Low-Cost Production Techniques for Lithium Iron Phosphate Batteries

Aug 8, 2025 · Technical Solution: BYD has developed a revolutionary Blade Battery technology for lithium iron phosphate (LFP) batteries. This innovation involves a unique cell-to-pack

Low-Cost Production Techniques for Lithium Iron Phosphate Batteries

Aug 8, 2025 · The production of Lithium Iron Phosphate (LFP) batteries faces several significant challenges that impact cost-effectiveness and large-scale manufacturing. One of the primary

6 FAQs about [Lithium iron phosphate battery pack produced in South America]

What are lithium iron phosphate (LFP) batteries?

As LFP technology has gained in popularity, these key players have emerged in the marketplace. Lithium iron phosphate (LFP) batteries are a type of lithium-ion battery that has gained popularity in recent years due to their high energy density, long life cycle, and improved safety compared to traditional lithium-ion batteries.

What is a lithium iron phosphate battery?

Lithium iron phosphate battery manufacturers are using the latest technological advances to create smart batteries that provide safe (and cost-effective) energy storage on a mass scale. In order to produce LFP batteries, manufacturers need battery materials, including advanced phosphate products.

Where are lithium phosphate batteries made?

The manufacturing plant, located in the northern state of Amazonas, is dedicated to the production of lithium iron phosphate (LiFePO4) batteries, and is primarily focused on installing these onto electric bus chassis.

Is lithium iron phosphate a good cathode material?

Lithium iron phosphate (LiFePO 4, LFP) has long been a key player in the lithium battery industry for its exceptional stability, safety, and cost-effectiveness as a cathode material.

Are LiFePO4 batteries toxic?

The materials used in LiFePO₄ battery packs, such as iron, phosphorus, and lithium, are relatively non - toxic compared to some of the heavy metals and toxic chemicals used in other battery chemistries.

Where does BYD manufacture lithium phosphate batteries?

BYD is also responsible for two SkyRail (monorail) projects in the country: In Salvador, with the cross-sea “VLT do Subúrbio”, and in the city of São Paulo, with the “Line 17 – Gold Line”. In 2020, BYD opened its third manufacturing plant in the country in Manaus, specifically for lithium iron phosphate batteries.

Random Links

- China high quality on grid inverter Wholesaler

- Uzbekistan flashlight lithium battery pack supply

- What technologies does containerized energy storage have

- One ton of photovoltaic glass equals how many square meters

- 48v inverter to 240w

- Photovoltaic and energy storage battery capacity

- Athens communication base station inverter connected to the grid for power generation

- Huawei Paramaribo environmentally friendly photovoltaic glass

- Lesotho uses energy storage

- Three-phase AC generator energy storage system

- Solar energy storage cabinet price China

- Equipment in the energy storage device

- Wholesale of container parts in Mombasa Kenya

- Stacked energy storage outdoors

- 5G base station electricity users

- Maximum specifications of photovoltaic panels

- Al jameel switchgear in China in Nigeria

- How to place the container for wall-mounted solar

- High quality 4000w solar inverter for sale Seller

- Advantages and disadvantages of hybrid solar-storage inverter

- Battery New Inverter

- Monaco large capacity super capacitor price

- Monrovia Temporary Container Wholesale

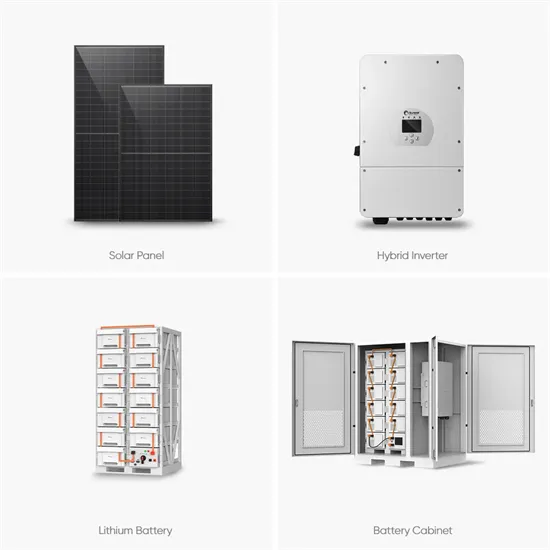

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.