South Bangkok power station

Aug 19, 2025 · South Bangkok power station (โรงไฟฟ้าพระนครใต้) is an operating power station of at least 1930-megawatts (MW) in Bang Prong, Samut Prakan, Thailand with multiple units,

Major Electricity Companies in Thailand and Their Energy

Feb 16, 2024 · Have you ever wondered which major companies produce and distribute electricity in Thailand? Here''s a look at some of the leading electricity companies in the country and their

Partners to deploy 20 solar-powered off-grid base stations in Thailand

Jun 20, 2024 · AIS has partnered with Gulf Energy Development to deploy 20 solar-powered off-grid base stations across remote areas of Thailand. This partnership, valued at approximately

6 FAQs about [Which companies have power base stations in Bangkok ]

Who are the top companies operating in Thailand power market?

Siemens Gamesa Renewable Energy SA, JinkoSolar Holding Co., Ltd., General Electric Company, BCPG PCL and Electricity Generation Authority of Thailand are the major companies operating in the Thailand Power Market. This report lists the top Thailand Power companies based on the 2023 & 2024 market share reports.

Where is South Bangkok power station?

South Bangkok power station (โรงไฟฟ้าพระนครใต้) is an operating power station of at least 1930-megawatts (MW) in Bang Prong, Samut Prakan, Thailand with multiple units, some of which are not currently operating. The map below shows the exact location of the power station. Loading map... Unit-level coordinates (WGS 84):

What are the major natural gas plants in Bangkok?

Bang Pakong Power Plant (Chachoengsao Province): A major gas-fired power station supplying electricity to the Bangkok metropolitan area. South Bangkok Power Plant (Samut Prakan Province): Another significant natural gas plant serving the central region.

Where is biomass energy used in Thailand?

Biomass Power Plants: Biomass energy, derived from agricultural and forestry waste, plays an important role in rural Thailand, particularly in provinces with high agricultural production. Key Plants: Khanom Biomass Power Plant (Nakhon Si Thammarat Province): A biomass power station in southern Thailand using agricultural waste for energy.

Which power plants are in Thailand?

Coal Power Plants: Although coal-fired power plants contribute to Thailand’s energy mix, there has been growing opposition to coal, leading to delays and cancellations of new projects. Key Plants: Mae Moh Power Plant (Lampang Province): The largest coal-fired power plant in Thailand, located in the north.

How many MW is the South Bangkok power plant generating capacity?

At present, the South Bangkok Power Plant has a contracted generating capacity of 1,930 MW: In the early time of electricity generation development of EGAT, Thailand was expanding developments from the city to several local areas. The government

Random Links

- Palau Communications Company Base Station

- Lithium battery energy storage of the same weight

- 12v high-performance inverter

- Syria outdoor power supply customization

- Panama Colon Sine Wave Inverter

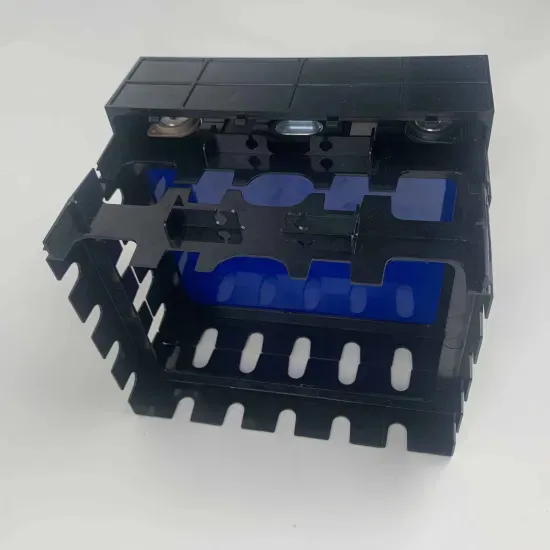

- Integrated communication base station lithium-ion battery box

- 345W photovoltaic panel price

- Chad lithium battery manufacturer

- Inverter important power components

- Huawei Denmark Photovoltaic Inverter Factory

- Cheap koten circuit breaker factory manufacturer

- Cheap Uninterruptible Power Supply in Angola

- North Macedonia Solar Power Container

- Liechtenstein computer room UPS uninterruptible power supply recommendation

- 20-foot energy storage battery cabin

- High quality 220 volt breaker in Uk

- China camping charger station in Cameroon

- Brand new sine wave 24 volt inverter

- Polish energy storage fire fighting equipment

- Ethiopia container energy storage device enterprise

- Singapore s electrochemical energy storage installed capacity

- How many volts are there in the Riga outdoor communication battery cabinet

- 2400W portable power station in Los-Angeles

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.