What Are the Fire Protection and Ventilation Requirements for UPS

Mar 11, 2025 · UPS battery racks store energy-dense batteries that generate heat during charging/discharging. Faulty connections, overcharging, or thermal runaway in lithium-ion

Eaton 9390 Integrated Battery Cabinet (Models IBC-S

Aug 16, 2024 · The term line-up-and-match refers to battery cabinets that are physically attached to the UPS, share internal wiring, and use the battery cabinet breaker as the battery isolation

6 FAQs about [What battery cabinet should I use for UPS s 120 batteries ]

Does ups shunt a Battery breaker?

c. Remote trip of the battery cabinet breaker: note that the UPS does NOT generate the shunt trip command for battery breakers. (a UPS “load off” or UPS EPO command will shut off the UPS but will not trip the battery breakers in the Samsung cabinets).

Does unified power offer battery cabinets?

Unified Power offers a complete line of battery cabinets for both UPS and Telecom Applications. These cabinets can be configured to match OEM cabinets and offer a competitive option for system upgrades or new projects. Features Space saving foot print is the industry’s most compact design.

Can a 208 volt ups run a black cabinet?

Gen 1 (white cabinet units, have a transformer in the conduit landing box that steps up 208Vac from the UPS to 480Vac to run the cabinet from a 208 output UPS. Gen 2 UL9540A (Black cabinets) should be selected with a 1-phase 120/240V protected power source for use with a 208V UPS or a 480V 3-phase source for a 480V or 600 V UPS.

How long does a UPS battery last?

a. The vendor warrants that when the battery is installed per vendor’s instructions, operated within vendors environmental guidelines, and charged by the UPS as specified, the battery system will provide at least 78-80% of its initial capacity at the 10-year mark.

Does LG Chem still offer a UPS battery?

LG Chem has discontinued this UPS battery, but many are deployed in the field, and will continue to be supported. b. LiiON cabinets that have been installed in several locations. This manufacturer still offers this battery, but Eaton does not support its use on Eaton products. Any service on these systems will be provided by LiiON.

Does Samsung ul9540a (Black) Cabinet need an ups?

Samsung has been evaluated to Seismic Zone 4 and is OSHPD certified for the UL9540A (Black) cabinet. d. AC power source i. Samsung requires a ‘UPS protected’ source for the BMS. Gen 1 (white cabinet units, have a transformer in the conduit landing box that steps up 208Vac from the UPS to 480Vac to run the cabinet from a 208 output UPS.

Random Links

- 35a Lithium battery pack arrangement

- 15ah single cylindrical lithium titanate battery

- Male Energy Storage Power Industrial Design

- Customization of containerized energy storage cabinets in Osaka Japan

- Photovoltaic power station energy storage project bidding

- Photovoltaic panel special sleeve manufacturer

- Fornafoti 5G base station distribution box supplier

- Kyiv air-cooled energy storage system

- Outdoor power supply 4kWh fast charging

- Solar panels and photovoltaic panels outdoor power generation

- High power supercapacitor price

- House solar inverter in China in Doha

- Atess 100kw inverter in China in Cape-Town

- Inverter AC Servo

- Photovoltaic cell modules in Bergen Norway

- Property Rights of Flow Batteries for Communication Base Stations

- Alkali Metal Flow Battery

- Hot sale single phase breaker for sale supplier

- Ouagadougou base station room energy management system 125kWh

- STOROLIS Mini Base Station

- Bms reset battery

- Sony communication base station inverter

- The place where liquid-cooled energy storage battery cabinets are replaced in Switzerland

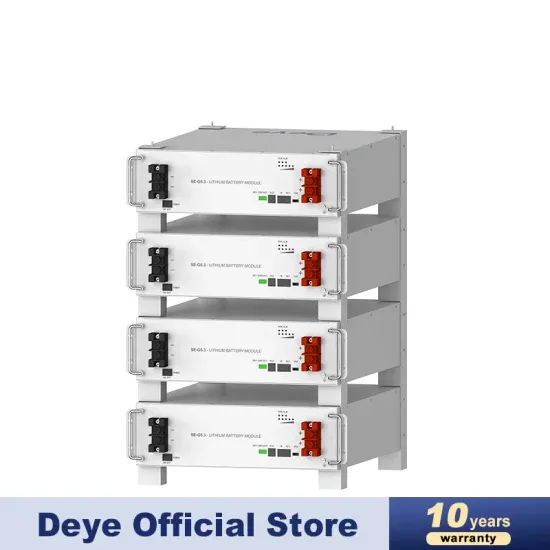

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.