Solar, energy storage industries after Biden''s Section 301 tariff

May 16, 2024 · Tariff rates will double from 25% to 50% for solar cells and modules after 2024 and rise from 7.5% to 25% for lithium-ion non-EV batteries (most energy-storage batteries) in

The trade war beginsWhat does this mean for EVs,

Apr 3, 2025 · With EVs not set to be affected by the reciprocal and universal tariffs, the focus turns to the second largest battery demand market in the US, energy storage. In 2024, over 90% of

How much is the import tariff on energy storage materials?

Jul 16, 2024 · How much is the import tariff on energy storage materials? Determining the import tariff on energy storage materials involves several critical considerations including, 1. Current

Trump Tariffs Impact on Battery Energy Storage System

Apr 9, 2025 · Explore how Trump s tariffs affected the Battery Energy Storage System (BESS) market, industry responses, key challenges, and solutions. Learn about supply chain shifts &

April 2025 update: Tariff impact to solar & storage product

May 13, 2025 · Looking more closely at countries with solar and energy storage manufacturing and assembly, the announced custom tariff rates are: An initial 10% tariff on all imports from

How much is the tariff for imported energy storage equipment?

Jul 19, 2024 · The tariff for imported energy storage equipment varies significantly depending on the type of equipment, country of origin, and applicable trade agreements. In general, the

6 FAQs about [How much is the import tariff for new energy storage equipment ]

Will US tariffs affect energy storage?

There have also been indications that the US administration may consider other tariff proposals impacting energy storage, such as a 10–20% universal tariff, tariffs of up to 60% across the board on Chinese-origin goods, and tariffs of 25% on Mexican and Canadian origin goods.

Are Chinese tariffs affecting battery energy storage systems?

If you’re in the business of battery energy storage systems (BESS), you’ve probably felt the squeeze of tariffs on Chinese imports. For years, China has been a go-to for affordable, high-capacity energy storage solutions, but ongoing trade policies and tariffs have made importing these systems into the U.S. more complicated — and expensive.

Will China increase battery tariffs in 2026?

The increase in tariffs for lithium-ion batteries from China from 7% to 25% was announced last week (14 May), effective this year for EV batteries and from 2026 for non-EV batteries, including battery energy storage system (BESS). Industry reaction to the move has been mixed, as we reported this week (Premium access).

How does tariff risk affect a battery energy storage system (BESS) project?

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can significantly affect cost structures and overall project economics.

How will China's new battery tariffs affect us Bess integrators?

The new tariffs on batteries from China will increase costs for US BESS integrators by 11-16%, consultancy Clean Energy Associates said, adding that new guidance around the domestic content ITC adder will make it easier to access.

How will the new tariffs affect the energy-storage cell industry?

Currently, LG demonstrates the most production expansion plans, potentially accumulating 25 GWh of energy-storage cell production capacity in the U.S. by 2027. Phasing in gradually in 2026, the new tariffs will not affect demand in the short term.

Random Links

- Hot sale circuit breaker amps in China supplier

- What is photovoltaic roof glass

- Export 72v lithium battery pack

- Which battery cabinet has 60v in Ljubljana

- Swiss Energy Storage Project BESS

- 60w inverter

- BAK manufactures portable energy storage power supply

- China solar power storage in China manufacturer

- National mobile base station equipment solar panel data

- How much does a 6kw monocrystalline silicon photovoltaic module cost

- Factory price dryer amp breaker

- Communication Green Base Station Data Analysis

- Solar road monitoring power supply system

- Amman Lithium Energy Storage Power Production Company

- Factory price 4000 w inverter in Calcutta

- Nicaragua Industrial Inverter Manufacturer

- China main circuit breaker for sale Seller

- Basseterre 5G base station battery bidding

- Off-grid ups solar power system

- 5kwh hybrid inverter in China in New-Zealand

- Ngerulmude photovoltaic grid-connected inverter commercial use

- Yerevan lithium battery pack assembly factory

- Is a 60v inverter better than a 48v inverter

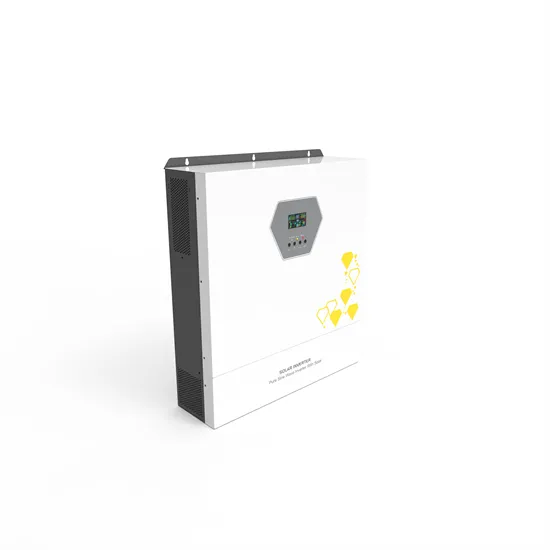

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.