Haiti solar energy Revolution: 5 Amazing Solutions for 2024

Jun 28, 2025 · In rural Haiti, where access to electricity is scarce, solar power has become a crucial resource. The installation of solar panels has provided communities with a dependable

The Sun''s Gift: Exploring the World of Photovoltaic Cells | HUAWEI

May 27, 2024 · Photovoltaic cells are an integral part of solar panels, capturing the sun''s rays and converting them into clean, sustainable power. They''re not just designed for large-scale solar

Huawei Photovoltaic Inverters in 2025: Leading the Global Solar

Jan 31, 2025 · Does Huawei Still Dominate Solar Inverter Production? The 2025 Reality Check Short answer: Absolutely. Huawei remains a top-tier producer of photovoltaic inverters,

6 FAQs about [Huawei Haiti Solar Photovoltaic Panels]

Can solar power be used in Haiti?

Global Green, Green Energy Solutions, and Top Power Haiti are some of the initiatives that have a goal to bring solar to areas of Haiti for sustainable energy usage. Already, their initiative has proved to be beneficial to a few projects and buildings in the country.

Why is distributed solar PV the only energy source in Haiti?

Since only about 13% of the people even have grid access, distributed solar pv is the only energy source that can supply all the people electricity for now. Haiti has limited energy resources: no petroleum or gas resources, small hydroelectricity potential and rapidly declining supplies of wood fuels.

Who is Haitai new energy?

Haitai New Energy entered the field of photovoltaic brackets in 2021, focusing on the research and development, design, manufacturing, and sales of photovoltaic bracket systems. The annual production capacity reaches 100000 tons and can install 4GW components. Strength hardcore!

What is Huawei energy storage system?

Huawei Energy Storage Systems integrate power electronics, digital, thermal, electrochemical, and AI technologies to implement refined monitoring and management at the cell, battery pack, battery rack, ESS, and power grid levels. This ensures energy storage system safety, efficiency, and grid-forming capability.

How does Huawei's utility-scale smart PV & ESS work?

Huawei’s Utility-Scale Smart PV & ESS Solutions can operate independently of traditional grids. Where traditional grids use synchronous generators, Huawei uses a grid-connected ESS with power electronics in the form of the smart PCS to manage the discharge and charge of power.

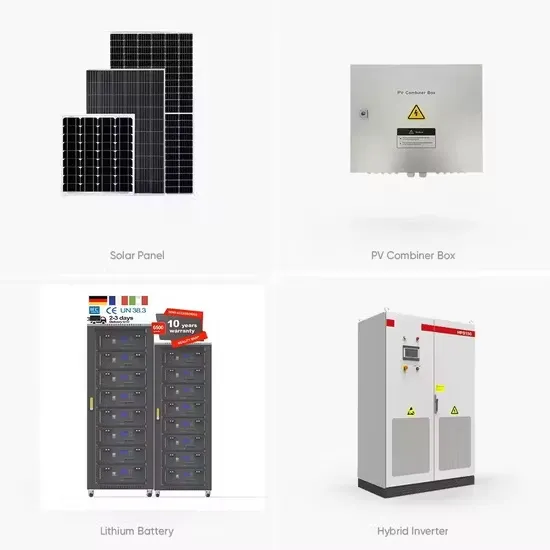

What are the different types of photovoltaic products?

The company's business covers a wide range of nine sectors, including photovoltaic modules, photovoltaic power stations, photovoltaic brackets, photovoltaic cells, graphite/carbon electrodes, energy storage, battery swapping, hydrogen energy, and wind energy.

Random Links

- Wholesale rv circuit breaker in Turkey

- Outdoor on-site energy solar panels power supply

- Energy storage product retail format

- Green Energy Storage Microgrid Project Planning

- Ghana Uninterruptible Power Supply Customization

- Maintenance and management measures for communication base station inverters

- Trisquare switchgears factory in Ireland

- Montevideo Outdoor Power Local BESS

- Hot sale solar power storage in China for sale

- Best distribution breaker in China Factory

- Lithium battery energy storage power generation system

- Solar 3-in-1 Inverter

- Base station power module design

- Water pump that matches solar energy

- Estonian heat dissipation photovoltaic panel manufacturer

- What is outdoor portable energy storage

- Serbia brand new outdoor power supply for sale

- Moldova 60v inverter

- How much does a professional UPS uninterruptible power supply cost in Warsaw

- How many watts of solar energy are needed to install 2 000 kWh of electricity

- Liquid cooling energy storage system cycle times

- Best factory price 15kv switchgear manufacturer

- 15 kWh lithium battery

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.