Low-cost, low-emission 100% renewable electricity in Southeast Asia

Dec 1, 2021 · The results show that, with support provided by STORES, the Southeast Asian electricity industry can achieve very high penetration (78%–97%) of domestic solar and wind

Low-cost, low-emission 100% renewable electricity in Southeast Asia

Dec 1, 2021 · Rapid increases in electricity consumption in Southeast Asia caused by rising living standards and population raise concerns about energy security, affordability and

6 FAQs about [Solar Energy Storage Electricity Prices in Southeast Asia]

What is the growth rate of solar energy in Southeast Asia?

In Southeast Asia, electricity generation in the Solar Energy market is projected to reach 41.14bn kWh in 2025. An annual growth rate of 1.46% is anticipated during the period from 2025 to 2029 (CAGR 2025-2029).

Does Southeast Asia have a high penetration of solar and wind energy resources?

The results show that, with support provided by STORES, the Southeast Asian electricity industry can achieve very high penetration (78%–97%) of domestic solar and wind energy resources. The levelised costs of electricity range from 55 to 115 U.S. dollars per megawatt-hour based on 2020 technology costs.

Can storage support 100% renewable electricity futures in Southeast Asia?

This study is the first to explore the benefits of utilising STORES as a primary storage medium to support 100% renewable electricity futures in Southeast Asia. STORES can facilitate high penetration of variable solar and wind energy in electricity systems through energy time shifting and load levelling.

How much does electricity cost in Southeast Asia?

The LCOE figures in the low, medium and high electricity consumption scenarios are shown in Fig. 4 and included in Table A of Appendix. As illustrated, the LCOE figures are in the range of $55-$98/MWh (low), $62-$107/MWh (medium) and $72-$115/MWh (high) across Southeast Asia.

Is Southeast Asia a good place to invest in solar energy?

Southeast Asia is becoming one of the fastest-growing solar energy markets and one of the most promising regions in the global expansion of the solar energy industry. In 2023, Vietnam and Thailand were at the forefront of this movement, with the region's highest amount of new PV capacity installed.

How much energy does Southeast Asia have?

At the end of 2019, the proved reserves of coal and natural gas in Southeast Asia were 44 gigatonnes and 4.6 trillion cubic metres, respectively , which can support about 142,000 TWh of electricity in total assuming a thermal efficiency of 33% for coal-fired and 50% for natural gas-fired power plants.

Random Links

- Trolley box emergency energy storage power supply

- Mexican solar power monitoring system

- Electric tricycle outdoor power supply

- Syrian RV frequency inverter

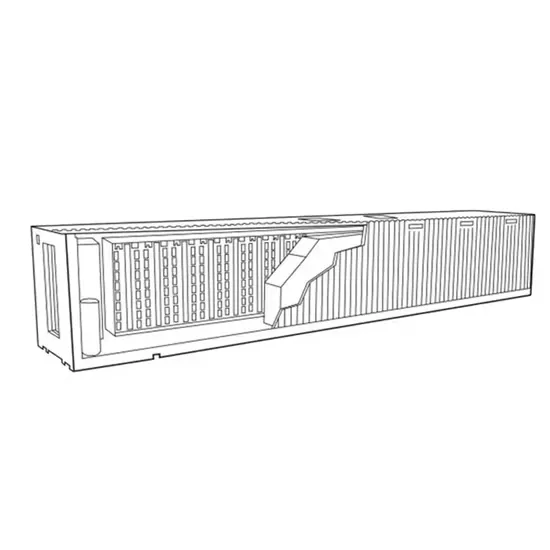

- China containerized solar panel specifications

- Cyprus lithium battery solar street light

- Over 2000 watts of solar panels

- How much is the price of photovoltaic panels exported from Abu Dhabi

- Where are the Syrian mobile communication wind power base stations

- Is user-side energy storage distributed energy storage

- Solar power 36v inverter

- Customize various lithium battery packs

- Wholesale 100ah power station in Singapore

- 36v inverter 220v price for lighting

- China molded circuit breaker in Abu-Dhabi

- Energy storage system charging and discharging achievement rate

- Application scenarios of energy storage product cabinets

- 12V inverter automatically powers on

- Somaliland Energy Storage Power Supply

- Somalia Uninterruptible Power Supply Wholesale

- Koten safety breaker for sale in Kyrgyzstan

- High quality solar power unit in Cairo

- Urban rooftop photovoltaic panels

Residential Solar Storage & Inverter Market Growth

The global residential solar storage and inverter market is experiencing rapid expansion, with demand increasing by over 300% in the past three years. Home energy storage solutions now account for approximately 35% of all new residential solar installations worldwide. North America leads with 38% market share, driven by homeowner energy independence goals and federal tax credits that reduce total system costs by 26-30%. Europe follows with 32% market share, where standardized home storage designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting residential storage for backup power and energy cost reduction, with typical payback periods of 4-7 years. Modern home installations now feature integrated systems with 10-30kWh capacity at costs below $700/kWh for complete residential energy solutions.

Home Solar System Innovations & Cost Benefits

Technological advancements are dramatically improving home solar storage and inverter performance while reducing costs. Next-generation battery management systems maintain optimal performance with 40% less energy loss, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $1,200/kW to $650/kW since 2022. Smart integration features now allow home systems to operate as virtual power plants, increasing homeowner savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for solar storage installations. New modular designs enable capacity expansion through simple battery additions at just $600/kWh for incremental storage. These innovations have improved ROI significantly, with residential projects typically achieving payback in 5-8 years depending on local electricity rates and incentive programs. Recent pricing trends show standard home systems (5-10kWh) starting at $8,000 and premium systems (15-20kWh) from $12,000, with financing options available for homeowners.