Chinese enterprises ready to help Zambia tackle energy crisis

Aug 6, 2024 · Chen noted that their current production of long-lasting batteries and inverters will help alleviate the country''s electricity shortage crisis, with plans to commence lithium battery

High-Grade Lithium Discovered at Zambia''s Msika Project

Oct 8, 2024 · UK mining firm First Africa Metals has confirmed the presence of high-grade lithium resources at the Misika Project in Zambia. Independent laboratory tests, including rock chip

6 FAQs about [Zambia Outdoor Power Lithium Production]

Will Zambia start lithium production?

Photo supplied Zambia is yet to start lithium production. Lithium is in demand as a critical transition mineral due to its role in the production of lithium-ion batteries used in electric vehicles, mobile phones and renewable energy storage systems.

Will Zambia increase its solar power capacity by 2030?

The Zambian government has set a target to increase its installed solar and wind capacity to 600 MW by 2030. However, the current installed capacity for solar photovoltaics is only 90 MWp, indicating significant underutilisation of Zambia's potential in the renewable energy sector.

Does Zambia export electricity?

Electricity imports and exports in GWh (first half of 2022) As mentioned in the previous chapter, Zambia has developed into an export powerhouse in recent years. This is also demonstrated by the data from the first half of 2022.

Can Zambia produce car batteries?

Zambia has advanced its manufacturing sector with potential to produce car batteries. For this reason, the southern Africa country has sought for a partnership with its neighbour DRC to boost their mining and manufacturing sectors to be able to take advantage of the global demand for cobalt and lithium-ion batteries.

Which countries are investing in lithium-ion batteries?

The governments of Zambia and the Democratic Republic of Congo (DRC) are partnering to invest in production of lithium-ion batteries which power these electric vehicles (EVs). Zambia and DRC have vibrant mining sectors. They form part of the so called “Copper belt” which stretches from the Central African Republic, the DRC and Zambia.

What companies trade in electricity in Zambia?

Private companies also trade in electricity in Zambia. The largest of these, Copperbelt Energy Corporation Plc (CEC), buys electricity primarily from ZESCO and sells it to the various mines in the Copperbelt Province. It also operates its own generators, most of which run on fossil fuels.

Random Links

- Mobile integrated telecommunication base station battery

- Anti-islanding device energy storage

- Honiara high power energy storage equipment

- French outdoor energy storage power supply manufacturer

- Charging solar photovoltaic energy storage cabinet

- Modify inverter power

- Breaker distribution in China in Costa-Rica

- High quality 1000 amp breaker in Denmark

- Trisquare switchgears factory in indonesia

- Does TCL make solar photovoltaic panels

- Germany communication base station battery energy storage system agreement

- Electric lithium battery container

- Outdoor Energy Storage Power Lighting

- China wholesale suntree dc breaker Price

- Which one can generate more electricity photovoltaic panels or power generation glass

- Rooftop energy storage photovoltaic

- Solar air conditioning in Aarhus factory Denmark

- Best gfci circuit breaker in China producer

- Damascus Industrial Energy Storage Cabinet Supplier

- Huawei Cambodia New Energy Storage Project

- Energy Storage Box Container Application Club

- Belarus PV module project

- Specifications related to container energy storage

Residential Solar Storage & Inverter Market Growth

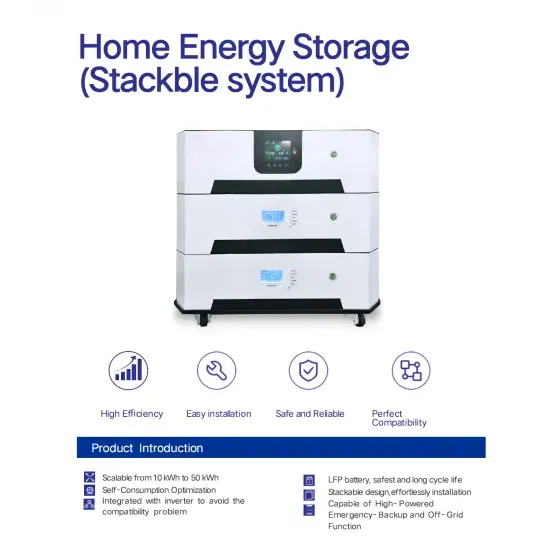

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.