Top 10 switchgear Manufacturers & Suppliers, China top 10 switchgear

top 10 switchgear manufacturers/supplier, China top 10 switchgear manufacturer & factory list, find best price in Chinese top 10 switchgear manufacturers, suppliers, factories, exporters &

Real Factory OEM Customized Solid Insulated Metal-Enclosed Switchgear

Jun 24, 2025 · Real Factory OEM Customized Solid Insulated Metal-Enclosed Switchgear No Sf6 Rmu Gas Insulated Switchgear, Find Details and Price about Insulated Switchgear Rmu Ring

5 FAQs about [Best factory price real switchgear Factory]

What is electrical switchgear?

Electrical switchgear refers to a centralized collection of circuit breakers, fuses... Its design is verified in accordance with IEC 61439-1/-2. The consistent application... Our main products is box type substation, high and lower switchgear, power distribution transformer.

Who is switchgear?

Over 10 years of Switchgear manufacturing experience. Our products have ISO9001, OHSAS18001, ISO14001, ISO9001, CCC certificates. Since the establishment of the company, we have focused on production. We have rich experience to help you order. We exported goods to Middle Asia, Middle East, Southeast Asia, Africa,South America and other countries.

Who makes Andeli switchgear?

Andeli Group Co., Ltd. is a prominent manufacturer specializing in both low- and high-voltage electrical devices, including a diverse range of switchgear. The company's commitment to innovation and quality is reflected in its extensive product lineup and numerous international certifications.

Why is China's switchgear industry important?

The Chinese government is increasingly prioritizing green technologies, pushing companies to adopt sustainable practices. Furthermore, the global market relevance of China's switchgear industry is significant, as it is one of the largest producers and consumers of electrical equipment.

Who is Xiamen Huadian switchgear?

Xiamen Huadian Switchgear specializes in medium and high voltage switchgears and offers a variety of products such as air insulated switchgear, vacuum circuit breakers, ring main units, and gas insulated switchgear, all designed for power transmission and distribution.

Random Links

- Does photovoltaic equipment include inverters

- High quality power switchgear in Brisbane

- 62 photovoltaic panel specifications

- Energy storage ancillary products

- Huawei Russia St Petersburg Energy Storage Container

- Power Inverter for sale

- Royu circuit breaker in China in Bangkok

- Wind Power Portable Power Supply

- 25kw commercial inverter

- Huawei transparent outdoor power brand

- Energy storage and electric energy storage

- Belgium 5g base station power supply factory

- Freetown Lithium Battery Pack

- Energy storage lead-acid battery price

- Oslo High Frequency Sine Wave Inverter

- Photovoltaic panel full set price

- China-Africa solar fan prices

- Water cooling of communication base station energy management system

- Advantages and disadvantages of DC high frequency inverter

- Hybrid inverter mppt in China in Turkmenistan

- 1 kW solar home

- Outdoor power supply and power battery weight

- China-Africa BMS battery management power system architecture

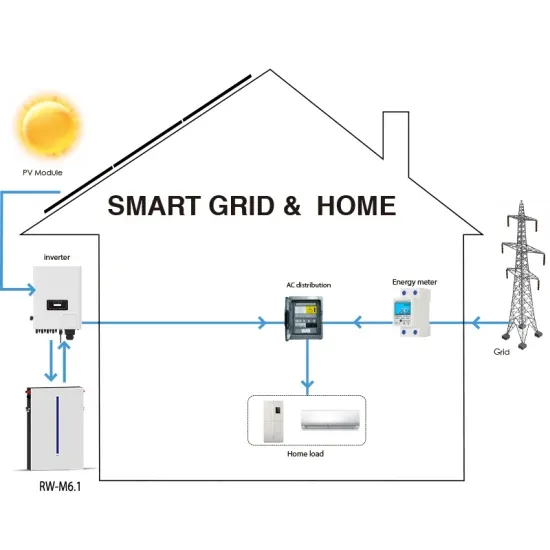

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.