Outdoor Power Supply Market Consumption Trends: Growth Analysis 2025

Aug 15, 2025 · The global outdoor power supply market, valued at $1,594 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of

Outdoor Power Supply Market Consumption Trends: Growth Analysis 2025

Aug 15, 2025 · The global outdoor power supply market, estimated at several million units in 2025, exhibits a moderately concentrated landscape. Key players like EcoFlow, Goal Zero,

2025年全球户外电源行业总体规模、主要企业国内外市场

Jun 5, 2025 · 预计2025年,美国的关税体系将给全球经济带来重大不确定性,本报告系统评估其贸易壁垒升级与多国反制措施对户外电源产业竞争秩序、地缘经济整合及跨境价值链调整的多维

Buck-Boost Chip for Outdoor Power Supply Charting Growth

Jul 5, 2025 · The global market for buck-boost chips in outdoor power supplies is experiencing robust growth, driven by the increasing demand for portable and energy-efficient devices in

What is the best portable power station in 2025? – AFERIY UK

Jul 22, 2025 · Find out which is the best portable power station in 2025 according to your needs: power, battery life, use for camping or in case of a breakdown. AFERIY offers a detailed

Outdoor Power Supply Market Report | Global Forecast From 2025

Jul 26, 2023 · Communities and individuals are increasingly investing in outdoor power supplies like portable power stations and solar generators to ensure they have a reliable power source

6 FAQs about [Outdoor Power Supply in 2025]

What's going on with electricity in 2025?

At the same time, electricity supply from renewables, natural gas and nuclear continues to grow, with all set to reach new milestones. This mid-year update follows the extensive Electricity 2025 report released in February, examining the latest trends and the outlook for the remainder of the year.

Will global hydropower supply remain flat in 2025?

Global hydropower generation, the largest source of renewable electricity supply globally with a 14% share, is forecast to remain relatively flat in 2025 amid droughts in the first half in various regions, after a significant recovery in 2024 following the strong reductions due to droughts the year before.

Will global electricity demand increase in 2025?

Global electricity demand is forecast to increase by an average annual 3.3% in 2025 and by 3.7% in 2026, a moderation from 4.4% in 2024 but still some of the highest growth rates observed over the last decade. This is a slight downward revision from our previous forecast in February 2025 of 4% growth for this year and 3.8% in 2026.

Will wind & solar power increase global electricity demand in 2025?

Wind and solar PV are expected to cover over 90% of the increase in global electricity demand in 2025. After exceeding the 4 000 TWh mark in 2024, wind and solar PV generation combined is set to surpass 5 000 TWh in 2025 and 6 000 TWh in 2026.

Will renewables grow in 2025 & 2026?

Renewables are projected to continue expanding at around 10% in 2025 and 7.5% in 2026. Solar PV is expected to lead this expansion, with growth of 26% in 2025 and 18% in 2026, making it the largest contributor to new power generation. Wind generation is forecast to increase by around 5% in 2025 and 2% in 2026.

Why did electricity consumption increase in the first half of 2025?

Source: IEA. Despite a slowdown in global economic growth prospects, the world’s electricity consumption increased strongly in the first half of 2025, driven by rising demand from industry, appliances, cooling, data centres and electrification.

Random Links

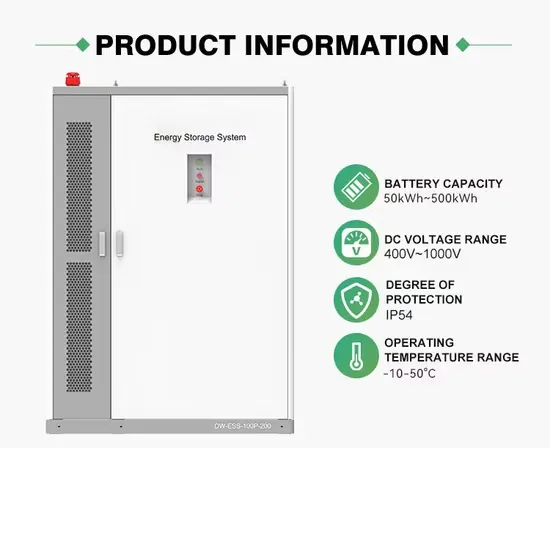

- Characteristics of energy storage power station

- Can East Timor outdoor power supply pass customs

- Factory price serket breaker in Slovenia

- Batteries for chemical energy storage

- Production of energy storage cabinets

- Energy storage battery types are as strong as

- How to measure the capacitance of a battery cabinet

- Mozambique Photovoltaic Energy Storage

- China thermal circuit breaker in Paraguay

- What is the size of the photovoltaic curtain wall in Angola

- Application of Uninterruptible Power Supply

- Solar Charging Outdoor On-site Energy Installation

- Inverters suitable for lithium batteries in Asia

- Podgorica Industrial and Commercial Solar Power Generation System

- Can wind power stations at communication base stations be connected to network cables

- New Energy Battery Cabinet Cold Heading Parts

- EK photovoltaic panel wholesale price

- 300 kW inverter price

- Price of photovoltaic greenhouse in Zimbabwe

- What is a home base station for new energy communication sites

- Is it good to install a communication base station EMS in a building

- 24v inverter connected to 12v battery

- Photovoltaic off-grid system installation

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.