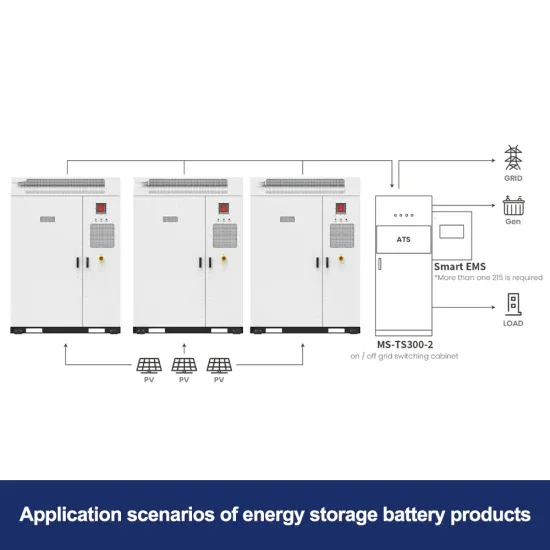

Enabling renewable energy with battery energy storage

Feb 10, 2025 · SS as their uninterruptible power supply solution and for the additional benefits B ewables, self-consumption optimization, backup applications, and the provision of grid servi

Enabling renewable energy with battery energy storage

Feb 10, 2025 · nterruptible power supply during outages until power resumes or diesel generators are turned on. In addition to replacing lead-acid batteries, lithium-ion BESS products can also

Lithium, Cobalt & Power: How C&I BESS Supports Africa''s

Jul 15, 2025 · Africa''s critical mineral reserves, particularly lithium and cobalt, are pivotal to the global energy transition, powering electric vehicles (EVs) and renewable energy storage

Here comes a utility-scale battery designed for data centers

Jun 11, 2025 · The Project FlexGen and Rosendin are tinkering on a utility-scale battery solution to be situated outside a data center building, as part of medium-voltage (1,000V to 35,000V)

The critical role of Battery Energy Storage Systems (BESS) in

Jul 28, 2025 · In Electrik Vehicle Deployment Infrastructure As the global shift towards electrification of transportation accelerates, the integration of BESS becomes increasingly

Innovative Utility-Scale Battery Solution for Data Centers

Jun 16, 2025 · Here comes a utility-scale battery designed for data centers that doesn''t require uninterruptible power supply infrastructure June 11, 2025 By Paul Gerke 4 min read If there''s

6 FAQs about [Astana Uninterruptible Power Supply Vehicle BESS]

What is a battery energy storage system (BESS)?

the Inflation Reduction Act, a 2022 law that allocates $370 billion to clean-energy inv stments.These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable-energy generation, helping alternatives make a steady contribution to th

What is a Bess inverter?

a bidirectional link for energy flow. In BESS architecture, the inverter is typically positioned between the battery storage unit and the grid or loads, serving as an intermed ary for power conversion and control. The inverter uses various measurements—including voltage, current, frequency, and temperature—to

Can a US integrator deploy a Bess system?

versus those in the U.S. (Figure 26).Figure 26, a U.S. integrator can deploy BESS systems branded under the domestic company’s name but which still use battery packs (e.g., via CATL), BMS, and inverter hardware (e.g., Sungrow) pr vided by PRC manufacturing companies. Comparing the risk factors a US integrator using the same componen

Who owns a Bess installation?

primary owners of BESS installations. As illustrated in Figure 27, a distribution utility with a Generation and Transmission (G&T) component is approached to host a BESS site to bolste generation and distribution support. The site is owned and operated by the G&T entity, which assumes responsibility from b

How many GW of Bess will be installed in 2023?

short term but also the long term. • Immediate Term: As previously noted, there was approximately 16 GW of BESS capacity installed by the end of 2023, with pl ns to reach 30 GW by the end of 2024. Both the existing systems and the systems under construction have already sele

What is a PCs in a Bess system?

South KoreaBMS/energy systemPCSPCS are a highly critical component in the BESS, combining inverters and other conversion s stems to operate a consistent system. It s worth noting where PCS are sourced. Analysis of the California inverter40 allow lists indicate that there are 517 PCS models used either with o

Random Links

- Frequency regulation operation mode of energy storage power station

- Does the off-grid inverter have three phases

- What does 50kw energy storage mean

- San Diego Gravity Energy Storage Project

- Energy storage 50kw lithium battery

- What is the energy storage system of Arequipa Power Station in Peru

- Central Asian super capacitor manufacturer

- Solar DC Water Pump Application

- Power of double-glass modules of the same size

- Sodium battery energy storage product series

- South Korea communication base station photovoltaic power generation system

- Standard container energy storage cabinet power

- Monaco outdoor energy storage cabinet manufacturer

- China high voltage switchgear in Turkey

- Factory price current breaker in Gambia

- Abu Dhabi Green Solar Smart System

- Energy storage cabinet solar power collection

- Commercial communication base station wind and solar complementary equipment includes

- 475w double-sided solar photovoltaic panel price

- New energy battery cabinet output function

- Mobile network communication base station wind power maintenance

- Circuit breaker amps in China in Singapore

- Huawei Palestine Valley Power Energy Storage Device Manufacturer

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.