How should government and users share the investment

Apr 1, 2019 · Therefore, under the current circumstances of the central government subsidy (0.42 yuan / kWh solar power subsidy), the best strategy for the local government is to make a one

Rushing for subsidies: The impact of feed-in tariffs on solar

Jan 1, 2021 · The cost of carbon mitigation through PV feed-in tariffs is estimated at around 120 yuan (~$17) per ton of CO 2. Our estimate of the impact of FIT on PV capacity is useful for the

Photovoltaic supply chain and government subsidy decision

Aug 10, 2023 · Government subsidies are positively proportional to PV product market size, user quality preference factor (QPF), user product coverage preference factor (PCPF), industrial

How much is the subsidy for photovoltaic panels per square

Mar 5, 2024 · The following tables summarize this year''s cost benchmarks and resulting LCOE values, for PV-only systems and for PV+ESS. All dollar values are inflation-adjusted to 2023

Performance analysis of government subsidies for photovoltaic industry

Mar 1, 2021 · In addition, the cost of photovoltaic power generation is relatively high, and governmental subsidies are required. In this paper, we propose a spatial econometric model to

Ultimate Guide to Solar Farm Subsidies: Best

Jul 13, 2024 · Solar farm subsidies, such as the Investment Tax Credit (ITC) and Feed-in Tariffs, provide crucial financial incentives that help offset the initial costs of developing solar farms.

Dynamic subsidy model of photovoltaic distributed generation in China

Apr 1, 2018 · Since the current subsidy mechanism for photovoltaic DG is relatively simple in China, and it does not reflect differences in regional resources, this paper is aimed at

6 FAQs about [How much subsidy does a photovoltaic power generation farmer get per panel ]

How do photovoltaic DG subsidies work?

The current subsidy policies for photovoltaic DG are divided into state subsidies and local subsidies. The power grid enterprises transfer the expense of subsidies to distributed photovoltaic power generation companies, while a few provinces also add the initial investment subsidy based on the state subsidy.

Do government subsidies affect photovoltaic industry?

We apply spatial econometric model to analyze the performance of government subsidies on photovoltaic industry. The installed capacity of photovoltaics has shown a significant spatial agglomeration situation since 2012. The feed-in tariff and R&D subsidy policies play a positive incentive to the photovoltaic installed capacity.

How can government subsidies help the PV industry?

In addition, government subsidies can reduce research and development costs of PV companies. Moreover, it is beneficial to achieve the collaborative innovation of PV industry chain between PV manufacturers and solar cell suppliers. Third, most control variables pass the significance test.

How does PV technology cost affect PV subsidies and PV capacity?

According to China’s policy regulation , an important basis for reducing subsidy levels lies in the reduction of PV technology cost. Thus, PV technology cost affects PV subsidies and PV capacity simultaneously, and should therefore be controlled for in the regression analysis.

Do subsidies affect solar PV installation volumes in China?

Few studies applied regional data in a single country to analyze the influence of support policies on solar PV industry. Moreover, no research studies performed the spatial effect of subsidies on solar PV installation volumes in China. Therefore, we select panel data of 31 provincial units in China from 2011 to 2018.

How do feed-in tariffs and R&D subsidies affect photovoltaic energy production?

The feed-in tariff and R&D subsidy policies play a positive incentive to the photovoltaic installed capacity. The scale of subsidies is in inverse correlation with the distribution of solar energy resources in some regions. Energy is the basis for development of material civilization.

Random Links

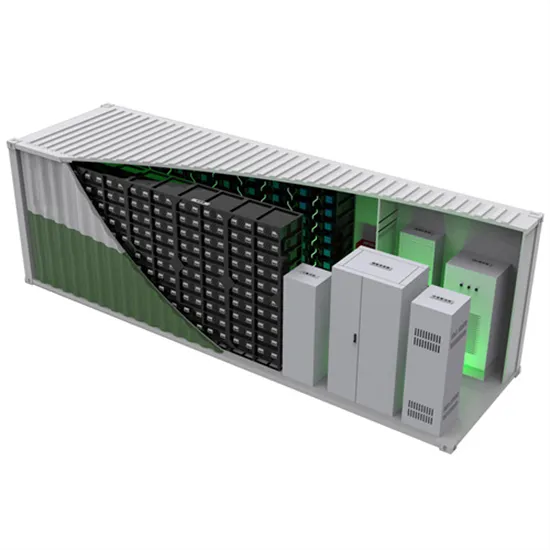

- 5g base station power cabinet Colin Electric

- How much does a 3kw site energy storage cabinet cost

- Main circuit breaker for sale in Bahamas

- Huawei Energy Storage Night Air Conditioning Equipment

- Lead Storage Battery Cabinet Base Station Energy

- Rcb circuit breaker for sale in Italy

- How inverter power is affected

- Lilongwe 20kw off-grid inverter price

- Does off-grid energy storage require an inverter

- Kuala Lumpur energy storage inverter brand

- Bolivia hybrid energy 5g base station energy method

- Communication base station flow battery value

- Guatemala Solar System

- Photovoltaic panels come with inverters

- Inverter DC series connection

- El Salvador boost inverter manufacturer

- Armenia Industrial Uninterruptible Power Supply Customization

- 1 5t can drive a 220v inverter

- New Energy Photovoltaic Energy Storage Products

- How about the communication base station energy management system maintenance major

- Which is the Samoa power generation and energy storage project

- Gabon single glass photovoltaic curtain wall price

- Inverter Home Off-Grid System

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.