Lithium Iron Phosphate (LFP) Battery Energy Storage: Deep

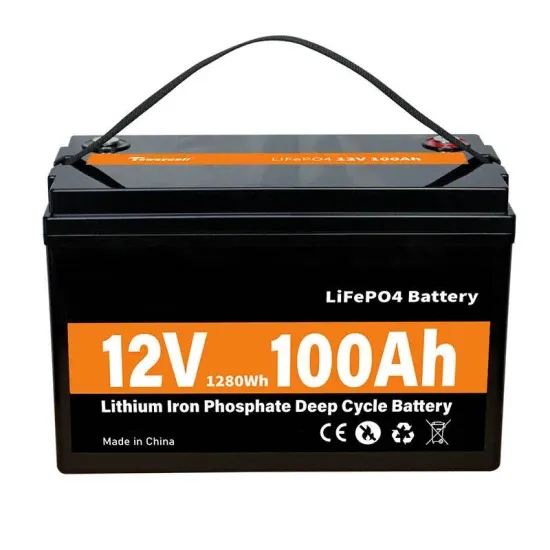

Jun 26, 2025 · Lithium Iron Phosphate (LiFePO₄, LFP) batteries, with their triple advantages of enhanced safety, extended cycle life, and lower costs, are displacing traditional ternary lithium

Exclusive-LG Energy Solution, Tesla sign $4.3 billion battery

Jul 30, 2025 · SEOUL (Reuters) -South Korean battery maker LG Energy Solution (LGES) has signed a $4.3 billion contract to supply Tesla with lithium iron phosphate (LFP) batteries for

Strategic Vision for Lithium Iron Phosphate (LiFePO4) Energy Storage

Apr 16, 2025 · The global Lithium Iron Phosphate (LiFePO4) Energy Storage Systems (ESS) market is experiencing robust growth, projected to reach a market size of $30.53 billion in

Lithium Iron Phosphate (LiFePO4) Energy Storage Systems

Feb 9, 2025 · Falling lithium iron phosphate (LiFePO4) battery prices serve as a dominant driver for commercial and industrial energy storage adoption. Average cell-level costs for LiFePO4

LG Energy, Samsung SDI to build 1st US LFP battery plants

May 28, 2025 · In a pivotal shift for the North American electric vehicle battery landscape, South Korea''s two leading battery makers – LG Energy Solution Ltd. and Samsung SDI Co. – plan to

BriefCASE: South Korean companies eye low-cost LFP battery

Aug 14, 2024 · Intensifying competition and slowing demand for battery-electric vehicles are pressuring carmakers to lower manufacturing costs. The lithium iron phosphate (LFP) battery

Lithium Iron Phosphate Batteries Market Analysis Report to

Mar 7, 2024 · However, the market growth is hampered by the high-cost criteria for the safety and health of the lithium iron phosphate batteries market and the product''s inability to prevent fog

5 FAQs about [Seoul lithium iron phosphate portable energy storage price]

Why are Korean battery makers launching cost-effective lithium iron phosphate batteries?

(Yonhap) Korean battery makers are nearing the launch of cost-effective lithium iron phosphate batteries — a market long dominated by China — as part of their strategy to navigate a downturn in electric vehicle demand.

Why is lithium iron phosphate a key step in cost control?

Intensifying competition and slowing demand for battery-electric vehicles are pressuring carmakers to lower manufacturing costs. The lithium iron phosphate (LFP) battery technology is emerging as a key step in cost control, with almost all major global automakers looking to integrate the battery chemistry into their product portfolios.

Are South Korean battery companies a suitable alternative to Chinese batteries?

The deal is LGES' first large-scale supply deal for LFP batteries and could indicate that South Korean battery companies are a suitable alternative to their Chinese counterparts for LFP batteries. LGES claims that it will offer a competitive price for its LFP batteries.

Why are South Korean battery makers accelerating the development of LFP technology?

Pushed by new market dynamics, South Korean battery-makers, known for their expertise in nickel-based lithium batteries, are accelerating the development of LFP technology. This is also fueled by the expiry of core LFP patents in 2022, allowing LFP battery production outside of mainland China.

Will a vendor diversification strategy create opportunities for South Korean battery companies?

This vendor diversification strategy is expected to create opportunities for South Korean battery companies such as LG Energy Solution (LGES), SK On and Samsung SDI to increase their stake in the LFP market.

Random Links

- Bolivia energy storage cabinet photovoltaic

- Which country is the communication base station flywheel energy storage from

- Majuro inverter wholesaler

- How to configure a photovoltaic inverter

- Inverter 12v to 220vEK

- Solar water pump installation and connection

- Monocrystalline photovoltaic panel 340 watts

- 48v20ah lead-acid battery modified inverter

- Sudan energy storage system lithium battery pack manufacturer

- What are photovoltaic inverters made of

- Luxembourg City Outdoor Portable Power Communication BESS

- Regulations on the construction of battery energy storage systems for communication base stations

- Greece power frequency isolation 100kw inverter

- Battery module pack cost

- Solar panels produce 100 watts

- Photovoltaic energy storage installation in Hanoi

- Price of photovoltaic panel Dae

- Which Nordic energy storage power supply is the best

- Huawei Riyadh photovoltaic panels

- Main breaker switch for sale in Dominica

- Lesotho Air Compression Energy Storage Project

- How big an inverter is needed for 2mw solar power generation

- Ashgabat solar energy manufacturer

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.