China Energy Storage Suppliers: Leaders Shaping the Global

Jan 27, 2025 · China''s energy storage suppliers are making waves globally, with companies like CATL, BYD, and Sungrow dominating leaderboards faster than you can say "lithium-ion." Let''s

Energy Storage System Buyers | Global Energy Storage System Importers

Jul 31, 2024 · Sell your Energy Storage System products to global buyers for Free. There are currently 128 Energy Storage System international importers waiting to connect with suppliers

China''s Energy Storage Sector: Policies and Investment

Apr 11, 2024 · In terms of BESS infrastructure in particular and its development timeline, China''s BESS market really saw take of only recently, in 2022, when according to the National Energy

6 FAQs about [China 1 375mw energy storage system Buyer]

How big is China's energy storage?

According to the China Energy Storage Alliance (CNESA), new storage installations in China reached 13.3 GW/ 32.1 GWh in the first five months of 2025, up 52.5% / 41.8% year-on-year. The CEEC procurement was split into three packages, totaling 25 GWh and covering systems with durations of one, two, and four hours.

How much does energy storage cost in China?

New energy storage also faces high electricity costs, making these storage systems commercially unviable without subsidies. China’s winning bid price for lithium iron phosphate energy storage in 2022 was largely in the range of USD 0.17-0.24 per watt-hour (Wh).

Does China have a market advantage for battery storage systems?

ds, and service networks for battery storage systems.At present China does have some market advantages when it comes to the development of BESS infrastructure, including the supply chain related to global lithium-ion battery production,

Will China's energy storage capacity grow in 2021?

13.1GW, more than double the amount reached in 2021.Ahead and heading into a new era for new energy, it is expected that China’s energy storage capacity and its BESS capacity in particular ill grow at a CAGR rate of 44% between 2023 and 2027.Finally, BESS development financing globally thus far has stemmed from various sources: funds, corpor

How has China created an energy storage ecosystem?

China has created an energy storage ecosystem with players throughout the supply chain. The upstream players are mainly battery and raw materials manufacturers, with many benefitting from first-mover advantage. Chinese manufacturers have gained a substantial market in this domain.

What does China Energy Engineering Corporation's landmark procurement mean for energy storage?

China Energy Engineering Corporation’s landmark procurement signals a shift toward market-driven energy storage, with bids reflecting aggressive cost-cutting and rising industry consolidation.

Random Links

- Middle East Yila Te UPS uninterruptible power supply equipment

- Solar Residential Systems

- What kind of battery is best for telecom base stations

- Solar energy should be paired with energy storage

- Factory price 220 amp breaker in Norway

- Andorra energy storage system manufacturer

- Working as a communication base station inverter

- Large Uninterruptible Power Supply in Northern Cyprus

- Requirements and standards for wind turbine rooms at communication base stations

- What is a tool battery

- How many V does 20 watts of solar energy have

- Yamoussoukro Communications Energy Storage Field

- Dominic 300W photovoltaic glass

- Bhutan photovoltaic inverter customization company

- Charging of the rechargeable battery at the photovoltaic energy storage cabinet site

- Bulgaria data center ups uninterruptible power supply price

- How much outdoor power supply is enough for going to Colon Panama

- Georgetown EK SOLAR Energy Storage Equipment Company

- Energy Storage Cabinet Project Development Process

- Source Manufacturer Photovoltaic Folding Container Wholesale

- What does flywheel energy storage mean

- 16kw sunsynk inverter factory in Chile

- Hj9 type high frequency inverter

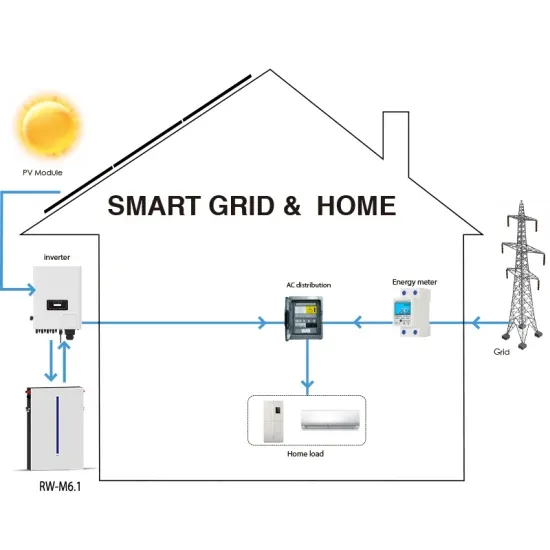

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.