A review of the current status of energy storage in

2 days ago · y exist for their use as energy storage for the energy system (power-to-hydrogen-to- power). The status of these energy storage technologies in Finland will be discussed in more

2023-2029全球与中国便携式储能电源市场现状及未来发展趋势

Feb 5, 2023 · 便携式储能电源(Portable Energy Storage Power Supply)是一种内置锂离子电池,自身可储备电能且具备交流输出的多功能便携式储能电源。 产品重量轻、容量高、功率

Powering Finland''s Future – Fingrid and Merus Power

Jun 18, 2025 · The energy storage facility (BESS), owned by Taaleri Energia ''s SolarWind III fund and delivered by Merus Power, highlights the importance of flexibility and innovation in the

A review of the current status of energy storage in Finland

Jul 15, 2024 · Wind power generation is estimated to grow substantially in the future in Finland. Energy storage may provide the flexibility needed in the energy transition. Reserve markets

How about the foreign trade portable energy storage power supply

Sep 11, 2024 · The discourse surrounding the foreign trade of portable energy storage power supplies encompasses myriad facets essential to understand its current trajectory and future

2025-2031中国便携式储能电源市场现状研究分析与发展前景

Feb 9, 2025 · 便携式储能电源(Portable Energy Storage Power Supply)是一种内置锂离子电池,自身可储备电能且具备交流输出的多功能便携式储能电源。 产品重量轻、容量高、功率

2024-2030全球与中国便携式储能电源市场现状及未来发展趋势

Apr 23, 2024 · 便携式储能电源(Portable Energy Storage Power Supply)是一种内置锂离子电池,自身可储备电能且具备交流输出的多功能便携式储能电源。 产品重量轻、容量高、功率

Technologies and economics of electric energy storages in power

Nov 19, 2021 · As fossil fuel generation is progressively replaced with intermittent and less predictable renewable energy generation to decarbonize the power system, Electrical energy

6 FAQs about [Finlandnewsmy portable energy storage power supply]

Is this Finland's largest battery energy storage system?

Swedish flexible assets developer and optimizer Ingrid Capacity has joined hands with SEB Nordic Energy’s portfolio company Locus Energy to develop what is claimed to be Finland’s largest and one of the Nordics’ largest battery energy storage systems (BESS). The 70 MW/140 MWh BESS project will be located in Nivala, northern Finland.

What is the future of energy storage in Finland?

Reserve markets are currently driving the demand for energy storage systems. Legislative changes have improved prospects for some energy storages. Mainly battery storage and thermal energy storages have been deployed so far. The share of renewable energy sources is growing rapidly in Finland.

Is energy storage the future of wind power generation in Finland?

Wind power generation is estimated to grow substantially in the future in Finland. Energy storage may provide the flexibility needed in the energy transition. Reserve markets are currently driving the demand for energy storage systems. Legislative changes have improved prospects for some energy storages.

Which energy storage technologies are being commissioned in Finland?

Currently, utility-scale energy storage technologies that have been commissioned in Finland are limited to BESS (lithium-ion batteries) and TES, mainly TTES and Cavern Thermal Energy Storages (CTES) connected to DH systems.

Is the energy system still working in Finland?

However, the energy system is still producing electricity to the national grid and DH to the Lempäälä area, while the BESSs participate in Fingrid's market for balancing the grid . Like the energy storage market, legislation related to energy storage is still developing in Finland.

Is energy storage a viable solution for the Finnish energy system?

This development forebodes a significant transition in the Finnish energy system, requiring new flexibility mechanisms to cope with this large share of generation from variable renewable energy sources. Energy storage is one solution that can provide this flexibility and is therefore expected to grow.

Random Links

- Damascus photovoltaic panel prices

- Saudi Arabia home energy storage system

- How many hydrogen energy stations are there in West Africa

- How long does it take to connect a photovoltaic inverter

- Photovoltaic glass in Tajikistan

- Which manufacturer should I look for for outdoor communication battery cabinet in Santo Domingo

- China wholesale challenger breakers Price

- Bulgaria small power inverter purchase

- Outdoor energy storage brand

- Luxembourg outdoor power charging pump price

- Battery cabinet discharge coupling

- Voltage inverter function

- Photovoltaic energy storage wall mounted

- San Diego Portable Outdoor Power Supply

- Communication base station power supply supplier

- Does lead-acid battery belong to electrochemical energy storage

- Closed Modular Lithium Battery Pack

- Small company energy storage equipment

- Supplier of photovoltaic glass for terrace in Milan Italy

- Burundi greenhouse photovoltaic power generation energy storage pump

- Huawei Bamako energy storage power station transaction

- One acre of photovoltaic panels generate electricity

- Solar water pump photovoltaic power generation installation

Residential Solar Storage & Inverter Market Growth

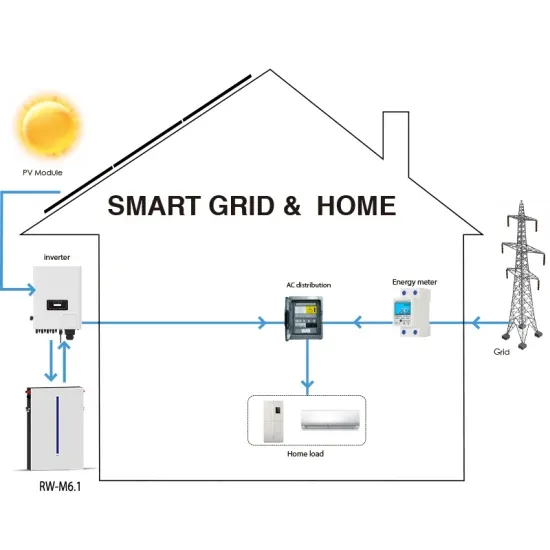

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.