Ankara Imported Energy Storage Battery Brand: Why

May 2, 2023 · When China''s lithium giant partnered with YIGIT AKU (Ankara''s battery OG since 1976) to build 5GWh capacity, they didn''t just bring capital – they brought a solid-state battery

Ankara Power Battery Energy Storage: Powering Turkey''s

Jul 29, 2024 · Energy Density: Stores 150–200 Wh/kg, ideal for Ankara''s compact urban projects. Cycle Life: Over 6,000 cycles—perfect for daily charge/discharge in Turkey''s fluctuating

6 FAQs about [Ankara PACK Power Battery Factory]

How many battery production facilities are there in Turkey?

New facilities capable of producing up to 5 gigawatt-hours of cells and batteries will be established in Ankara, Istanbul, Izmir, and Kocaeli, Usta said, adding that agreements signed this year alone exceeded $1 billion in investments. With these new additions, the total number of battery production facilities in Türkiye will reach 11.

How many battery plants are there in Türkiye?

With these new additions, the total number of battery production facilities in Türkiye will reach 11. However, Usta noted that despite draft regulations, the legal framework for battery and storage power plants is still evolving. The first approvals are expected next year.

Will Türkiye's battery and storage power plants be approved next year?

However, Usta noted that despite draft regulations, the legal framework for battery and storage power plants is still evolving. The first approvals are expected next year. Türkiye’s battery imports remained steady at around $1.1 billion, similar to last year.

What is a new GWh plant in Ankara?

The new joint venture will be located in an organised industrial zone in Başkent, near Ankara. The project is on track and expected to break ground later this year. Production is intended to start in 2026 with the three parties committing to at least 25 gigawatt hours (GWh) of annual production capacity, which could potentially expand up to 45 GWh.

What's happening in Türkiye's lithium ion battery sector?

Bank of lithium ion batteries at the University of California San Diego Center for Energy Research in La Jolla, California, U.S. (AFP Photo) I nvestments in Türkiye 's battery sector surpassed $1 billion this year, driven by incentives and regulations aimed at achieving an 80-gigawatt-hour storage target by 2030.

Will Türkiye get a battery approval next year?

The first approvals are expected next year. Türkiye’s battery imports remained steady at around $1.1 billion, similar to last year. Usta forecasted that exports would rise from $39 million to $48 million by the end of the year.

Random Links

- 1000 wh power station factory in Germany

- Outdoor power supply interior

- Inverter gas filling 12v24v universal

- How much is the electricity price of Oman energy storage power station

- Best high quality 1000 va inverter for sale

- Huawei Energy Storage Container in Barcelona Spain

- Wellington energy storage inverter converted to 12v

- Moroni Base Station Energy Storage Battery System

- 2200w energy storage cabinet solar charging

- How to adjust base station communication equipment

- Distributed photovoltaic solar panels in Algeria

- Cameroon Douala Solar Lithium Battery Pack Parameters

- N Djamena Photovoltaic Power Station Component Project

- Valletta Power Station Tender Information

- 12v outdoor power supply recommended cost-effective

- Large energy storage cabinet enterprise in Equatorial Guinea

- Croatia inverters for sale EK

- Battery photovoltaic energy for communication base stations

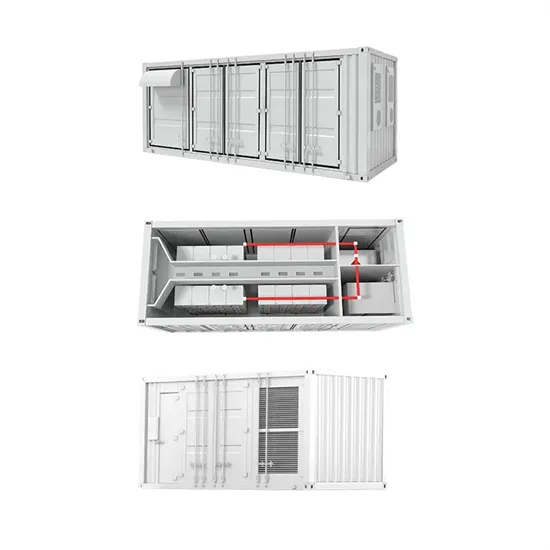

- Parameter setting requirements for energy storage battery containers

- Australian energy storage power generation project

- What are the super large energy storage batteries

- Cairo new energy battery cabinet capacity expansion

- Is it okay to install an outdoor power supply for charging

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.