2025 Solar Panels: 6 Key Trends, Costs, and Sustainability

Mar 11, 2025 · Discover the latest trends in solar panels for 2025—cutting-edge technology, cost insights, sustainability benefits, and market growth. See how solar can transform your energy

6 FAQs about [Latest new photovoltaic panel prices]

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

How much did solar panels cost in October 2024?

Here’s a detailed breakdown: High-Efficiency Solar Panels: The average price was €0.125/Wp, marking a 3.8% decrease compared to October 2024. Mainstream Solar Panels: Prices averaged €0.095/Wp, experiencing a 5% decline from October 2024. Low-Cost Solar Panels: Prices remained stable at €0.060/Wp, unchanged from the previous month.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

Will solar module prices change in 2025?

As of January 2025, solar module prices have remained relatively stable across all categories, including ultra-high-efficiency products and other module classes. While there have been minor price increases in the two lower categories—partially due to the updated classification—the overall market has yet to see significant price changes.

Random Links

- Earth leakage breaker factory in Auckland

- Thin-film photovoltaic panels

- What kind of self-service battery replacement cabinets are there in Yemen

- Site Energy Photovoltaic Sites in Morocco

- Danish standard lithium battery pack factory price

- Price of BESS photovoltaic energy storage power station

- Huawei photovoltaic inverter installation in Chiang Mai Thailand

- Where are the new energy switch stations in Suriname

- What are the components of the liquid-cooled energy storage cabinet

- What are the types of battery energy storage systems for self-use communication base stations

- Various types of grid-connected inverters

- Which new energy storage company is better in Dhaka

- Sri Lanka promotes new energy storage applications

- German photovoltaic projects need to be equipped with energy storage

- Household charging pile peak shaving and valley filling energy storage cabinet

- Latvian Communication BESS Power Station Model

- Cheap home circuit breaker in China Buyer

- Solar panel photovoltaic power generation column

- Energy storage container material thickness specifications

- Liquid Cooling Energy Storage System PLC

- Gfci circuit breaker in China in Calcutta

- Use of energy storage batteries in Brno Czech Republic

- Dhaka 12v inverter

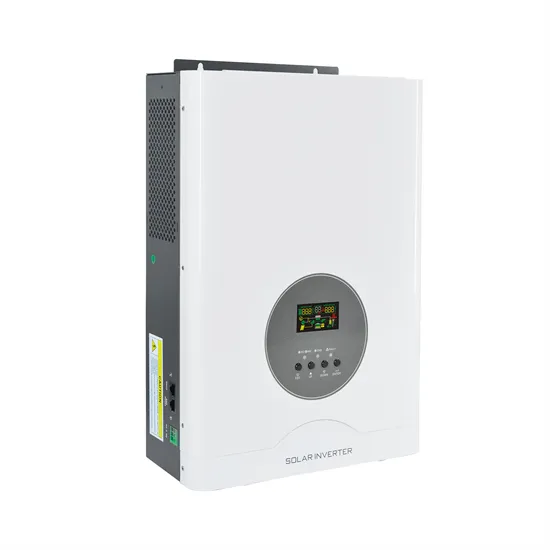

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.