The wind rises – Italy looks to fulfil its offshore and onshore

Jul 31, 2024 · The wind market in Italy has been limited and has not nearly reached its potential. Yet, operators are active and optimistic and, once the regulatory framework is completed for

(PDF) Dispatching strategy of base station backup power supply

Apr 1, 2023 · With the mass construction of 5G base stations, the backup batteries of base stations remain idle for most of the time. It is necessary to explore these massive 5G base

A new Wind Atlas to support the expansion of the Italian wind power

Jan 4, 2024 · For the Italian wind power fleet, this translates into growth from 11 GW of installed power in 2022 to 25 GW by 2030. 2 Additionally, 3.6 GW of that target should be realized

Collaborative optimization of distribution network and 5G base stations

Sep 1, 2024 · In this paper, a distributed collaborative optimization approach is proposed for power distribution and communication networks with 5G base stations. Firstly, the model of 5G

Design of 3KW Wind and Solar Hybrid Independent Power Supply System for

Nov 30, 2009 · This paper studies structure design and control system of 3 KW wind and solar hybrid power systems for 3G base station. The system merges into 3G base stations to save

6 FAQs about [Wind power supply for communication base stations in Italy]

Where are Italian wind plants located?

Italian wind plants are concentrated in the south of the country and generate a sixth of Italy’s green energy. Thanks to the wind, 20 terawatt hours of energy are produced each year and installed capacity is expected to almost double by 2030.

How is wind energy distributed in Italy?

Wind energy is not distributed in a homogenous way across Italy’s regions, but is predominantly concentrated in Southern Italy.

Which country has the most wind power in Italy?

Italy is 1.6 MW.New wind power capacity was main-ly installed in Sicily (43%), followed by Campania (18%) and the Apulian Region (16%). 90% of the total installed capacity is concentrated in six southern regions: Apulian (25%), Sicily (19%), Campania (16%), Basilica-ta (12%), Calabria (10%),

Where does Italian wind power come from?

In fact, the heart of Italian wind power production is the southern part of the Apennine ridge, prevalently the eastern side. Moreover, wind energy is also being harnessed in significant quantities on the large islands, thanks to favorable natural conditions. Another peculiarity of Italian wind power concerns the deployment of individual plants.

Can wind energy be used to power mobile phone base stations?

Worldwide thousands of base stations provide relaying mobile phone signals. Every off-grid base station has a diesel generator up to 4 kW to provide electricity for the electronic equipment involved. The presentation will give attention to the requirements on using windenergy as an energy source for powering mobile phone base stations.

How many wind plants are there in Italy?

And in 2004, for example, in all of Italy there were still only 120 wind plants installed, for an overall capacity of 1.1 gigawatts. The expansion of wind power then advanced erratically, peaking in the two-year period 2000-2001, and growing rapidly between 2006 and 2012.

Random Links

- Windhoek Photovoltaic Energy Storage Industrial Park

- Paris Molybdenum Wind and Solar Energy Storage Power Generation

- Island New Energy Storage

- Does the inverter frequency adjust the voltage

- Mogadishu photovoltaic panel prices

- Flywheel energy storage low temperature superconducting

- 60v lithium battery pack specifications

- Sophia Energy Storage Power Cabinet Types

- Burundi mobile power signal base station

- 18000W solar energy

- The main functions of the BMS battery management system are

- China circuit breaker outside in Moscow

- Huawei outdoor power supply is of poor quality

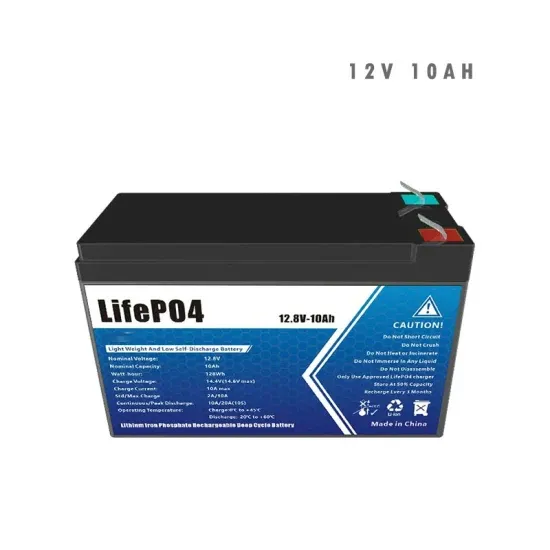

- LiFePO4 battery pack capacity difference 1ah

- Huawei power restrictions on solar photovoltaic panels

- How to install an outdoor base station

- 500kw mobile energy storage price

- 72v small wind power generation system

- Highest voltage inverter

- Layoun polycrystalline photovoltaic module panels

- What are the shortwave outdoor power supplies

- Xiaomi inverter 12v universal

- Eastern European Photovoltaic Panel Agency Price

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.