Solar and Wind Energy in the Russian Strategy of Low

Jan 22, 2025 · The volumes of electrical energy produced in the Russia by solar and wind power plants, as well as their current and prospective role in the energy balances of Russian regions

Solar energy and wind power supply supported by battery storage

Mar 1, 2024 · The nature of solar energy and wind power, and also of varying electrical generation by these intermittent sources, demands the use of energy storage devices. In this study, the

Wind ENERGY in Russia: The current state and development trends

Mar 1, 2021 · Wind energy is one of the leading forms of non-hydro renewable energy sources in the world. Russia ranks among the top countries with vast wind energy resources and among

6 FAQs about [Russian wind and solar energy storage power station]

Do solar and wind power plants produce electricity in Russia?

The volumes of electrical energy produced in the Russia by solar and wind power plants, as well as their current and prospective role in the energy balances of Russian regions are analyzed.

Where are wind turbines developed in Russia?

The organization was based on a team at the Wind Energy Department “VNIIEM”, led by Vladimir Sidorov. The wind turbine development was organized at many branches of the SPO “Vetroen” - in Astrakhan, Ufa, as well as in Kyrgyzstan and Kazakhstan . 4. Wind energy in Russia 4.1. Wind energy potential

How much power is generated by wind farms in Russia?

Wind energy generation and capacities Power generation in Russia has grown only slightly since 1990 due to the slow growth of industrial production volume. Power generation from wind farms is currently only 148 GWh.

How does wind power affect power generation in Russia?

The effects of the newly installed wind, solar, and hydroelectric power capacity on power generation became noticeable in 2018 when production of wind energy in Russia rose by 69.2%, and that from PV by 35.7%. Combined, wind and solar PV output crossed the 1 TWh threshold. 5

What is Russia's wind and solar potential?

s/2018/06/29/774143-reforma-rao-ees.Wind and SolarRussia began systematic assessments of its wind and solar resources in the late 1990s.5 The first studies found that Russia’s total technical wind potential exceeded 11,000 TWh/year.6 The coastal northern and landlocked southwestern regions of European Russia, the Fa

What is Russia's current share of solar power?

While the global economy gets roughly 10% of its power from wind and solar sources, in Russia, solar’s share is just 0.2%. As the third-largest carbon emitter in human history, Russia faces an uphill battle in its attempts to move from fossil fuels to renewable and other sources of clean energy.

Random Links

- Solar water pump with solar panel

- Ireland Nickel-Cadmium Battery Energy Storage Power Station

- Lima rechargeable energy storage battery

- Laayoune Energy Storage Project Construction

- Warsaw UPS uninterruptible power supply battery manufacturer

- Australian factory photovoltaic folding container wholesale

- Professional energy storage equipment manufacturer

- Harare Submerged Liquid Cooling Energy Storage Station

- Solve the problem of high inverter input voltage

- C32 lead-acid battery cabinet

- Which Israeli energy storage power supply is better to use

- Features of double glass photovoltaic panels

- How to install the rechargeable battery cabinet

- Al hassan switchgear for sale in Bangkok

- Small 12 volt inverter

- Photovoltaic energy storage lithium battery manufacturers

- Middle East Aluminum Alloy Energy Saving and Energy Storage Equipment Project

- Can energy storage stations use industrial land

- 30kW DC inverter

- 100ah power station for sale in Vancouver

- Inverter Xiaomi Solar

- Vatican EK energy storage battery construction

- Magadan Power Storage Box Customization Company

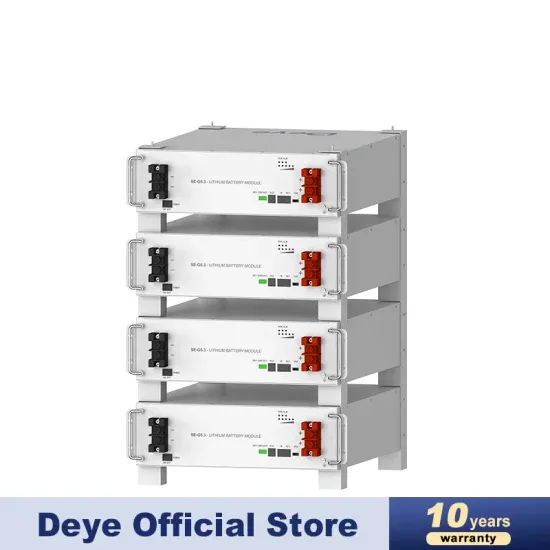

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.