ASEAN Folding IBC Market Size, Trends & Insights 2025-2035

Feb 12, 2025 · Market growth of folding IBC in ASEAN was positive as it reached a value of USD 51.0 million in 2024 from USD 41.6 million in 2020. Folding IBCs sales are slowly on the rise

Essential Packaging for Southeast Asian Businesses In Industry

May 29, 2024 · The folding carton industry has grown significantly across Southeast Asia over the past few decades. Folding cartons first emerged as a popular packaging format in the region

4 FAQs about [ASEAN Folding Container Wholesale]

Are empty containers a problem in ASEAN?

Many Member States have struggled to access empty containers throughout the pandemic. ASEAN does not currently have any shipping container manufacturing capabilities. Allowing international vessels to move empty containers has helped facilitate their repositioning, but this still requires one-off licences in some Member States.

Why are container shipping services in the ASEAN region unreliable?

Container shipping services in the ASEAN region became unreliable, in part because vessels were redeployed to more lucrative Asia-US or Asia-Europe routes. Slow container circulation left the region’s exporters with a shortage of empty containers. These issues rippled through port and hinterland operations, causing delays throughout supply chains.

How can ASEAN improve liner shipping?

Measures, such as capping shipping rates, would likely cause shipping lines to divert services to more commercially viable routes. However, as market concentration becomes more visible, ASEAN could work with international partners to increase coordination against further consolidation in the liner shipping industry.

How can ASEAN improve port capacity & hinterland connectivity?

Member States could: Improve port capacity and hinterland connectivity. Congested transhipment hubs across Asia have provided an opportunity for ASEAN mid-tier ports to attract more direct calls. To capitalise on this, ports must provide connected and competitive port capacity ahead of time.

Random Links

- Flywheel Energy Storage Environment

- China vacuum circuit breaker in Turkmenistan

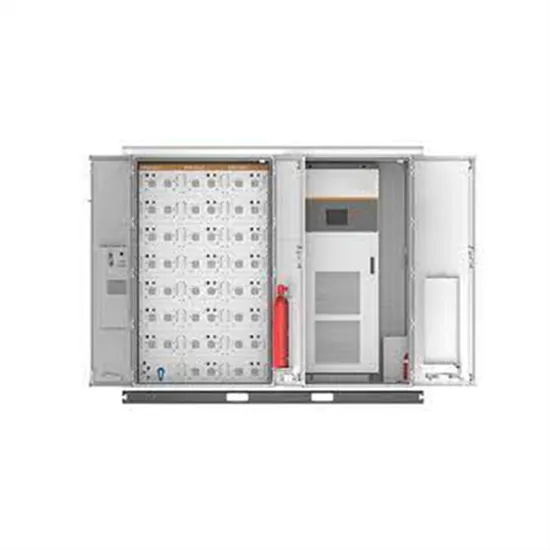

- What are the dimensions and specifications of the energy storage battery container

- Amman Wholesale Outdoor Power Supply

- Al hassan switchgear for sale in Sydney

- Columbia Power Storage Vehicle

- Brand of energy storage equipment

- Thailand Base Station Communication System Installation

- Africa Hydrogen Energy Photovoltaic Site 215KWh

- Bridgetown Photovoltaic Communication Base Station Battery

- Solar air conditioning in Basseterre

- Mechanical energy storage device production

- 600va24v wind-solar hybrid control inverter for home use

- Apia High Power Uninterruptible Power Supply

- Russia St Petersburg Household Photovoltaic Inverter Manufacturer

- Hundred-megawatt-level large-scale energy storage

- Can photovoltaic panels be connected in parallel if their voltages are close

- Electrochemical Energy Storage Design Solutions

- Factory price safety breaker in Cairo

- Caracas Industrial Park Energy Storage Device

- Lusaka Green Container Energy Storage Enterprise

- Outdoor power supply noise

- Buenos Aires should have independent energy storage project

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.