Energy Storage Containers Analysis Uncovered: Market

Jun 2, 2025 · The global energy storage container market is experiencing robust growth, driven by the increasing demand for renewable energy integration, grid stabilization, and backup power

Energy Storage Containers Growth Forecast and Consumer

Apr 26, 2025 · The rising adoption of renewable energy sources, such as solar and wind power, necessitates effective energy storage solutions to address intermittency issues. Data centers,

Energy Storage Containers 2025-2033 Overview: Trends,

Apr 10, 2025 · The global energy storage container market is experiencing robust growth, driven by the increasing demand for reliable and efficient energy solutions across diverse sectors.

6 FAQs about [Energy storage container data]

What is a containerized battery energy storage system?

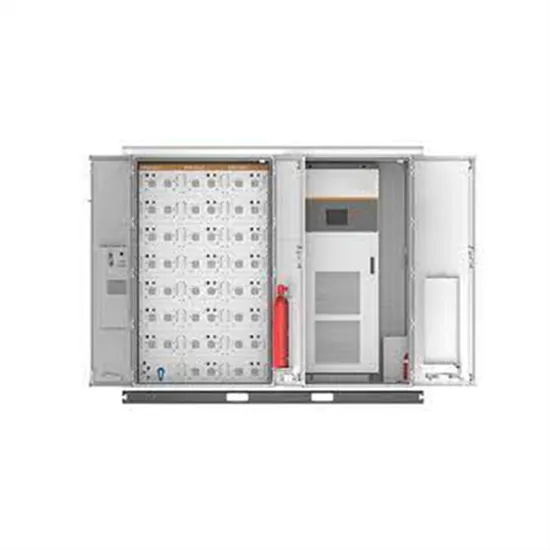

Containerized Battery Energy Storage Systems (BESS) are essentially large batteries housed within storage containers. These systems are designed to store energy from renewable sources or the grid and release it when required. This setup offers a modular and scalable solution to energy storage.

Are energy storage containers a viable alternative to traditional energy solutions?

These energy storage containers often lower capital costs and operational expenses, making them a viable economic alternative to traditional energy solutions. The modular nature of containerized systems often results in lower installation and maintenance costs compared to traditional setups.

What types of energy storage are included?

Other storage includes compressed air energy storage, flywheel and thermal storage. Hydrogen electrolysers are not included. Global installed energy storage capacity by scenario, 2023 and 2030 - Chart and data by the International Energy Agency.

What resources are available for energy storage?

The following resources provide information on a broad range of storage technologies. General Battery Storage, ARPA-E’s Duration Addition to electricitY Storage (DAYS), HydroWIRES (Water Innovation for a Resilient Electricity System) Initiative

What are stationary energy storage failure incidents?

Note that the Stationary Energy Storage Failure Incidents table tracks both utility-scale and C&I system failures. It is instructive to compare the number of failure incidents over time against the deployment of BESS. The graph to the right looks at the failure rate per cumulative deployed capacity, up to 12/31/2024.

What are the different types of energy storage failure incidents?

Stationary Energy Storage Failure Incidents – this table tracks utility-scale and commercial and industrial (C&I) failures. Other Storage Failure Incidents – this table tracks incidents that do not fit the criteria for the first table. This could include failures involving the manufacturing, transportation, storage, and recycling of energy storage.

Random Links

- Albanian companies making photovoltaic inverters

- Inverter pure sine wave high power 12244860v

- 3kva-ups uninterruptible power supply

- New energy battery cabinet is low on power

- Colombia mobile energy storage charging station installation

- Amsterdam 5G base station hydrogen power supply

- Safe lithium battery energy storage cabinet quotation

- Huawei UPS Uninterruptible Power Supply in Monterrey Mexico

- 2 75mwh energy storage system in Estonia

- 10 kW instantaneous power of photovoltaic panel

- How big a storage battery is needed for one thousand degrees

- Sophia Energy Storage Project 2025

- Portable power solar station in Abu-Dhabi

- 4000 watt inverter manufacturer

- Principle of prefabricated container energy storage station

- EK Energy Storage Power Factory

- Voltage-type inverter grid connection

- Price of liquid cooling energy storage cabinet

- Solar Light Single Photovoltaic Panel

- XOOXI portable power bank

- Distribution network low-carbon operation grid-side energy storage

- Earth leakage breaker factory in Poland

- Switchgear equipment in China in Canberra

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.