How much is the profit of energy storage power station

Jan 17, 2024 · The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Research on the capacity of charging stations based on

Aug 15, 2024 · Domínguez-Navarro et al. researched by integrating renewable energy and energy storage systems, utilizing detailed charging process models and optimization algorithms to

What are the economic models of energy storage power stations?

Jun 20, 2024 · Economic models in energy storage power stations are primarily aligned with four core dimensions that dictate operational efficacy and financial sustainability: 1. Diversity of

Economic Analysis of Energy Storage Stations: Costs, Profits,

Jun 22, 2022 · Let''s slice through the financial layers of a typical 100MW/200MWh lithium-ion storage station: Initial investments (60-80% of total cost): Battery systems still eat up 50-60%

How is the profit of enterprise energy storage power station?

Apr 7, 2024 · A pivotal element influencing the financial viability of energy storage power stations is their operational efficiency. The efficiency rates dictate how much of the power stored can

Capacity investment decisions of energy storage power stations

Sep 12, 2023 · Design/methodology/approach Based on the research framework of time-of-use pricing, this paper constructs a profit-maximizing electricity price and capacity investment

How is the profit model of energy storage power station

Jan 27, 2024 · 1. The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Flexible energy storage power station with dual functions of power

Nov 1, 2022 · The high proportion of renewable energy access and randomness of load side has resulted in several operational challenges for conventional power systems. Firstly, this paper

Value and economic estimation model for grid-scale energy storage

Apr 15, 2019 · Given this, this paper presents a grid-scale production cost model for monopoly power markets in which EES generates profits by offering both energy and ancillary services.

Optimal planning of energy storage system under the business model

Nov 1, 2023 · As the penetration rate of renewable energy increases in the electric power system, the issues of renewable power curtailment and system inertia shortage become more severe.

Operation Strategy Optimization of Energy Storage Power

Nov 1, 2020 · Abstract In the multi-station integration scenario, energy storage power stations need to be used efficiently to improve the economics of the project. In this paper, the life model

How much profit does an energy storage power station have?

Oct 8, 2024 · Energy storage power stations derive profit from several key revenue streams, which reinforce their financial sustainability. These streams largely depend on the operational

6 FAQs about [Estimates of the profit model of energy storage power stations]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Is energy storage a tipping point for profitability?

We also find that certain combinations appear to have approached a tipping point towards profitability. Yet, this conclusion only holds for combinations examined most recently or stacking several business models. Many technologically feasible combinations have been neglected, profitability of energy storage.

Are pumped-storage power plants participating in the secondary regulation service?

pumped-storage power plants participating in the secondary regulation service. Appl. Energy 216, 224–233 (2018). 58. Lai, C. S. & McCulloch, M. D. Levelized cost of electricity for solar photovoltaic and electrical energy storage. Appl. Energy 190, 191–203 (2017). 59. Australian Energy Market Operator.

Random Links

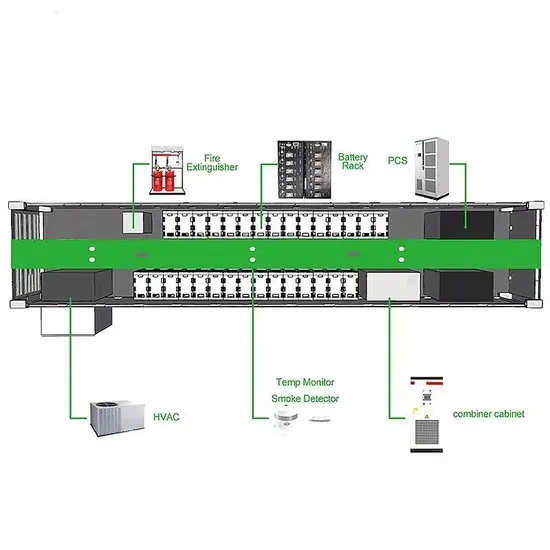

- Ratio of battery packs in energy storage cabinets

- Alofi container energy storage company ranking

- How much does a 2 500-watt solar panel cost

- Home energy storage cabinet integrated machine

- What is the grid connection of the Skopje communication base station inverter

- How to use electricity in the base station energy storage battery box

- Podgorica energy storage project latest

- Budapest computer room ups uninterruptible power supply manufacturer

- Asuncion Monomer Supercapacitor Manufacturer

- High temperature energy storage device

- Photovoltaic and Energy Storage Think Tank

- Portugal New Energy Site

- Seychelles lithium energy storage power supply direct sales manufacturer

- China wholesale household inverters manufacturer

- Lithium battery industry trends

- What are the technical difficulties of container energy storage

- Battery Cabinet Safety System

- PCS lithium battery inverter in Mombasa Kenya

- Hungarian energy storage container manufacturer

- Business building 5g base station energy storage battery

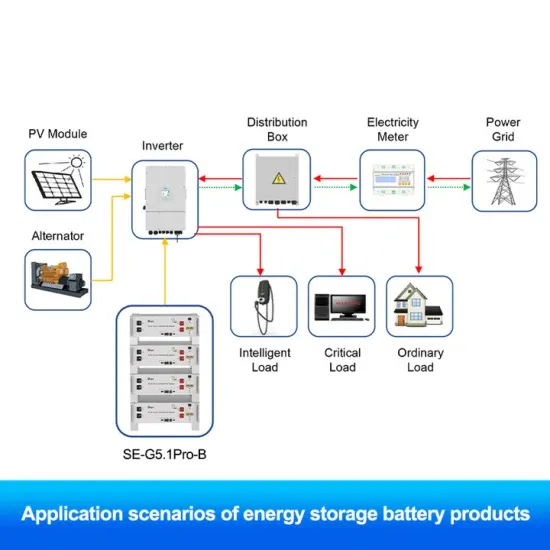

- Electrical architecture of Huawei energy storage products

- How much does container energy storage cost in Bhutan

- Where is the Seychelles communication base station energy management system

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.