5G Base Station Energy Storage Bidding: What You Need to

Jun 29, 2021 · With over 816,000 5G基站 (5G base stations) expected in China by 2025 [3], the energy storage market has become a battlefield of innovation and cutthroat pricing. Just last

Strategy of 5G Base Station Energy Storage Participating in

Mar 13, 2023 · The proportion of traditional frequency regulation units decreases as renewable energy increases, posing new challenges to the frequency stability of the power system. The

Optimal configuration for photovoltaic storage system

Oct 1, 2021 · Base station operators deploy a large number of distributed photovoltaics to solve the problems of high energy consumption and high electricity costs of 5G base stations. In this

Regional Growth Projections for Communication Base Station Energy

Mar 30, 2025 · The global market for communication base station energy storage batteries is experiencing robust growth, driven by the expanding telecommunications infrastructure and

Optimization Control Strategy for Base Stations Based on Communication

Mar 31, 2024 · With the maturity and large-scale deployment of 5G technology, the proportion of energy consumption of base stations in the smart grid is increasing, and there is an urgent

Strategy of 5G Base Station Energy Storage Participating

Oct 3, 2023 · The energy storage of base station has the potential to promote frequency stability as the construction of the 5G base station accelerates. This paper proposes a control strategy

Distribution network restoration supply method considers 5G base

Feb 15, 2024 · In view of the impact of changes in communication volume on the emergency power supply output of base station energy storage in distribution network fault areas, this

Multi-objective cooperative optimization of communication base station

Sep 30, 2024 · The operating cost of ADN containing 5G communication base stations mainly includes the cost of power purchase from external markets, the cost of power purchase from

3 FAQs about [The price of building a communication base station energy storage]

How to estimate the cost of building and operating a cellular network?

A simple method for estimating the costs of building and operating a cellular mobile network is proposed. Using the empirical data from a third generation mobile system (WCDMA), it is shown that the cost is driven by different factors depending on the characteristics of the base stations deployed.

Are solar base stations economically interesting?

Based on eight scenarios where realistic costs of solar panels, batteries, and inverters were considered, we first found that solar base stations are currently not economically interesting for cellular operators. We next studied the impact of a significant and progressive carbon tax on reducing greenhouse gas emissions (GHG).

How does the cost module work?

The cost module first calculates the total discounted cost of capital and operating expenditures over the 10-year horizon, to obtain the Net Present Value in the first year of the assessment period (2020).

Random Links

- China China distribution switchgear company

- Outdoor power with battery life

- 5g base station power supply market

- What is the size of a 275w photovoltaic solar panel

- Solar powered portable outlet in Botswana

- Venezuela s dynamic energy storage system

- 20W solar panel manufacturer in Cote d Ivoire

- How to choose UPS uninterruptible power supply in Libya

- Austrian photovoltaic glass house manufacturer

- Photovoltaic module project plan

- Pardon uninterruptible power supply quote

- Solar power generation small container price

- What is Fengguang Storage Car

- Niue power battery bms wholesale

- High reflective glaze for photovoltaic glass

- Manufacturer photovoltaic panel wholesale

- 295w high efficiency perc bifacial module

- Huawei Brussels power battery pack

- Protective layer of new energy battery cabinet

- Slovakia energy storage container

- Energy storage power station operation mechanism

- Cost of container energy storage cabinets in Pakistan

- Wall-mounted energy storage battery loss

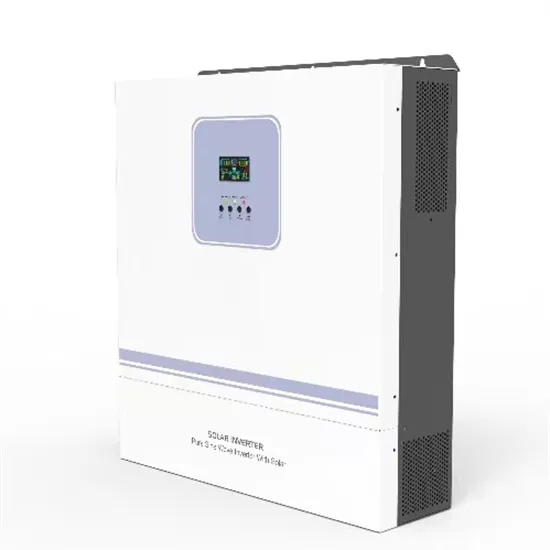

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.