2021 photovoltaic glass new expansion project investment

Nov 12, 2021 · According to incomplete statistics in the industry, since 2021, photovoltaic glass companies have announced at least 12 major photovoltaic glass expansion projects, with a

An Annual Output of 40 Million Square Meters of Ultra-Thin

Mar 23, 2025 · In order to improve the photoelectric conversion efficiency, crystalline silicon photovoltaic cells require the encapsulated panel glass to have a high light transmittance while

500,000 Tons, Total Investment of 2 Billion Yuan: Another Photovoltaic

Apr 28, 2025 · Project name: Annual output of 500,000 tons of photovoltaic glass production line project. Project construction location: in Khalifa Industrial Park Free Trade Zone (KIZAD), Abu

China: Distributed photovoltaic management approach may

Oct 12, 2024 · Distributed photovoltaic projects are exempt from requiring an electricity business license, but the investment (registration) entity must sign a power purchase agreement with

SCZone head inaugurates new Chinese glass production project

Nov 28, 2024 · The project will cover an area of 500,000 square meters, with total investments amounting to $300 million, and is set to build two production lines—one for flat glass with a

4.5 Billion Yuan! Large-scale PV Glass Production Lines to Be

6 days ago · The project is initiated by Taiheyuan Tech, with a total investment of 4.5 billion yuan. It will set up four PV glass production lines with production capacity of 1,200t/d each, and the

Huge PV Glass Project Goes Live in China, Paving the Way

May 13, 2025 · Launched in 2020 as a three-phase initiative with a total investment of 10 billion yuan, the project aims to establish a comprehensive photovoltaic new materials industrial park.

New glass production project to support renewable energy

Nov 28, 2024 · The project will cover an area of 500,000 square meters, with total investments amounting to $300 million, and is set to build two production lines—one for flat glass with a

China''s Flat Glass to Invest USD261 Million in PV Module Cover Glass

The investment will guarantee Flat Glass'' ability to supply PV module glass, and further increase the firm''s share of the PV glass market by taking advantage of the low cost of large melting

900 Million Yuan! Kibing to Promote PV Glass Project of Its

Jun 14, 2025 · The registered capital of Chenzhou Kibing PV company will be increased from CNY 2.41826 billion to 3.21826 billion, after the capital increased, and Kibing Glass still holds

Assessing the sustainability of solar photovoltaics: the case of glass

Sep 12, 2024 · The life cycles of glass–glass (GG) and standard (STD) solar photovoltaic (PV) panels, consisting of stages from the production of feedstock to solar PV panel utilization, are

6 FAQs about [Total investment of photovoltaic glass project]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

How much money did solar PV invest in 2023?

In 2023, global investments in solar PV capacity expansions climbed by around 30% to approach USD 480 billion, setting yet another record. In 2023, investments in solar photovoltaics exceeded those in all other power production technologies combined.

What is solar glass manufacturing plant project report 2025?

IMARC Group’s report, titled “ Solar Glass Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue, ” provides a complete roadmap for setting up a solar glass manufacturing plant.

How to start a solar glass manufacturing plant?

Establishing and operating a solar glass manufacturing plant involves various cost components, including: Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

What is a solar glass manufacturing project report?

The solar glass manufacturing project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

What is Solar Photovoltaic Glass?

Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

Random Links

- Indonesia Surabaya Shopping Mall Photovoltaic Curtain Wall Customized Manufacturer

- Luxembourg Photovoltaic Inverter Solutions Company

- Huawei Serbia Inverter

- China 500 watt power inverter in Lithuania

- Usb c power station for sale in Mumbai

- South America 314ah battery outdoor power supply

- Barbados Communications 5G Base Station Photovoltaic Power Generation System 418KWh

- Ashgabat inverter factory direct sales store

- How many hours does the solar energy storage container work

- Can household appliances store energy

- How big a battery should a 5 000w inverter be equipped with

- Can I use a three-phase photovoltaic inverter

- Abuja energy storage battery maintenance-free

- Energy storage communication products produced in Shanghai

- Superconducting Energy Storage Project

- High quality 220 gfci breaker in Finland

- The most versatile outdoor power supply

- Flywheel energy storage motor parameters

- Turkmenistan photovoltaic enterprise energy storage

- Mbabane Three Communication Base Station Wind Power

- Managua 18kw high quality inverter merchant

- Democratic Republic of Congo Flow Battery Energy Storage Company

- Chile Valparaiso forklift energy storage battery prices

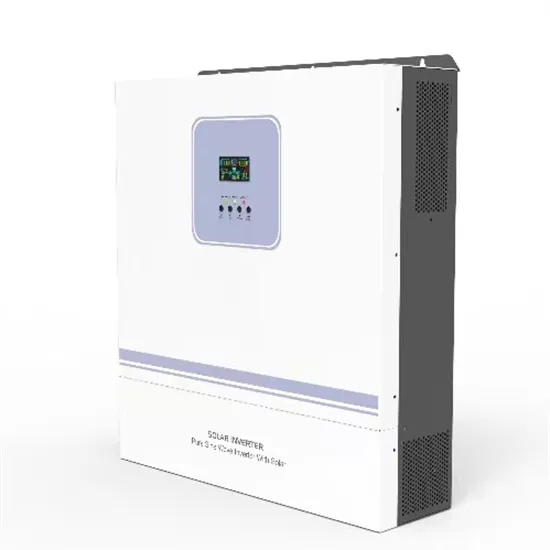

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.