Industrial and Commercial Energy Storage Cabinet Market Size

Mar 31, 2024 · New Jersey, United States,- The Global Industrial and Commercial Energy Storage Cabinet Market refers to the sector involved in the manufacturing, distribution, and utilization of

Energy Storage Cabinet Market Report | Global Forecast

Oct 5, 2024 · In 2023, the global energy storage cabinet market size is estimated to be valued at approximately USD 8.5 billion. According to market forecasts and current trends, the market is

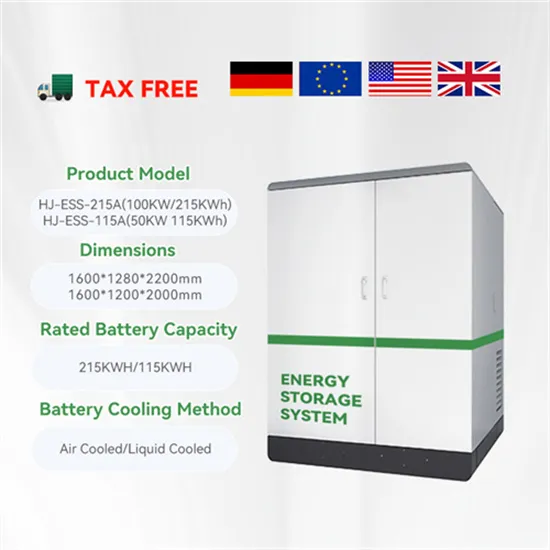

Liquid-cooled Energy Storage Cabinet-Commercial & Industrial

Commercial & Industrial ESSExcellent Life Cycle Cost • Cells with up to 12,000 cycles. • Lifespan of over 5 years; payback within 3 years. • Intelligent Liquid Cooling, maintaining a temperature

Analyzing Competitor Moves: Commercial and Industrial Energy Storage

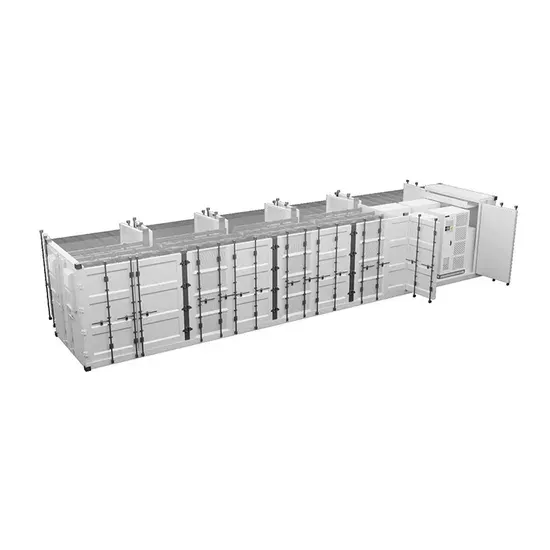

Mar 30, 2025 · The Commercial and Industrial Energy Storage Cabinet System market is experiencing robust growth, driven by the increasing adoption of renewable energy sources,

4 FAQs about [Size distribution of industrial and commercial energy storage cabinets]

What is a commercial and industrial energy storage system?

Commercial and industrial (C&I) energy storage systems are deployed behind-the-meter (BTM) and generally help those with factories, warehouses, offices and other facilities to manage their electricity costs and power quality, often enabling them to increase their use of renewables too.

Does exro spy market potential in commercial and industrial energy storage?

Exro battery storage cabinet on the outside of a commercial building. Image: Exro via Twitter. A flurry of activity has been observed in commercial and industrial (C&I) energy storage, suggesting that industry players spy market potential in a traditionally underperforming segment of the market.

When is the Energy Storage Summit EU?

Energy-Storage.news’ publisher Solar Media will host the 8th annual Energy Storage Summit EU in London, 22-23 February 2023. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place.

Is C&I energy storage uptake lagging behind?

Compared to 1,257MW/4,733MWh of utility-scale energy storage, or even to 161MW/400MWh of residential systems deployed in the three month period under review, it’s fairly clear that C&I energy storage uptake is lagging behind significantly.

Random Links

- Solar charging inverter

- Supercapacitor module price in Ghana

- 2MWH battery energy storage system for communication base stations Business requirements

- How long does it take to replace an outdoor inverter

- Pyongyang lithium battery manufacturer

- Heishan lithium battery outdoor power supply factory

- Off-grid inverter size

- High quality China vacuum circuit breaker Buyer

- Bridgetown brand new outdoor power supply 220v

- Mali 20kw off-grid inverter manufacturer

- Role of EK Energy Storage System in the Marshall Islands

- Huawei Poland photovoltaic solar panels

- Guinea Rare Energy Storage System

- Enterprise photovoltaic energy storage price

- Factory price breaker outdoor in indonesia

- New energy storage VI design

- What are the energy storage power station charging stations

- China high voltage breaker in China distributor

- Funafuti rooftop communication base station wind and solar complementarity

- BESS dedicated outdoor power supply

- Energy storage power supply unit price

- Huawei Beirut Energy Storage Products

- ADB Photovoltaic Energy Storage Project

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.