What Is Base Station in Mobile Communication? – The Heart

Jan 11, 2025 · At the heart of this system lies the base station, a crucial component that enables seamless communication between mobile devices and the network. In this blog post, we will

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · The choice of allocation methods has significant influence on the results. Repurposing spent batteries in communication base stations (CBSs) is a promising option to

2024-2030全球与中国通信基站用锂电池市场现状及未来发展趋势

2024-2030 Global and China Lithium Battery for Communication Base Stations Market Status and Forecast 报告编码: qyr2404221027288 服务方式: 电子版或纸质版 电话咨询: +86-176 7575

6 FAQs about [Battery debugging work for communication base station]

Why do telecom base stations need a battery management system?

As the backbone of modern communications, telecom base stations demand a highly reliable and efficient power backup system. The application of Battery Management Systems in telecom backup batteries is a game-changing innovation that enhances safety, extends battery lifespan, improves operational efficiency, and ensures regulatory compliance.

Why do telecom base stations need backup batteries?

Backup batteries ensure that telecom base stations remain operational even during extended power outages. With increasing demand for reliable data connectivity and the critical nature of emergency communications, maintaining battery health is essential.

How does a telecom base station work?

Telecom base stations—integral nodes in wireless networks—rely heavily on uninterrupted power to maintain connectivity. To ensure continuous operation during power outages or grid fluctuations, telecom operators deploy robust backup battery systems.

Why do power stations need backup batteries?

These stations depend on backup battery systems to maintain network availability during power disruptions. Backup batteries not only safeguard critical communications infrastructure but also support essential services such as emergency response, mobile connectivity, and data transmission.

Are lithium ion batteries a good choice for a telecom backup system?

Lithium-Ion Batteries: Although more expensive upfront, lithium-ion batteries provide a higher energy density, longer lifespan, and deeper discharge capabilities. Their superior performance is driving increased adoption in modern telecom backup systems.

What is a backup battery & why do you need one?

Backup batteries not only safeguard critical communications infrastructure but also support essential services such as emergency response, mobile connectivity, and data transmission. Flooded Lead-Acid Batteries: Known for their cost-effectiveness and reliability, these batteries have been the traditional choice for telecom backup applications.

Random Links

- EAST uninterruptible power supply ups standard

- The function of energy storage device control module

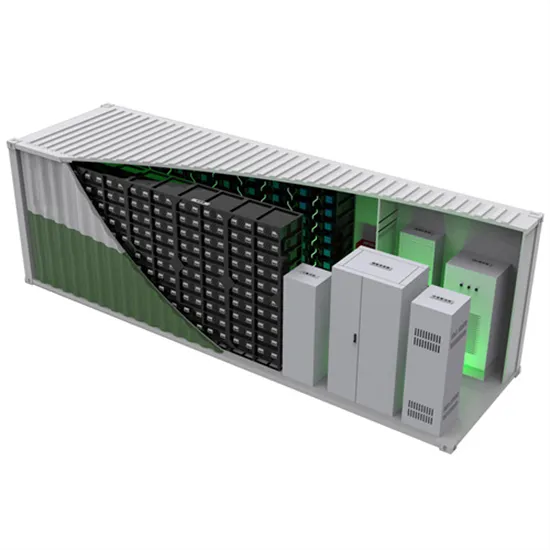

- Box-type industrial energy storage system

- Profit of battery pack

- Key parameters of electrochemical energy storage power station

- PV inverter AB group voltage

- Modular energy storage system

- 260 Photovoltaic panel size

- Industrial and commercial small energy storage container manufacturers

- Kingston Micro Inverter Purchase

- Hot sale China 1 5 kva hybrid inverter Price

- German Energy Storage Container Procurement

- Simple machine room for battery energy storage system of communication base station

- EK Outdoor Communication Power Supply BESS Information

- Investment in energy storage power stations in various places in Cebu Philippines

- Super Farad capacitor voltage

- High quality 3 2 kva inverter in Puerto-Rico

- Inverter 12v instantly changes to 220v

- Albania low rate lithium battery pack

- Development prospects of outdoor energy storage in Bolivia

- China factory price main switchgear Wholesaler

- Portable power bank price in Paris

- Yaounde Mobile Energy Storage Power Supply

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.