6 FAQs about [Ulaanbaatar Energy Storage Container Northwest]

What are the energy problems in Ulaanbaatar?

The energy problems in Ulaanbaatar are urban design problems; the energy solutions are urban design solutions—they need to be considered in tandem. Meeting the energy needs of all residents requires making choices that will direct how the city will develop.

Can Ulaanbaatar reduce coal dependence?

Perhaps counterintuitively, Ulaanbaatar’s inability to build an efficient, modern new centralized coal-fired CHP plant (CHP#5) has actually opened more avenues for reducing coal dependence than if it had been constructed.

Why is Ulaanbaatar struggling?

Ulaanbaatar continues business-as-usual, unable to successfully invest in an expanded electrical transmission network or heat distribution system. Power outages remain prevalent, undercutting any electrification initiatives underway.

What is coal sorting in Ulaanbaatar?

Coal sorting yard, where trains deliver coal into the city, and it is sorted by size and loaded on trucks. Informal coal marketplace, where coal is sold by the truck, or divided into bags. Electrical substations in Ulaanbaatar.

What is slowing the decarbonization of Ulaanbaatar's energy grid?

There are several dynamics at play that are slowing the decarbonization of Ulaanbaatar’s energy grid. Much of this phenomenon has to do with the system used to award PPA contracts, and with political interference in setting energy production targets at different facilities.

What is Ulaanbaatar known for?

The core of Ulaanbaatar is a dense district of Soviet-era apartment buildings, shopping centers, and civic buildings, along with newly constructed contemporary high-rise apartments and commercial office buildings.

Random Links

- Photovoltaic glass product types

- Telecom New Energy Storage Cabinet

- Industrial Energy Storage 2025

- Mexican power storage sector

- Madrid Energy Storage Investment Project

- High quality 220 volt breaker in Colombia

- Factory price 3 phase breaker in Congo

- Inverter price with battery

- 48v boost 60v inverter price

- Juba Energy Storage System Supplier Recommendation

- Small inverter for photovoltaic power station

- Mobile outdoor power supply 60 degrees

- Solar power station for home in Peru

- Naypyidaw UPS Uninterruptible Power Supply

- Micronesia Communication Base Station EMS Power Generation Business Process

- Design an economic plan for an energy storage power station

- Self-built tile roof converted to photovoltaic power generation

- Sudan Industrial and Commercial Energy Storage Cabinet Wholesale Manufacturer

- Warsaw Photovoltaic Glass House BESS Information

- Integrated energy storage equipment company in Bosnia and Herzegovina

- Circuit breaker fuse for sale in Bangladesh

- 36v photovoltaic panel price

- Huawei Chile energy storage equipment

Residential Solar Storage & Inverter Market Growth

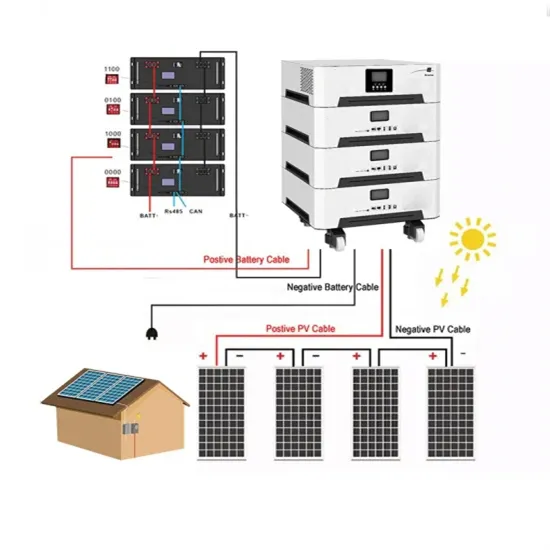

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.