Russian airstrikes destroy major Kyiv power plant, damage other stations

Apr 11, 2024 · The destroyed power plant outside Kyiv, a major power supplier for the Kyiv, Cherkasy and Zhytomyr regions, is the third and last facility owned by state-owned energy

DTEK selects Fluence to deliver 200 MW advanced energy storage

Jan 13, 2025 · The six energy storage plants will be located at multiple sites across Ukraine, with capacities ranging from 20 MW to 50 MW and a total capacity of 200 MW. Together, they will

Kyiv CHP-5 power station

3 days ago · Kyiv CHP-5 power station (Київська ТЕЦ-5, Киевская ТЭЦ-5, Филиал «ТЭЦ-5» ПАО «КИЕВЭНЕРГО» (predecessor)) is an operating power station of at least 700-megawatts

Approval and progress analysis of pumped storage power stations

Nov 15, 2024 · Pumped storage power stations in Central China are typical for their large capacity, large number of approved pumped storage power stations and rapid approval. This

6 FAQs about [The latest plan for Kyiv energy storage power station]

How many energy storage plants are there in Ukraine?

The six energy storage plants will be located at multiple sites across Ukraine, with capacities ranging from 20 MW to 50 MW and a total capacity of 200 MW. Together, they will store up to 400 MWh of electricity – enough to supply two hours of power to 600,000 homes (equivalent to roughly half the households in Kyiv).

What is Kyiv chp-5 power station?

a Global Energy Monitor project. Kyiv CHP-5 power station (Київська ТЕЦ-5, Киевская ТЭЦ-5, Филиал «ТЭЦ-5» ПАО «КИЕВЭНЕРГО» (predecessor)) is an operating power station of at least 700-megawatts (MW) in Kyiv, Ukraine.

Why is Ukraine investing €140 million in energy storage?

The €140 million total investment aims to enhance power grid stability, bolstering Ukraine’s energy security and independence. The project will be the biggest operational energy storage portfolio in Eastern Europe at the time of commissioning.

Is Kyiv power station mothballed?

The power station is presumed to be mothballed. The power station was among the targets of a series of missile strikes on March 9, 2023. According to Ukrenergo (a transmission system operator of Ukraine), electricity production in Kyiv fully meets the needs of the city.

Did Ukraine have a power system before the 2022 invasion?

Before the 2022 invasion, Ukraine's power system was interconnected with the Russian and Belarussian grids. Plans had been in place since 2017 to synchronize with the continental Europe system in 2023.

What happened to Ukraine's nuclear power plant in 2024?

As of the end of May 2024 2, about 70% of Ukraine's thermal generation capacity was either occupied or damaged, and the Zaporizhzhia nuclear power plant (whose 6 GW of capacity generated around one-quarter of Ukraine’s electricity supply prior to 2022) remained under Russian control.

Random Links

- Pakistan photovoltaic panel greenhouse manufacturer

- Lesotho energy storage lithium battery professional manufacturer

- What is the best energy storage power source

- Energy storage equipment installation civil engineering

- Energy storage container 20 feet and 40 feet

- Energy storage battery steel ring

- Opening site energy recommendation outdoor solar energy

- Does the 11 5kw photovoltaic panel require an inverter

- Portable energy storage manufacturer

- 16kw sunsynk inverter factory in Congo

- Industrial battery energy storage loss rate

- 16kw sunsynk inverter factory in Japan

- Battery Energy Storage System Design for Communication Base Stations

- Communication base station battery maintenance company

- How many volts are generally safe for lithium battery packs

- Microgrid Solar Power Supply System

- Central Africa Indoor Solar System Design

- Solar energy storage consumables metal

- Inverter constant DC voltage control

- Beijing Energy Storage Container BESS

- 5G base station microstrip circuit

- Swiss nickel-cadmium battery energy storage container sales

- Huawei s global energy storage projects

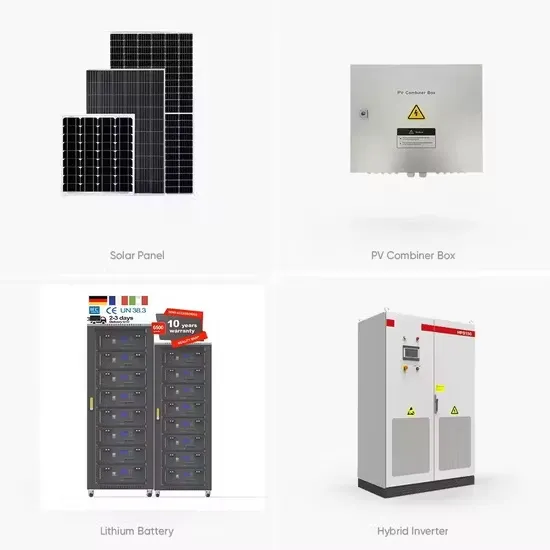

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.