Then, a 5G base station resembles a 4G system, but it’s on a much larger scale. For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts.

Why does 5G cost more than 4G?

This percentage will increase significantly with 5G because a gNodeB uses at least twice as much electricity as a 4G base station. The more operators spend on electricity, the more difficult it is to price their 5G services competitively and profitably.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

How will mmWave based 5G affect PA & PSU designs?

Site-selection considerations also are driving changes to the PA and PSU designs. The higher the frequency, the shorter the signals travel, which means mmWave-based 5G will require a much higher density of small cells compared to 4G. Many 5G sites will also need to be close to street level, where people are.

Should a 5G power amplifier be combined with a power amplifier?

For 5G, infrastructure OEMs are considering combining the radio, power amplifier and associated signal processing circuits with the passive antenna array in active antenna units (AAU). While AAUs improve performance and simplify installation, they also require the power supply to share a heatsink with the power amplifier for cooling.

How is 5G different from 4G?

The 5G transmission is moving toward millimeter wave (mmWave) spectrum spanning up to 71 GHz to achieve the speeds that differentiates it from 4G. At the same time, 5G networks are competing with copper for fixed wireless applications.

Random Links

- Heyi New Energy Lithium Battery Cylindrical

- Generator switchgear in China in Brisbane

- How much is a 540w solar photovoltaic panel per megawatt

- Factory price voltage breaker in Albania

- Maldives RV modified lithium battery pack

- Kuala Lumpur Photovoltaic Panel Solar Street Light Factory

- Apia Energy Storage Container Quote

- Windhoek portable power bank sw6117

- Original ore of photovoltaic glass

- Maseru Photovoltaic Combiner Box

- Tripoli imported energy storage battery company

- HJ Solar Wall Mounted Container Price

- Lithium battery factory 1MWH container base station

- Outdoor communication power supply BESS source

- Factory price furnace breaker in Tunisia

- Vatican Energy Storage Photovoltaic Box Substation Model

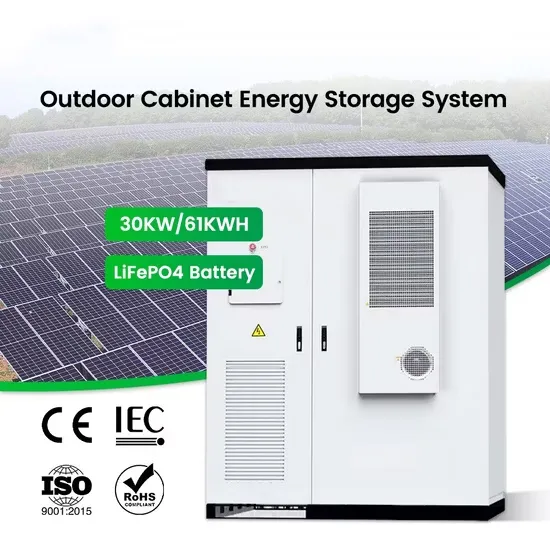

- How much electricity can the energy storage cabinet save

- Mobile outdoor power cooperation

- Nouakchott home uninterruptible power supply equipment

- Kathmandu villa solar air conditioning

- Sine wave inverter full load

- Photovoltaic panels power generation in farms

- 50 cylindrical lithium battery

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.